Chromatography Software Market Overview

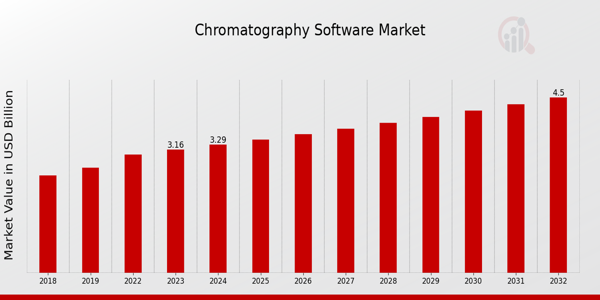

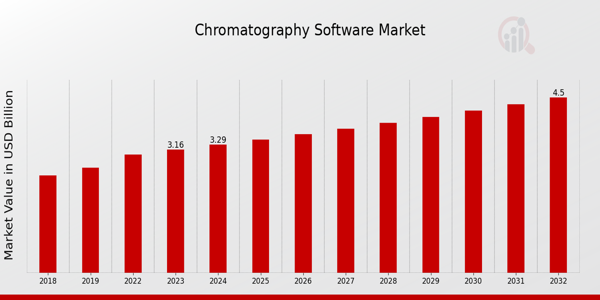

As per MRFR analysis, the Chromatography Software Market Size was estimated at 3.04 (USD Billion) in 2022. The Chromatography Software Market Industry is expected to grow from 3.16 (USD Billion) in 2023 to 4.5 (USD Billion) by 2032.

The Chromatography Software Market CAGR (growth rate) is expected to be around 4.01% during the forecast period (2024 - 2032).

Key Chromatography Software Market Trends Highlighted

The Chromatography Software Market is primarily driven by the growing demand for analytical solutions across various industries, such as pharmaceuticals, food and beverage as well as environmental testing.

The increase in the regulatory requirements for quality control and assurance intensifies the demand for sophisticated software systems. Moreover, the growing intricacy of today's chromatographic techniques accelerates the use of advanced software for analyzing and managing chromatographic data.

Laboratories are increasingly pursuing efficiency and precision and wish to achieve these goals without the use of human operators. There is also an increase in the requirement for automated chromatography systems and, consequently, for integrated software capable of controlling such systems.

Opportunities in the chromatography software market include the integration of artificial intelligence and machine learning algorithms, which can significantly improve data analysis and predictive capabilities.

The expansion of personalized medicine is also fostering the need for customized solutions, thereby presenting avenues for software providers to innovate. Furthermore, advancements in cloud technology offer a chance for enhanced data accessibility and collaboration among research teams.

The growth of smaller laboratories and the need for cost-effective software solutions are additional opportunities for growth as these entities seek to optimize their operations without incurring extensive costs.

Recent trends indicate a move toward user-friendly interfaces and enhanced data visualization tools, making chromatography software more accessible to a broader range of users.

Additionally, the focus on sustainability has led to the development of eco-friendly practices in chromatography that also extend to software solutions, promoting greener laboratory operations.

The demand for real-time analytics and remote access capabilities is shaping the future of chromatography software as professionals seek to streamline their workflows and maintain productivity in an increasingly digital landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Chromatography Software Market Drivers

Increasing Demand for Advanced Analytical Techniques

The Chromatography Software Market industry is experiencing significant growth due to the burgeoning demand for advanced analytical techniques across various sectors, including pharmaceuticals, biotechnology, and environmental testing.

As industries strive to enhance their product quality and adhere to stringent regulatory standards, there is a pressing need for sophisticated chromatography techniques.

These techniques allow for precise separation, identification, and quantification of components in complex mixtures, making them indispensable in research and quality control processes.

Consequently, the demand for chromatography software, which facilitates the acquisition, analysis, and management of data generated through chromatography, is skyrocketing.

The accurate data interpretation and reporting capabilities offered by advanced chromatography software solutions have become critical in supporting decision-making processes, ultimately driving the expansion of the Chromatography Software Market industry.

Furthermore, the integration of artificial intelligence and machine learning algorithms into chromatography software is revolutionizing data analysis, enabling laboratories to operate more efficiently and effectively.

As technology continues to evolve, laboratories are adopting advanced chromatography systems, which directly correlates with the increasing uptake of chromatography software, illustrating a key driver in the market's growth trajectory.

