China IVD Contract Manufacturing Market Overview

As per MRFR analysis, the China IVD Contract Manufacturing Market Size was estimated at 443.12 (USD Million) in 2023.The China IVD Contract Manufacturing Market is expected to grow from 750(USD Million) in 2024 to 1,270 (USD Million) by 2035. The China IVD Contract Manufacturing Market CAGR (growth rate) is expected to be around 4.905% during the forecast period (2025 - 2035).

Key China IVD Contract Manufacturing Market Trends Highlighted

The growing need for quick and precise diagnostic solutions is propelling the China IVD Contract Manufacturing Market's notable expansion. This increase is mostly driven by China's emphasis on improving healthcare quality and growing healthcare demands brought on by the country's expanding population.

The Chinese government is making a significant effort to improve medical testing services and increase the capabilities of in vitro diagnostics (IVD) due to the country's ageing population and growing burden of chronic diseases. Strong market drivers are being provided by policies meant to support regional manufacturing and encourage innovation in the healthcare industry.

The China IVD Contract Manufacturing Market offers a plethora of opportunities, especially as regional producers seek to diversify their product lines and make investments in cutting-edge technologies.

Local businesses may now concentrate on research and development while maintaining compliance with the strict regulatory standards established by the National Medical Products Administration (NMPA) thanks to the growing practice of outsourcing manufacturing to domestic contract manufacturers.

Additionally, local firms stand to gain from alliances and cooperation that improve their technological capabilities as foreign players attempt to negotiate the intricacies of the Chinese market. The increasing focus on personalised medicine and the incorporation of digital health technologies into the IVD landscape are recent trends.

Technology breakthroughs are also driving a major move towards point-of-care testing, which makes diagnostics quicker and easier in a large nation like China. Additionally, the COVID-19 pandemic has sped up the uptake of cutting-edge diagnostic tools, forcing producers to modify and advance their products.

All things considered, a strong regulatory framework, rising healthcare demands, and cooperation between domestic and foreign stakeholders have moulded the IVD Contract Manufacturing Market in China.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

China IVD Contract Manufacturing Market Drivers

Rising Prevalence of Chronic Diseases

China has been witnessing a significant rise in chronic diseases such as diabetes, cardiovascular disorders, and cancer, which has increased the demand for In-Vitro Diagnostics (IVD) solutions. Reports suggest that between 2010 and 2020, the number of diabetes cases in China rose from 92 million to approximately 140 million according to the China Center for Disease Control and Prevention (CDC).

Furthermore, the World Health Organization (WHO) indicates a concerning rise in cancer incidence, with projections estimating a 20% increase in cancer cases by 2030.

This escalating burden of chronic diseases necessitates advanced IVD solutions for timely diagnosis and management, consequently boosting the China IVD Contract Manufacturing Market as healthcare providers seek efficient, localized production partners to meet this increasing demand.

Established organizations like Roche and Abbott Laboratories are actively expanding their operations within China, aligning their production capabilities with local needs, thereby impacting the market significantly.

By investing in Research and Development initiatives tailored to the Chinese population's health challenges, these companies contribute to the growth of the China IVD Contract Manufacturing Market.

Government Support and Investment in Healthcare

The Chinese government has been increasingly focused on enhancing its healthcare infrastructure, especially in diagnostics. The 'Healthy China 2030' initiative underscores a commitment to improving public health, which directs resources toward expanding diagnostic capabilities.

In recent years, healthcare spending in China has exceeded 6% of its Gross Domestic Product (GDP), highlighting a substantial investment in healthcare facilities and diagnostic technologies.

With numerous policies aimed at encouraging domestic production of IVD products, the China IVD Contract Manufacturing Market stands to benefit significantly. For instance, initiatives to provide financial support for Research and Development (R&D) in the healthcare sector foster a conducive business environment for contract manufacturers to innovate and expand.

Technological Advancements in IVD Products

Technological innovations have been a key driving force in the China IVD Contract Manufacturing Market. Advancements in molecular diagnostics, point-of-care testing, and biomarkers have made IVD testing more accurate and efficient. In 2021, China's market for molecular diagnostics was valued at approximately USD 1.1 billion and is expected to grow at a CAGR of over 10% through the next five years.

These developments compel manufacturers to adopt cutting-edge technologies, enhancing product quality and reliability.

