- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

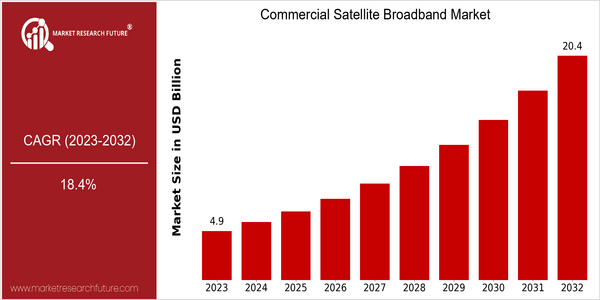

| Year | Value |

|---|---|

| 2023 | USD 4.9 Billion |

| 2032 | USD 20.4 Billion |

| CAGR (2024-2032) | 18.4 % |

Note – Market size depicts the revenue generated over the financial year

The satellite communications market is expected to reach $ 4.9 billion in 2023 and to rise to $ 20 billion by 2032. This reflects a robust CAGR of 18.4 percent from 2024 to 2032. The growth is a result of the growing demand for high-speed Internet in various industries such as telecommunications, maritime, aviation and remote areas where terrestrial broadband is not available. The data consumption resulting from the IoT, the need for reliable connection in remote regions and the increasing number of connected devices are driving this market. High-throughput satellites (HTS) and low-earth-orbit satellite constellations are revolutionizing the satellite broadband industry. SpaceX with its Starlink project, OneWeb and Viasat are at the forefront of this revolution. They are investing heavily in satellite technology and strategic alliances to enhance service delivery and expand their market reach. These efforts are not only lowering the cost of satellite communications but are also increasing the availability of satellite broadband.

Regional Market Size

Regional Deep Dive

The commercial satellite broadband market is experiencing considerable growth in all regions, driven by increasing demand for high-speed Internet access, especially in remote and underserved areas. In addition, the growth of the market is being influenced by technological developments, regulatory support and the growing need for reliable communications in sectors such as telecommunications, maritime and aviation. Each region is characterized by unique characteristics in terms of its development, regulatory framework and market maturity.

Europe

- The European Space Agency (ESA) has launched several initiatives to support satellite broadband development, including funding for innovative projects that enhance connectivity in remote regions, which is expected to stimulate market growth.

- Regulatory changes in the EU, such as the European Electronic Communications Code, are encouraging investment in satellite broadband infrastructure, promoting competition, and facilitating the entry of new players into the market.

Asia Pacific

- “In India, satellite broadband is booming. The government’s digital India programme, for example, is driving a boom in satellite broadband, and it is creating a conducive environment for satellite service operators.

- The region is also seeing significant investments from companies like OneWeb and Amazon's Project Kuiper, which are working on deploying satellite constellations to provide high-speed internet, particularly in rural and remote areas.

Latin America

- The Brazilian government has initiated the National Broadband Plan, which includes satellite broadband as a key component to improve internet access in remote regions, thus creating opportunities for satellite service providers.

- Recent partnerships between local telecom operators and satellite companies, such as the collaboration between Claro and Hughes Network Systems, are aimed at expanding broadband services in underserved areas, which is expected to drive market growth.

North America

- The United States Federal Communications Commission has been actively promoting the use of satellites in the country through the Rural Broadband Access Program. This program, which aims to expand Internet access in rural areas, offers a new opportunity for satellite operators.

- Companies like SpaceX with its Starlink project are revolutionizing the market by deploying low Earth orbit (LEO) satellites, significantly reducing latency and improving service quality, which is expected to attract more users and drive competition.

Middle East And Africa

- The African Union has launched the African Space Strategy, which includes plans to enhance satellite communication capabilities across the continent, thereby boosting the commercial satellite broadband market.

- In the Middle East, companies like Yahsat are expanding their satellite broadband services to cater to the growing demand for connectivity in both urban and rural areas, which is expected to enhance market penetration.

Did You Know?

“As of 2023, over 50% of the world's population still lacks access to reliable internet, highlighting the critical role that satellite broadband can play in bridging the digital divide.” — International Telecommunication Union (ITU)

Segmental Market Size

The commercial satellite communications market is growing rapidly, fueled by the growing demand for high-speed Internet access in underserved and remote areas. This is due to the growing need for reliable connections in the telemedical, educational and agricultural sectors, and the regulatory initiatives aimed at promoting digital access. And new satellite technology, such as low earth orbit (LEO), is making satellite broadband more efficient and appealing. At present, the market is in a phase of scale deployment, with SpaceX Starlink and OneWeb at the forefront of efforts to provide global satellite Internet access. The United States’ rural broadband initiative is also a notable application, as are maritime and aviation communications. The macro-factors driving growth are digital transformation, accelerated by the COVID-19 pandemic, and the governments’ drive to improve rural connectivity. The future of satellite communications is bright, with the development of phased array antennas and the next generation of ground stations.

Future Outlook

COMMERCIAL SATELLITE BROADBANDS MARKET TO GROW STRONGLY FROM 2023 TO 2032 WITH A CAGR OF 18.4 PERCENT. The increasing demand for high-speed Internet access in remote and underserved areas where terrestrial communication is lacking is driving the growth of the market. By 2032, satellite broadband is expected to account for nearly 15 percent of the global market, owing to the development of low-Earth-orbit (LEO) satellite constellations that offer low latency and high-bandwidth compared to traditional geostationary satellites. The ongoing developments of next-generation satellites and the expansion of 5G are expected to enhance the services and customer experience. The government initiatives to bridge the digital divide will further spur the market growth. Besides, the integration of satellite services with IoT applications and the growing use of satellite services in the aviation, maritime, and emergency response industries will further drive the market. The satellite industry players must be ready to seize these opportunities and face the challenges posed by competition and regulations.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 4.1 Billion |

| Market Size Value In 2023 | USD 4.9 Billion |

| Growth Rate | 20.40% (2023-2032) |

Commercial Satellite Broadband Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.