Regulatory Compliance and Quality Assurance Requirements

In the Chromatography Software Market industry, rigorous regulatory compliance and quality assurance requirements serve as crucial market drivers. Companies across various sectors are urged to maintain high-quality standards in their products to meet legal obligations and ensure consumer safety.

This need for compliance with regulations, such as Good Manufacturing Practices (GMP) and Good Laboratory Practices (GLP), necessitates the utilization of advanced chromatography methods.

Chromatography software plays a pivotal role in ensuring that these methods are executed properly while allowing for precise documentation and traceability of data.

The growing emphasis on quality assurance is compelling organizations to invest in chromatography software that enhances data integrity, security, and availability, which ultimately drives the growth of the market.

Growing Investments in Research and Development

The rise in investments in research and development activities across the pharmaceutical and biotechnology sectors is a prominent driver of the Chromatography Software Market industry.

As these sectors work towards developing new drugs and therapies, the need for reliable analytical methods to ensure product efficacy and safety becomes paramount.

Chromatography software is essential in managing the data generated from analytical processes, thereby facilitating the R&D activities efficiently.

Chromatography Software Market Segment Insights

Chromatography Software Market Application Insights

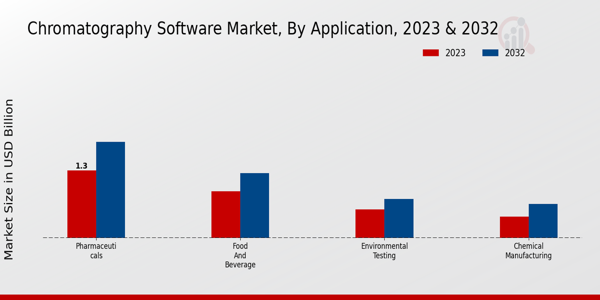

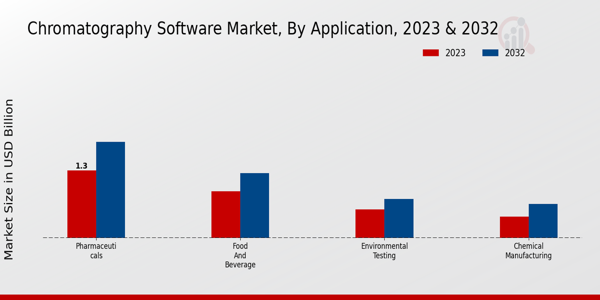

The Chromatography Software Market exhibits a robust and diverse landscape across various applications, underscoring the critical role chromatography plays in analytical chemistry and quality control across industries.

In 2023, the overall market was projected to reach a valuation of 3.16 USD Billion, showcasing a notable increase to 4.5 USD Billion by 2032, which reflects steady growth driven by the ongoing need for precision in analysis and quality assurance.

Within this market, the Pharmaceuticals sector holds significant importance, boasting a valuation of 1.3 USD Billion in 2023, expected to increase to 1.85 USD Billion by 2032.

This dominant position is attributed to the rigorous testing and regulatory requirements pharmaceuticals must adhere to, making chromatography tools vital for drug formulation and validation processes.

The Food and Beverage sector follows closely, valued at 0.9 USD Billion in 2023 and anticipated to rise to 1.25 USD Billion by 2032. This segment is crucial for ensuring food safety and quality.

Chromatography is employed to detect contaminants and verify ingredient authenticity, thus cultivating consumer trust. Environmental Testing, valued at 0.55 USD Billion in 2023 and projected to grow to 0.75 USD Billion by 2032, highlights the importance of chromatography in assessing environmental pollutants.

This also ensures compliance with safety regulations, thereby playing a vital role in public health and safety initiatives. Finally, the Chemical Manufacturing segment, valued at 0.41 USD Billion in 2023 and expected to reach 0.65 USD Billion by 2032, demonstrates its relevance in process optimization and product consistency.

These are essential for maintaining competitive edge and operational efficiency. Each application underscores the diverse utility of chromatography software, with Pharmaceuticals leading the market share, driven by stringent regulations and the need for precision.

As the Chromatography Software Market continues to evolve, opportunities abound in enhancing analytical capabilities, addressing evolving regulatory standards, and expanding applications across various industries, making it a pivotal component of analytical processes in today's technology-driven landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Chromatography Software Market Deployment Type Insights

The Chromatography Software Market is projected to be valued at 3.16 billion USD in 2023, with deployment type playing a crucial role in the industry's development.