Established companies such as Siemens Healthineers have integrated Artificial Intelligence (AI) and machine learning to improve diagnostic accuracy in IVD solutions, thus contributing to the market growth and establishing a competitive edge in the China IVD Contract Manufacturing Market.

Increasing Adoption of Personalized Medicine

Personalized medicine is emerging as a transformative approach in healthcare, fostering the development and manufacturing of tailored IVD diagnostics in China. This trend is evident as the market for personalized medicine is projected to reach around USD 30 million by 2025, driven by increasing public awareness and demand for customized treatment plans.

Organizations specializing in genomics, such as Illumina, are significantly impacting this market, as they strive to enhance the accessibility of genetic testing. This trend encourages collaboration between diagnostic innovators and manufacturers in China, positioning the China IVD Contract Manufacturing Market at the forefront of next-generation healthcare solutions.

China IVD Contract Manufacturing Market Segment Insights

IVD Contract Manufacturing Market Product Type Insights

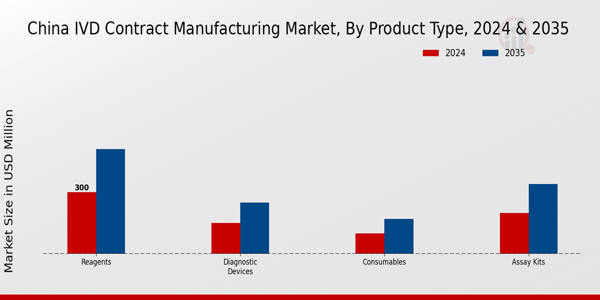

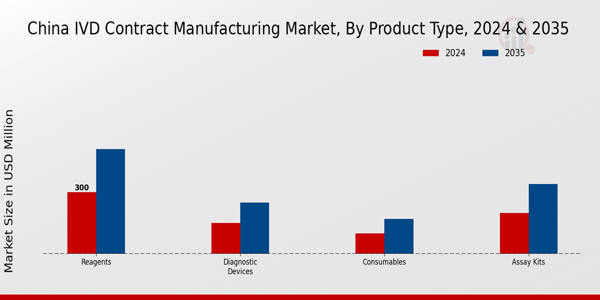

The China IVD Contract Manufacturing Market is categorized into various product types including Reagents, Diagnostic Devices, Assay Kits, and Consumables, each playing a critical role in the overall market dynamics. Reagents are often regarded as the backbone of laboratory diagnostics, facilitating a wide range of testing processes integral to healthcare diagnostics.

Their demand is consistently high due to their essential function in both clinical and research settings. Diagnostic Devices have been experiencing significant advances, driven by technological innovations in areas such as point-of-care testing and molecular diagnostics, which enhance the accuracy and efficiency of results.

Assay Kits are essential for performing specific tests and are crucial for various conditions, ranging from infectious diseases to chronic illnesses. These kits are favored for their convenience and reliability, which is pivotal in timely diagnosis.

Consumables, which include items such as test strips and pipettes, hold a dominant position in the market as they are frequently required in clinical laboratories, thus ensuring a continuous demand.

The growth of these product types is driven by the expanding healthcare sector in China, where increasing investment in Research and Development (R&D) and a rising prevalence of chronic diseases call for advanced diagnostic solutions.

Furthermore, the Chinese government's focus on improving healthcare infrastructure and promoting early disease detection has amplified the importance of IVD products. The integration of technology in these products, such as automation and digital health solutions, continues to spur market growth, allowing for more efficient workflows and improved patient outcomes.

However, challenges such as regulatory hurdles and the need for compliance with stringent quality standards persist in the market, impacting the speed of innovation. As the market evolves, opportunities for growth are abundant within each product type, particularly as the demand for personalized medicine and home diagnostic solutions rises.

Consequently, understanding the segmentation within the China IVD Contract Manufacturing Market is crucial for stakeholders aiming to capitalize on growth prospects in this dynamic landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

IVD Contract Manufacturing Market Technology Insights

The Technology segment of the China IVD Contract Manufacturing Market plays a crucial role in the nation's healthcare landscape. This segment is distinguished by its diverse offerings, including Molecular Diagnostics, Immunoassays, Clinical Chemistry, and Microbiology, each contributing significantly to diagnostic advancements.

Molecular Diagnostics stands out due to its ability to provide rapid and accurate results, essential in managing public health crises, while Immunoassays are pivotal for their reliability in disease detection and monitoring.

