- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

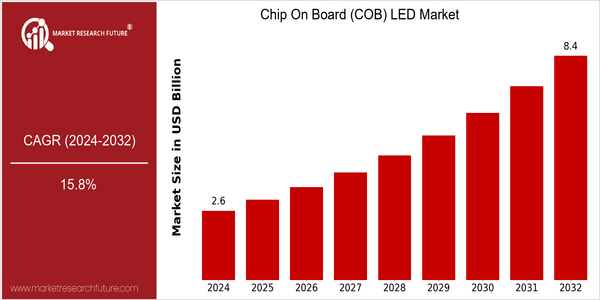

| Year | Value |

|---|---|

| 2024 | USD 2.59 Billion |

| 2032 | USD 8.4 Billion |

| CAGR (2024-2032) | 15.8 % |

Note – Market size depicts the revenue generated over the financial year

COB LEDs will be in great demand, with a market value of $2.5 billion in 2024 and $8.5 billion in 2032. This remarkable growth translates into a CAGR of 15.8 per cent. This growth is being driven by the growing demand for energy-efficient lighting solutions and advances in LED technology. For example, COB LEDs are gaining popularity in industry and in the residential market as they offer excellent performance and are highly compact. There are a number of factors contributing to the robust growth of the COB LED market. The growing number of smart city initiatives and the increasing use of LED lighting in the automotive industry are notable trends. The improvements in packaging and cooling technology are enhancing the performance and life of COB LEDs, which are becoming more popular among both manufacturers and end users. Several market leaders, including Cree, Nichia and Osram Licht AG, are investing heavily in research and development, and forming strategic alliances with other companies. These activities not only strengthen their position in the market but also further develop COB LED technology, thus further driving the market’s growth.

Regional Market Size

Regional Deep Dive

COB LED market is expected to witness a significant growth on account of technological advancements, increasing demand for energy-efficient lighting solutions and shift towards smart lighting systems. Each region has its own characteristics influenced by local regulations, economic conditions and cultural preferences, which influence the adoption and innovation of COB LEDs. COB LED market is expected to benefit from the increasing emphasis on reducing carbon emissions and improving energy efficiency in lighting applications.

Europe

- Europe is at the forefront of adopting COB LED technology due to stringent energy efficiency regulations, such as the EU's Ecodesign Directive, which mandates higher efficiency standards for lighting products.

- Key players like Osram and Philips are investing heavily in R&D to develop next-generation COB LEDs, focusing on enhancing color quality and reducing energy consumption, which is expected to drive market growth.

Asia Pacific

- The Asia-Pacific region, particularly China, is a major hub for COB LED manufacturing, with companies like San'an Optoelectronics and Nationstar leading the market, benefiting from lower production costs and a robust supply chain.

- Government initiatives aimed at promoting green technologies and reducing pollution are accelerating the adoption of COB LEDs in urban infrastructure projects, such as smart city developments.

Latin America

- Latin America is experiencing a gradual shift towards energy-efficient lighting solutions, with countries like Brazil and Mexico implementing policies to phase out incandescent bulbs, thereby boosting the demand for COB LEDs.

- Local manufacturers are beginning to collaborate with international firms to enhance their technological capabilities, which is expected to improve the quality and availability of COB LED products in the region.

North America

- COB LEDs are in great demand in the American automobile industry, where they are being used in the advanced lighting systems of electric vehicles, especially those made by General Motors and Tesla.

- Regulatory initiatives such as the Energy Policy Act and various state-level energy efficiency programs are promoting the adoption of COB LEDs, incentivizing manufacturers to innovate and improve product offerings.

Middle East And Africa

- In the Middle East and Africa, COB LED is gaining traction because of the increase in investments in urban development and the rise of e-government. The United Arab Emirates and Saudi Arabia have been investing heavily in the lighting market for their large projects.

- The region's unique climatic conditions and energy challenges are driving demand for energy-efficient lighting, prompting local governments to implement regulations that favor the use of COB LEDs in public and commercial spaces.

Did You Know?

“Did you know that COB LEDs can produce a higher lumen output per watt compared to traditional LED technologies, making them a preferred choice for high-performance lighting applications?” — LEDs Magazine

Segmental Market Size

The market for chip-on-board LEDs is a fast-growing market segment in the LED industry. It is characterized by high growth rates, driven by the increasing demand for high-efficiency lighting. This growth is driven by the growing demand for energy-saving products, as well as by the continuous development of LED technology, which makes it possible to increase the performance and reduce the cost. Moreover, the government's policies on energy conservation and environmentalism are also stimulating the market for COB LEDs. At present, the COB LED technology has reached the phase of mass production, and Philips and Osram are leading the way in a variety of applications, including vehicle lighting and general lighting. The market for COB LEDs is led by North America and Asia-Pacific, where they are mainly used for their compactness and excellent thermal management. The main application fields are office lighting, residential lighting and display technology, where the advantages of color rendering and brightness are especially appreciated. Besides the push for smart lighting solutions and the demand for sustainable products, further developments in the field of packaging and thermal management are also expected to boost the market.

Future Outlook

The market for COB LEDs is projected to grow at a CAGR of 15.8 per cent from 2024 to 2032. The demand for energy-efficient lighting solutions is increasing in various sectors such as residential, commercial, and automobile. The stricter energy regulations by governments and the rising trend towards sustainable practices are expected to drive the adoption of COB LEDs in new as well as retrofit projects. The key factor that will drive the market for COB LEDs is the technological advancements. Advancements in the chip design, thermal management, and packaging of COB LEDs will improve their performance and life span, thereby increasing their marketability. The rise of smart lighting and the integration of the Internet of Things (IoT) with COB LEDs will further boost their demand. COB LEDs are emerging as a preferred choice of lighting solutions for modern applications.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 2.2Billion Billion |

| Growth Rate | 18.10% (2023-2032) |

Chip on board LED Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.