China Ready to Eat Meals Market Overview

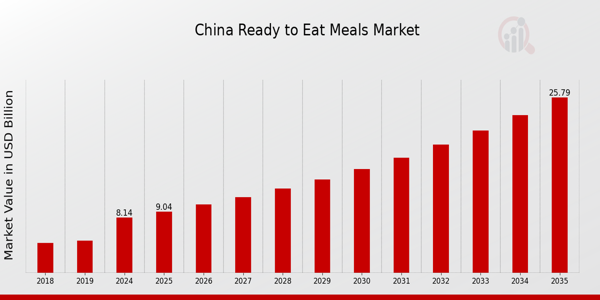

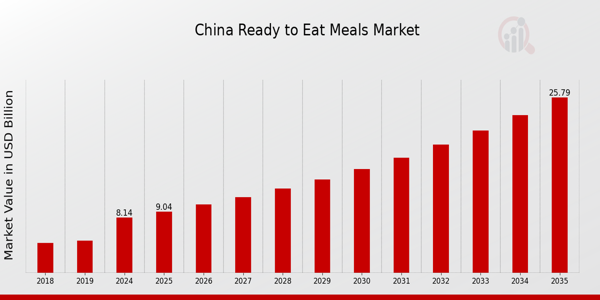

China Ready to Eat Meals Market Size was estimated at 6.86 (USD Billion) in 2023. The China Ready to Eat Meals Market Industry is expected to grow from 8.14(USD Billion) in 2024 to 25.79 (USD Billion) by 2035. The China Ready to Eat Meals Market CAGR (growth rate) is expected to be around 11.053% during the forecast period (2025 - 2035).

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key China Ready to Eat Meals Market Trends Highlighted

The China Ready to Eat Meals Market is experiencing significant changes driven by modern lifestyle shifts and consumer demands. Fast-paced urban living and busy work schedules are key market drivers, leading to a growing preference for convenient meal options. Increased disposable income among the urban population allows more consumers to seek ready-to-eat meal solutions as a practical alternative to traditional cooking. Furthermore, the rise of the health-conscious consumer in China is contributing to demand for healthier meal options, prompting manufacturers to focus on nutritional value and ingredient transparency.

Recent trends indicate a surge in innovative flavors and regional varieties as brands aim to cater to diverse Chinese culinary preferences.The rapid urbanization has also resulted in a significant increase in the number of online food delivery services, which has made it simpler to access ready-to-eat products. The integration of technology into the food supply chain is facilitating the introduction of new products and the optimization of distribution processes for companies. Furthermore, sustainability is becoming an increasingly important factor as consumers become more cognizant of the environmental consequences, which is compelling companies to implement eco-friendly packaging and ethically sourced ingredients.

There are numerous opportunities in the market, such as catering to the expanding elderly population who are seeking easy-to-prepare meals and tapping into the growing segment of younger consumers who are eager to sample new international flavors. In order to improve the authenticity and flavor of their products, businesses may pursue partnerships with local producers. The ready-to-eat meal sector in China will continue to evolve, reflecting both contemporary lifestyle needs and cultural preferences, as consumers place greater importance on convenience and quality.

China Ready to Eat Meals Market Drivers

Increasing Urbanization in China

Urbanization in China is rapidly increasing, with the urban population expected to increase from 60% in 2020 to over 70% by 2030 according to the National Bureau of Statistics of China. This transition drives demand for convenient food options such as Ready to Eat Meals, as urban dwellers often have busy lifestyles and seek quick meal solutions.

The China Ready to Eat Meals Market Industry is particularly poised to benefit from this trend, as the convenience of ready meals aligns with the preferences of urban consumers.Major corporations like Alibaba and Tencent have invested in food delivery services to cater to this demographic, reinforcing the shift towards ready-to-eat solutions in urban areas. Additionally, the Chinese government has been promoting urban development initiatives that enhance food distribution networks, further supporting the growth potential of the China Ready to Eat Meals Market.

Changing Consumer Preferences Towards Convenience

There is a significant shift in consumer preferences in China toward convenience and time-saving solutions, particularly among working professionals and younger generations. A report by the Ministry of Commerce indicates that 50% of urban consumers are leaning towards pre-packaged meals to save time. This trend is driving the growth of the China Ready to Eat Meals Market Industry, as consumers prioritize ease and efficiency in meal preparation.

Companies like Nestle and Unilever have been quick to adapt their product lines to meet this demand by introducing diverse ready meal options tailored to local tastes.Furthermore, as busy lifestyles become more common, the reliance on ready-to-eat meals is likely to rise, presenting substantial opportunities for growth in this sector.