Clinical Chemistry is vital, supporting a wide range of tests that help in understanding patient health, and Microbiology is crucial for identifying infectious agents, thus playing a key role in controlling outbreaks. The prevalence of chronic diseases, a growing aging population, and rising healthcare spending are some of the key drivers sustaining growth within these technology sub-segments.

Additionally, the push for innovation amidst increasing demand for diagnostic accuracy presents opportunities for enhanced product development within the China IVD Contract Manufacturing Market. The overall market statistics reflect a steady progression, underscoring the importance of technology in shaping the future of health diagnostics in China.

IVD Contract Manufacturing Market End-user Insights

The End-user segment of the China IVD Contract Manufacturing Market encompasses a variety of key players, significantly impacting market dynamics. Hospitals represent a crucial component, given their role in patient care and reliance on accurate diagnostic testing to guide treatment decisions.

Diagnostic Laboratories are essential as they serve a vast number of patients, conducting numerous tests which bolsters their position in the market. Research Institutions contribute to the segment through continuous innovation and development, advancing diagnostic capabilities and enhancing the overall effectiveness of IVD solutions.

Home Care has emerged as a rapidly growing area, with an increasing demand for at-home testing solutions, reflecting changing patient preferences and a push towards decentralized healthcare models. Factors driving growth across these areas include an aging population, rising prevalence of chronic diseases, and technological advancements in diagnostic equipment.

However, challenges such as regulatory hurdles and the need for high-quality standards persist. In this evolving landscape, opportunities lie in expanding market access and offering tailored solutions to address the specific needs of each End-user category in China, ultimately driving the broader China IVD Contract Manufacturing Market growth.

IVD Contract Manufacturing Market Service Type Insights

The China IVD Contract Manufacturing Market is experiencing notable growth, particularly in the Service Type segment, which encompasses essential categories such as Manufacturing Services, Research and Development Services, and Packaging Services.

Manufacturing Services play a pivotal role in the market, providing high-quality production capabilities that are critical for meeting the increasing demand for diagnostic products in the region.

Research and Development Services are vital as they focus on innovation and the development of new diagnostic technologies, aligning with China's emphasis on enhancing healthcare solutions and regulatory advancements.

Furthermore, Packaging Services ensure that products are delivered safely and effectively, addressing both quality and compliance standards. Each of these services contributes significantly to the overall health and expansion of the China IVD Contract Manufacturing Market, driven by factors such as rising healthcare investments and increasing awareness of diagnostic solutions among the population.

The market is poised for advancements with ongoing technology integration and strategic collaboration among stakeholders, which is likely to enhance its competitive landscape moving forward.

China IVD Contract Manufacturing Market Key Players and Competitive Insights

The China IVD Contract Manufacturing Market is characterized by a rapidly evolving landscape driven by advancements in technology, increasing demand for diagnostic solutions, and the growing influence of global players. This market encompasses a diverse range of services provided by contract manufacturers specializing in in-vitro diagnostic devices and reagents.

With a blend of local enterprises and multinational corporations, the competitive dynamics are shaped by innovation, regulatory changes, and partnerships aiming to enhance product efficiency and meet the rising healthcare standards in China.

As the industry experiences growth, companies are increasingly focusing on strategic collaborations to expand their capabilities and distribution networks, thus creating a dynamic ecosystem that supports advancement in the field of diagnostics.

Mindray stands as one of the prominent players in the China IVD Contract Manufacturing Market, renowned for its comprehensive portfolio that includes diagnostic equipment and reagents. The company leverages its strong research and development capabilities, enabling it to offer innovative solutions tailored to the specific needs of the Chinese healthcare market.

Mindray has established a significant market presence, reflecting its commitment to quality and technological excellence. The firm benefits from a robust distribution network and extensive customer relationships, which enhance its competitiveness within the industry.

Its strengths lie in cutting-edge manufacturing processes, quality assurance protocols, and continuous innovation, allowing it to remain a key player amidst local and international competitors.

Tianjin Tethys Technologies is another key entity within the China IVD Contract Manufacturing Market, focusing on the development and manufacturing of diagnostic kits and instruments. The company is noted for its expertise in point-of-care testing, where it has made significant inroads into the healthcare sector.

Tianjin Tethys Technologies has built a reputation for offering high-quality products at competitive prices, which has helped it capture a substantial share of the market. The company’s strengths are centered on its agile manufacturing processes, strong supplier relationships, and a focus on meeting regulatory standards.