The segmentation into On-Premise, Cloud-Based, and Hybrid deployment types showcases the diverse preferences among users. On-premise solutions offer greater control and security, appealing to laboratories with strict compliance requirements.

Cloud-Based options provide flexibility and accessibility, enhancing collaboration across teams. The Hybrid approach merges the benefits of both methods, allowing organizations to optimize resources effectively.

With such varied offerings, the market growth reflects the ongoing trend toward digital transformation in scientific research, offering increased efficiency and better data management.

Additionally, the rise in collaborative research initiatives presents opportunities for scalability and innovation within the Chromatography Software Market as businesses continue to embrace technological advancements.

This segmentation insight is crucial for understanding the dynamics of the market, as each deployment type addresses unique customer needs and regulatory challenges, contributing to an evolving competitive landscape bolstered by continuous developments in chromatography software capabilities.

Chromatography Software Market End User Insights

The Chromatography Software Market is poised for significant growth, particularly within the end-user segment, which encompasses diverse applications across various fields.

As of 2023, the market is valued at 3.16 billion USD, with expectations of robust expansion over the coming years. Academic Institutions are crucial as they drive research and innovation, focusing often on chemical and biological analyses.

Similarly, Research Laboratories play a pivotal role in utilizing chromatography software to enhance experiment accuracy and data analysis efficiency. Pharmaceutical Companies dominate the landscape, leveraging these tools for drug development and quality control, ensuring safety and compliance in their processes.

Moreover, Contract Research Organizations provide essential support in conducting studies, and their increasing demand for efficient software solutions is noteworthy.

The trend toward automation and advanced analytical techniques further propels the market growth. However, challenges remain, including the need for continuous software updates and high operational costs.

Overall, the insights derived from Chromatography Software Market data reveal a dynamic interplay among these End Users, shaping the industry's future trajectory.

Chromatography Software Market Functionality Insights

The Chromatography Software Market, valued at 3.16 USD Billion in 2023, showcases significant potential within the Functionality segment, which encompasses various critical aspects such as Data Management, Regulatory Compliance, System Integration, Reporting, and Analysis.

Data Management plays a vital role, streamlining the handling and storage of vast amounts of data generated during chromatographic processes, thereby enhancing efficiency and accuracy.

Regulatory Compliance is another crucial area, as adherence to strict regulations ensures the reliability of analytical results and validity of methodologies, which is essential for industries like pharmaceuticals and biotechnology.

System Integration allows for seamless operation among disparate systems, enabling better data flow and collaboration, which often leads to improved operational efficiencies.

Reporting and Analysis functions dominate the landscape, providing users with robust tools to visualize and interpret complex data, facilitating informed decision-making.

The growth drivers in this segment include advancements in technology, the increasing demand for high-quality results, and the pressing need for compliance across various sectors.

However, challenges such as the rapid pace of technological change and the need for constant software updates persist, presenting both opportunities and barriers within the Chromatography Software Market data landscape.

Chromatography Software Market Regional Insights

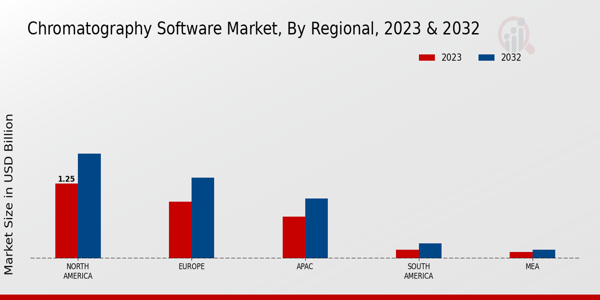

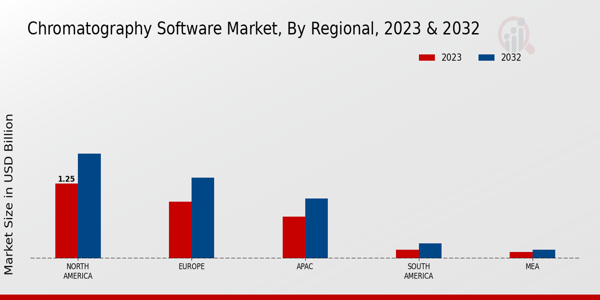

The Chromatography Software Market is poised for substantial growth across various regions, with a total anticipated revenue of 3.16 USD Billion in 2023, projected to rise to 4.5 USD Billion by 2032.

