Growing Cybersecurity Threats

The increasing frequency and sophistication of cyber threats in China is a primary driver for The China Email Security Market. Cyberattacks, including phishing, ransomware, and data breaches, have surged, prompting organizations to invest heavily in email security solutions. According to recent statistics, over 60% of Chinese enterprises reported experiencing cyber incidents in the past year. This alarming trend has led to a heightened awareness of the need for robust email security measures. As businesses recognize the potential financial and reputational damage from such attacks, the demand for advanced email security solutions is expected to grow significantly. Consequently, the china email security market is likely to see a surge in investments aimed at safeguarding sensitive information and ensuring compliance with data protection regulations.

Increased Remote Work Culture

The rise of remote work in China has emerged as a significant driver for The China Email Security Market. With more employees working from home, the reliance on email communication has intensified, creating new vulnerabilities. Organizations are increasingly aware that remote work can expose them to various cyber threats, necessitating enhanced email security measures. As a result, companies are investing in solutions that provide secure access to email systems, ensuring that sensitive information remains protected regardless of the user's location. This shift is likely to lead to a surge in demand for email security solutions that offer features such as multi-factor authentication and secure email gateways. The ongoing evolution of work culture in China is expected to further fuel the growth of the china email security market as businesses adapt to new operational realities.

Digital Transformation Initiatives

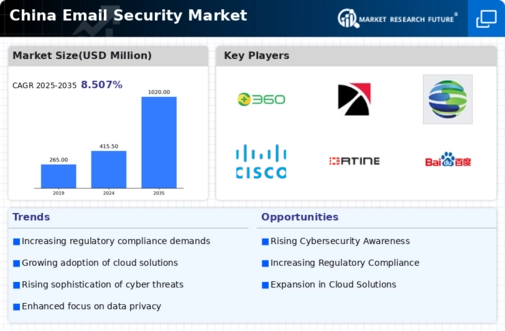

China's rapid digital transformation is significantly influencing The China Email Security Market. As organizations increasingly migrate to digital platforms and adopt cloud-based services, the volume of email communication has surged. This shift necessitates the implementation of advanced email security solutions to protect against emerging threats. The market for email security solutions is projected to grow at a compound annual growth rate (CAGR) of over 15% in the coming years, driven by the need for secure email communication in a digital-first environment. Furthermore, businesses are recognizing that traditional security measures may no longer suffice, leading to a greater emphasis on innovative solutions that integrate artificial intelligence and machine learning. This trend towards digitalization is expected to propel the demand for sophisticated email security technologies within the china email security market.

Emergence of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence and machine learning, is driving innovation within The China Email Security Market. These technologies enable organizations to detect and respond to threats in real-time, enhancing the overall effectiveness of email security solutions. As cyber threats become more sophisticated, traditional security measures may prove inadequate, prompting businesses to seek out solutions that leverage these advanced capabilities. The market is witnessing a shift towards proactive security measures that can anticipate and mitigate potential risks before they materialize. This trend is likely to result in increased investments in email security technologies that incorporate AI-driven analytics and automated threat response mechanisms. Consequently, the china email security market is poised for significant growth as organizations prioritize the adoption of cutting-edge solutions to safeguard their email communications.

Regulatory Framework and Compliance

The evolving regulatory landscape in China is a crucial driver for The China Email Security Market. The implementation of stringent data protection laws, such as the Personal Information Protection Law (PIPL) and the Cybersecurity Law, mandates organizations to adopt comprehensive email security measures. These regulations require businesses to ensure the confidentiality and integrity of personal data, which directly impacts their email communication practices. As companies strive to comply with these legal requirements, the demand for email security solutions that offer encryption, data loss prevention, and secure access controls is likely to increase. This regulatory pressure not only drives the adoption of email security technologies but also fosters a culture of accountability and transparency within organizations, thereby enhancing the overall security posture of the china email security market.