Expansion of E-commerce in Food Sector

The e-commerce segment for food products in China has seen explosive growth, with the China E-commerce Research Center reporting a yearly growth rate of over 25% in online food sales. As more consumers turn to online platforms for food purchases, the accessibility of Ready to Eat Meals increases significantly. The China Ready to Eat Meals Market Industry can leverage this trend, as companies such as Meituan and JD.com enhance their online offerings.These platforms have revolutionized how food products reach consumers, allowing easy access to a variety of ready meals.

The Chinese government's initiatives to digitize various sectors also contribute to this trend, reinforcing the upward trajectory of the ready meal market as e-commerce solutions become more integrated into daily life.

China Ready to Eat Meals Market Segment Insights

Ready to Eat Meals Market Type Insights

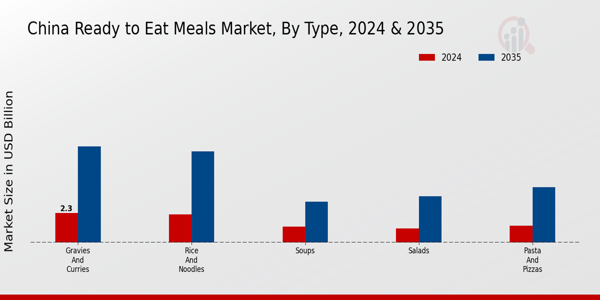

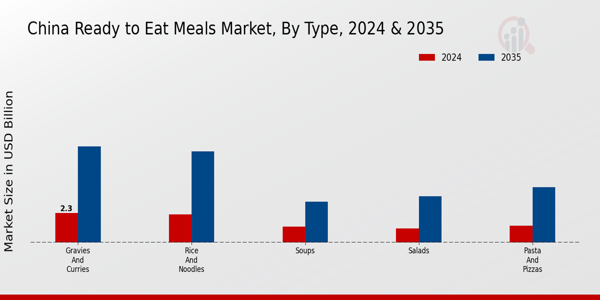

The China Ready to Eat Meals Market, particularly within the Type segment, showcases a diverse range of meal options, reflecting the dynamic food preferences of the Chinese population. Rice and noodles, as staple foods, form the backbone of many meals in China, thereby enjoying substantial popularity and demand in the ready-to-eat category. Salads, once considered culturally less significant, have been gaining traction due to the increasing health consciousness among consumers, leading to a rising preference for fresher meal options.

Gravies and curries, with their rich flavors, cater to traditional palates, providing convenience without sacrificing taste, thus appealing to a wide demographic.In recent years, the adoption of pasta and pizzas has been notable as younger consumers embrace Western cuisine, integrating it into their diet. Soups, often associated with comfort and nutrition, remain a preferred choice for many, especially in urban areas, capitalizing on the growing trend of convenience without compromising warmth and health.

Each type within the market not only fulfills consumer needs but also highlights cultural trends and evolving tastes, reflecting a significant shift towards more convenient, quality meal options in China's rapidly changing food landscape.The market's segmentation underscores a mix of traditional and modern influences, creating opportunities for both established brands and new entrants in the Ready to Eat Meals Market, as they strive to cater to the diverse preferences of Chinese consumers. With these shifts, innovation in flavors and packaging also plays a pivotal role in attracting consumers, thereby enhancing the overall market growth trajectory.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Ready to Eat Meals Market Distribution Channel Insights

The Distribution Channel segment of the China Ready to Eat Meals Market plays a crucial role in how these products reach consumers. In China, an increasing preference for convenience and efficiency has led to the growth of both store-based and non-store-based channels. Store-based channels, including supermarkets, convenience stores, and hypermarkets, often attract consumers due to their extensive product variety and immediate availability.

This is significant, as many consumers prefer to purchase ready-to-eat meals in person for quality assurance and to explore different options.Meanwhile, non-store-based channels, such as e-commerce platforms, have gained substantial traction, particularly with the rise of mobile commerce and delivery services during the pandemic. This shift has provided an opportunity for consumers to access a broader range of products from the comfort of their homes. As the population in urban areas continues to grow and lifestyle changes propel the demand for ready-to-eat meals, the dynamics within the Distribution Channel segment are likely to evolve.

This segmentation is crucial for understanding the China Ready to Eat Meals Market revenue and statistics, highlighting trends that drive both market growth and challenges in consumer access.

China Ready to Eat Meals Market Key Players and Competitive Insights

The China Ready to Eat Meals Market has exhibited remarkable growth and transformation, fueled by changing consumer lifestyles, urbanization, and the rising demand for convenience foods. With a burgeoning middle class and increasing disposable incomes, consumers are seeking quick meal solutions that do not compromise on taste or quality. This market is characterized by a diverse range of players, from multinational corporations to local businesses, each vying for a significant share.