North America holds a majority share, valued at 1.25 USD Billion in 2023 and expected to increase to 1.75 USD Billion in 2032, showcasing its dominance due to the presence of key industry players and advanced research facilities.

Europe follows, with a value of 0.95 USD Billion in 2023, rising to 1.35 USD Billion, driven by stringent regulations in pharmaceuticals prompting investment in chromatography technologies.

The APAC region, valued at 0.7 USD Billion in 2023 and projected to reach 1.0 USD Billion by 2032, is significant due to rapid industrialization and increased focus on healthcare.

South America, although smaller at 0.15 USD Billion in 2023, is set to rise to 0.25 USD Billion, reflecting a growing interest in biotechnology and pharmaceuticals.

The MEA region, valued at 0.11 USD Billion in 2023 with growth to 0.15 USD Billion, shows potential as markets expand with increasing healthcare needs.

Overall, these regional insights highlight the dynamic landscape and the varied opportunities for growth within the Chromatography Software Market industry.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Chromatography Software Market Key Players and Competitive Insights

The Chromatography Software Market is characterized by a competitive landscape that is continually evolving due to advancements in technology, increasing demand for efficient analytical solutions, and the need for enhanced laboratory productivity.

In recent years, the proliferation of chromatography techniques across various industries, including pharmaceuticals, biotechnology, and environmental analysis, has fueled the market's growth.

Players in this space are focusing on manufacturing sophisticated software solutions that not only ensure accurate results but also streamline workflows and improve data management.

As regulatory requirements become more stringent, companies are innovating their software offerings to meet compliance standards better while enhancing functionalities related to data visualization, reporting, and integration with laboratory instruments.

Phenomenex stands out in the Chromatography Software Market due to its comprehensive approach to analytical chemistry solutions. The company has built a solid reputation for its user-friendly software that supports a wide range of chromatography techniques.

Phenomenex's strengths lie in its strong emphasis on customer support and education, offering resources that enable users to maximize their software's capabilities.

The firm's innovative features often include enhanced data analysis tools and seamless instrument compatibility, positioning it as a reliable partner for laboratories seeking to optimize their analytical performance.

Phenomenex's strong market presence is bolstered by strategic collaborations and a commitment to ongoing development, ensuring that its software remains relevant and responsive to the modern needs of researchers and industrial professionals alike.

JASCO has established itself as an influential player in the Chromatography Software Market with a focus on delivering tailored solutions that cater to specific laboratory needs.

The company's software is recognized for its robust features that facilitate complex data analyses and improve laboratory efficiency. JASCO's strengths are particularly evident in its ability to integrate seamlessly with a wide range of chromatography instruments, allowing users to achieve comprehensive data management and reporting.

Furthermore, JASCO places considerable emphasis on training and support, ensuring that clients are well-equipped to leverage the full potential of their software solutions.

This commitment to customer success and innovation has solidified JASCO's presence in the market, making it a preferred choice for laboratories aiming for precision and accuracy in their analytical processes.

Key Companies in the Chromatography Software Market Include:

- KNAUER Wissenschaftliche Geräte GmbH

Chromatography Software Industry Developments

-

Q2 2024: Agilent Technologies Launches New OpenLab CDS 2.7 Chromatography Data System Agilent Technologies announced the release of OpenLab CDS 2.7, the latest version of its chromatography data system, featuring enhanced compliance tools and improved data integrity for regulated laboratories.

-

Q2 2024: Thermo Fisher Scientific Introduces Chromeleon 8.0 Chromatography Data System Thermo Fisher Scientific launched Chromeleon 8.0, a major update to its chromatography data system, offering new cloud connectivity and advanced automation features for pharmaceutical and environmental labs.

-

Q1 2024: Waters Corporation Expands Empower Chromatography Software with AI-Powered Analytics Waters Corporation announced the integration of AI-powered analytics into its Empower Chromatography Software, enabling predictive maintenance and automated data review for improved laboratory efficiency.

-

Q2 2024: Shimadzu Launches LabSolutions CS Version 7 for Enhanced Data Security Shimadzu Corporation released LabSolutions CS Version 7, featuring advanced data security and compliance enhancements to support pharmaceutical and food safety laboratories.

-

Q1 2024: Bruker Launches SCiLS Lab 2024 Chromatography Software Suite Bruker introduced the SCiLS Lab 2024 software suite, designed to streamline chromatography data analysis and visualization for clinical and life science research applications.

