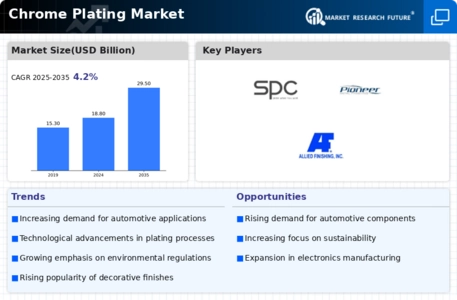

Top Industry Leaders in the Chrome Plating Market

Chrome plating, once synonymous with dazzling car bumpers and gleaming kitchen appliances, is undergoing a metamorphosis. From traditional applications to cutting-edge technologies, the global chrome plating market, is a thrilling stage where established giants and nimble startups battle for a share of the shine. Let's unveil the strategies polishing this landscape, explore the factors influencing market share, and illuminate the recent developments redefining the future of chrome plating.

Chrome plating, once synonymous with dazzling car bumpers and gleaming kitchen appliances, is undergoing a metamorphosis. From traditional applications to cutting-edge technologies, the global chrome plating market, is a thrilling stage where established giants and nimble startups battle for a share of the shine. Let's unveil the strategies polishing this landscape, explore the factors influencing market share, and illuminate the recent developments redefining the future of chrome plating.

Strategies Brightening the Market:

-

Product Diversification: Beyond traditional decorative chrome, companies like Atotech and Enthone are expanding into functional chrome plating with superior wear resistance, high-temperature tolerance, and enhanced corrosion protection, catering to diverse industrial needs. -

Embracing Technological Advancements: Pioneering new plating technologies like laser-assisted chrome plating and pulse plating, as seen in Coventya's offerings, are crucial for improving efficiency, reducing waste, and enhancing plating quality. -

Sustainability Focus: Utilizing eco-friendly alternatives to hexavalent chromium, minimizing water and energy consumption, and offering closed-loop recycling systems, as seen in PPG Industries' initiatives, are becoming key differentiators in a responsible market. -

Regional Expansion and Localization: Entering high-growth markets like China and India, coupled with adapting services to local regulations and environmental standards, is key to success. Atotech's strong presence in Asia exemplifies this approach. -

Strategic Partnerships and Collaborations: Collaborations with research institutions, automotive and aerospace OEMs, and metal finishing companies enhance knowledge sharing, accelerate innovation, and secure market access. Enthone's partnerships with major metal fabrication firms showcase this strategy.

Factors Forging Market Share Fortresses:

-

Brand Reputation and Quality: Established players with a long history of consistent quality and performance, like Chemetall and MacDermid Enthone, hold an edge over newer entrants. -

Production Capacity and Network Coverage: Extensive plating facilities and efficient logistics networks ensure timely delivery and service accessibility, giving established players like Chrome Technologies a competitive advantage. -

Innovation and Technological Prowess: Pioneering new applications like microchrome plating for electronics, hard chrome plating for aircraft parts, and even decorative chrome with self-healing properties, as seen in BASF's offerings, fosters market distinction. -

Price Competitiveness and Regional Focus: Cost-effective solutions for mass markets in emerging economies like India and China can offer companies like Peninsula Metal Finishing an edge. -

Marketing and Customer Service: Engaging marketing campaigns showcasing the diverse applications and cost-saving benefits of chrome plating, coupled with impeccable customer service, are crucial for brand loyalty and repeat business. MacDermid Enthone's focus on customer service sets them apart.

Key Companies in the Chrome Plating market include

- J and N Metal Products

- AI ASHRAFI Group

- Sharretts Plating

- Al Asriah Metal Coating L.L.C.

- Peninsula Metal Finishing

- Pioneer Metal Finishing

- Allied Finishing

- Atotech Deutschl

- Interplex Industries

- Kuntz Electroplating Market

- Trinity Holdings

- Roy Metal Finishing

- Bajaj Electroplaters

- Al wadi Metal

Recent News

Yildirim Group bought Albchrome, the largest chrome company in Albania, in January 2022. This move may be considered significant, taking into account the stable growth of the chrome plating market due to its corrosion resistance properties required by the automotive industry, among others like aerospace or electronics, where it is used for decorative purposes, too.

Wall Colmonoy Limited, headquartered in the United Kingdom, recently introduced a new range of cobalt-chromium powders and cast discs designed specifically for use within the dentistry sector in May 2021. These newly developed materials exhibit excellent strength coupled with biocompatibility plus wear resistance, which makes them ideal candidates for dental implants as well as partial dentures or prosthetics.

In August 2020, Henkel AG & Co KGaA purchased the Atotech Deutschland GmbH’s chromium-plating business.

Nihon Plating Co., Ltd.’s chromium-plating business was bought by Nippon Light Metal Co., Ltd. in September 2020.

January 2022: Albchrome Holding, an Albanian chrome and ferrochromium manufacturer, was purchased by Yildirim Group. The primary goals of this acquisition are to promote the company's advancement and to further solidify its market position globally.

May 2022: At the cutting-edge facility now being built in the United States (US), Atotech and Schweitzer Engineering Laboratories established a cooperation.

September 2019: SAE International and Elsyca NV have established a partnership to create aerospace standards for the electropolishing of both critical and non-critical metallic parts.

July 2022: Interplex Industries, Inc. (USA) announced a new research and development facility that will focus on advanced chromium plating technology. The main goal of this establishment is to create better-performing, efficient and environmentally friendly materials through innovative plating processes. Moreover, Interplex seeks to be the leader in chrome plating innovation and offer state-of-the-art solutions for its customers from different sectors.