Competitive insights reveal that innovation plays a crucial role in differentiating products, while market players must also navigate regulatory challenges, cultural preferences, and distribution logistics to meet the diverse needs of Chinese consumers. As a result, companies are increasingly focusing on product development, marketing strategies, and building strong supply chains to achieve sustainable growth in this dynamic sector.General Mills has established a noteworthy presence in the China Ready to Eat Meals Market, leveraging its global expertise and brand reputation to cater to local consumers.

The company’s strengths lie in its ability to offer a diverse portfolio of products that appeal to varying tastes and preferences, while also addressing the growing trend of health-conscious eating. By investing in local research and development, General Mills has successfully localized its offerings, ensuring that products resonate with the Chinese palate. Additionally, the company’s robust distribution network allows it to maintain a competitive edge by ensuring product availability and visibility in retail outlets across the region.

Furthermore, General Mills is committed to sustainability and responsible sourcing practices, enhancing its brand image and appealing to environmentally conscious consumers.China National Food Industry Group holds a prominent position in the China Ready to Eat Meals Market, renowned for its extensive range of key products and services tailored to local tastes. The company is recognized for its focus on quality and affordability, making it a preferred choice among consumers seeking convenient meal options. With a strong foothold in various distribution channels, including traditional retail and modern e-commerce platforms, China National Food Industry Group effectively reaches a wide customer base.

The company’s strengths include its well-recognized brand and commitment to innovation, which has led to the development of new products that align with current food trends in China. Additionally, through strategic mergers and acquisitions, China National Food Industry Group has expanded its market presence and capabilities, enabling it to capture a larger share of the ready-to-eat meal segment while maintaining a strong competitive stance against other market players.

Key Companies in the China Ready to Eat Meals Market Include

- China National Food Industry Group

- Ting Hsin International Group

China Ready to Eat Meals Market Industry Developments

The China Ready to Eat Meals Market has witnessed significant developments recently, marked by increasing consumer demand for convenience foods. As of September 2023, General Mills and Nestle launched innovative meal solutions catering to local tastes, aiming to capture a larger market share. Unilever also intensified its focus on sustainability by introducing environmentally friendly packaging for its meal products, addressing growing consumer concerns regarding waste. In terms of mergers and acquisitions, Coca-Cola confirmed its acquisition of a minority stake in a local food startup in August 2023, further diversifying its product range in the ready-to-eat segment.

Similarly, in July 2023, Master Kong expanded its portfolio through the acquisition of Shanghai Yimin Food, enhancing its distribution capabilities. The market is projected to grow considerably, driven by the urbanization trend and the increasing number of working professionals seeking quick meal solutions. Furthermore, government initiatives promoting food safety and nutritional standards are shaping product offerings, with companies like Campbell Soup Company and Heinz adapting their strategies to comply with new regulations. The valuation of key players is forecasted to increase, positively influencing the overall market landscape in China.

China Ready to Eat Meals Market Segmentation Insights

Ready to Eat Meals Market Type Outlook

- rice and noodles

- salads

- gravies and curries

- pasta and pizzas

- soups

- others

Ready to Eat Meals Market Distribution Channel Outlook

- store-based

- non-store-based

Report Scope:

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

6.86(USD Billion) |

| MARKET SIZE 2024 |

8.14(USD Billion) |

| MARKET SIZE 2035 |

25.79(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

11.053% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

General Mills, China National Food Industry Group, Coco Cola, Heinz, PepsiCo, Campbell Soup Company, Fulinmen, Unilever, Master Kong, Ting Hsin International Group, Nestle, Maruchan, CNP Foods, Shanghai Yimin Food, Kraft Foods |

| SEGMENTS COVERED |

Type, Distribution Channel |

| KEY MARKET OPPORTUNITIES |

Rising urbanization and busy lifestyles, Increasing demand for convenience food, Growth in online food delivery services, Expansion of health-conscious meal options, Diverse regional flavors and cuisines |

| KEY MARKET DYNAMICS |

growing urbanization, changing consumer lifestyles, increasing demand for convenience, expanding e-commerce platforms, health-conscious eating trends |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ):

The China Ready to Eat Meals Market is expected to be valued at 8.14 USD Billion in 2024.

By 2035, the market is projected to be valued at 25.79 USD Billion.

The market is anticipated to grow at a CAGR of 11.053 percent from 2025 to 2035.

The rice and noodles segment is expected to reach a value of 7.14 USD Billion by 2035.

Major players include General Mills, China National Food Industry Group, and PepsiCo among others.

The gravies and curries segment is valued at 2.3 USD Billion in 2024.

The salads segment is projected to be valued at 3.6 USD Billion by 2035.

Increasing urbanization and the demand for convenience foods are key growth drivers.

The soups segment is expected to be valued at 1.24 USD Billion in 2024.

There are considerable opportunities in product innovation and health-conscious meal options.