-

Q2 2024: PerkinElmer Unveils Signals Chromatography Software for Cloud-Based Data Management PerkinElmer launched Signals Chromatography, a new cloud-based software platform aimed at improving data management and collaboration in analytical laboratories.

-

Q1 2024: Sciex Announces Partnership with LabWare to Integrate Chromatography Data Systems Sciex entered a partnership with LabWare to integrate its chromatography data systems with LabWare's LIMS, enhancing workflow automation and regulatory compliance for laboratory customers.

-

Q2 2024: Agilent Technologies Acquires Chromatography Software Firm Avida Agilent Technologies completed the acquisition of Avida, a provider of specialized chromatography software, to expand its digital laboratory solutions portfolio.

-

Q1 2024: Thermo Fisher Scientific Appoints New Vice President for Chromatography Software Division Thermo Fisher Scientific announced the appointment of Dr. Emily Carter as Vice President of its Chromatography Software Division, aiming to drive innovation and global expansion.

-

Q2 2024: Waters Corporation Opens New Software Development Center in Dublin Waters Corporation inaugurated a new software development center in Dublin, Ireland, focused on advancing chromatography data systems and laboratory informatics.

-

Q1 2024: Bruker Signs Multi-Year Contract with Major Pharmaceutical Company for Chromatography Software Bruker secured a multi-year contract to supply its chromatography software solutions to a leading global pharmaceutical company, supporting drug development and quality control operations.

-

Q2 2024: PerkinElmer Receives FDA 21 CFR Part 11 Certification for Signals Chromatography Software PerkinElmer announced that its Signals Chromatography software received FDA 21 CFR Part 11 certification, ensuring compliance for use in regulated pharmaceutical environments.

Chromatography Software Market Segmentation Insights

Chromatography Software Market Application Outlook

- Pharmaceuticals

- Food and Beverage

- Environmental Testing

- Chemical Manufacturing

Chromatography Software Market Deployment Type Outlook

- On-Premise

- Cloud-Based

- Hybrid

Chromatography Software Market End User Outlook

Chromatography Software Market Functionality Outlook

- Data Management

- Regulatory Compliance

- System Integration

- Reporting and Analysis

Chromatography Software Market Regional Outlook

- North America

- Europe

- South America

- Asia-Pacific

- Middle East and Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2022

|

3.04(USD Billion)

|

|

Market Size 2023

|

3.16(USD Billion)

|

|

Market Size 2032

|

4.5(USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

4.01% (2024 - 2032)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2023

|

|

Market Forecast Period

|

2024 - 2032

|

|

Historical Data

|

2019 - 2023

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Phenomenex, JASCO, Agilent Technologies, GE Healthcare, Thermo Fisher Scientific, ABB Ltd, bioMérieux, Sierra Instruments, Endress+Hauser, Waters Corporation, Merck KGaA, SHIMADZU CORPORATION, PerkinElmer, KNAUER Wissenschaftliche Geräte GmbH, Oxford Instruments

|

|

Segments Covered

|

Application, Deployment Type, End User, Functionality, Regional

|

|

Key Market Opportunities

|

Increased demand for automation, Integration with AI technologies, Expansion in pharmaceutical applications, Growing regulations and compliance needs, Rising need for data management solutions

|

|

Key Market Dynamics

|

technological advancements, regulatory compliance requirements, increasing demand for automation, growing pharmaceutical R activities, rising need for data integrity

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Chromatography Software Market Highlights:

Frequently Asked Questions (FAQ):

The Chromatography Software Market is expected to be valued at 4.5 USD Billion in 2032.

The expected CAGR for the Chromatography Software Market from 2024 to 2032 is 4.01%.

North America is expected to hold the largest market share with a valuation of 1.75 USD Billion in 2032.

The Food and Beverage application is projected to grow to 1.25 USD Billion by 2032.

Key players include Phenomenex, Agilent Technologies, and Thermo Fisher Scientific, among others.

The APAC region's market size is expected to reach 1.0 USD Billion by 2032.

The Environmental Testing application is valued at 0.55 USD Billion in 2023 and is expected to rise to 0.75 USD Billion in 2032.

The Chemical Manufacturing application is projected to reach 0.65 USD Billion in 2032.

South America is expected to have a market value of 0.25 USD Billion by 2032.