Tianjin Tethys Technologies has also engaged in strategic partnerships and collaborations to enhance its production capabilities, and the firm’s commitment to integrating advanced technologies into its offerings ensures its relevance in the fast-paced IVD environment in China.

Key Companies in the China IVD Contract Manufacturing Market Include:

- Mindray

- Tianjin Tethys Technologies

- Hua Medicine

- Beijing Jinong

- Wondfo

- Xiamen TNB

- Suzhou MGI Tech

- SinoImmuno

- Changchun Daling

- Anhui Meditronic

- Zhejiang Haojing

- Lequn Biotechnology

- Shanghai Kehua

- Guangdong Yicheng Medical

China IVD Contract Manufacturing Market Developments

The China In Vitro Diagnostics (IVD) Contract Manufacturing Market has seen notable developments recently. Mindray and Wondfo have expanded their product lines, focusing on innovative diagnostic solutions to meet the growing demands of healthcare professionals.

Tianjin Tethys Technologies announced partnerships to enhance their diagnostic capabilities, while Suzhou MGI Tech launched new sequencing platforms aimed at improving precision medicine. In terms of mergers and acquisitions, Zhejiang Haojing successfully acquired a competitor in September 2023, aiming to enlarge its market reach and streamline manufacturing processes.

Beijing Jinong has initiated collaborations with international firms to enhance research collaborations in IVD technology, signaling increased global engagement in this sector. Additionally, market valuations for companies like Changchun Daling and Anhui Meditronic surged following investments in Research and Development, highlighting a robust growth trajectory in the IVD space in China.

The government's continued support for healthcare innovations is driving growth in the sector, reflecting a strong commitment to improving public health through advanced diagnostic tools. The overall market landscape is becoming increasingly competitive, emphasizing the need for continuous innovation and strategic partnerships among leading companies in the industry.

China IVD Contract Manufacturing Market Segmentation Insights

IVD Contract Manufacturing Market Product Type Outlook

- Reagents

- Diagnostic Devices

- Assay Kits

- Consumables

IVD Contract Manufacturing Market Technology Outlook

- Molecular Diagnostics

- Immunoassays

- Clinical Chemistry

- Microbiology

IVD Contract Manufacturing Market End-userOutlook

- Hospitals

- Diagnostic Laboratories

- Research Institutions

- Home Care

IVD Contract Manufacturing Market Service Type Outlook

- Manufacturing Services

- Research and Development Services

- Packaging Services

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

443.12(USD Million) |

| MARKET SIZE 2024 |

750.0(USD Million) |

| MARKET SIZE 2035 |

1270.0(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

4.905% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Mindray, Tianjin Tethys Technologies, Hua Medicine, Beijing Jinong, Wondfo, Xiamen TNB, Suzhou MGI Tech, SinoImmuno, Changchun Daling, Anhui Meditronic, Zhejiang Haojing, Lequn Biotechnology, Shanghai Kehua, Guangdong Yicheng Medical |

| SEGMENTS COVERED |

Product Type, Technology, End User, Service Type |

| KEY MARKET OPPORTUNITIES |

Growing demand for rapid diagnostics, Expansion of personalized medicine, Increasing investment in R&D, Rising prevalence of chronic diseases, Strong government support for healthcare innovation |

| KEY MARKET DYNAMICS |

regulatory compliance and quality standards, increasing demand for diagnostics, technological advancements in IVD, cost-effective manufacturing solutions, growing partnerships and collaborations |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ):

By 2035, the China IVD Contract Manufacturing Market is projected to reach a valuation of 1270.0 USD Million.

In 2024, the market value of the China IVD Contract Manufacturing Market is expected to be 750.0 USD Million.

The expected CAGR for the China IVD Contract Manufacturing Market from 2025 to 2035 is 4.905%.

Reagents hold the largest market value in 2024, with an expected valuation of 300.0 USD Million.

The diagnostic devices segment is valued at approximately 150.0 USD Million in 2024.

The market size for assay kits is expected to reach about 340.0 USD Million in 2035.

Key players in the market include Mindray, Wondfo, and Suzhou MGI Tech among others.

The projected market size for consumables by 2035 is estimated to be around 170.0 USD Million.

Growth drivers include advancements in diagnostic technology and increasing demand for healthcare solutions.

Emerging trends include the rise of personalized medicine and increased focus on rapid testing solutions.