- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

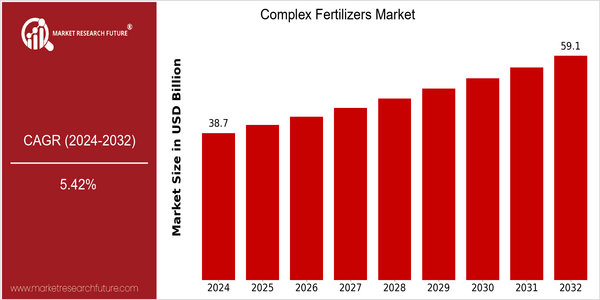

| Year | Value |

|---|---|

| 2024 | USD 38.74 Billion |

| 2032 | USD 59.07 Billion |

| CAGR (2024-2032) | 5.42 % |

Note – Market size depicts the revenue generated over the financial year

The global complex fertilizers market is poised for significant growth, with a current market size of USD 38.74 billion in 2024, projected to expand to USD 59.07 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 5.42% over the forecast period. The increasing demand for high-yield crops, driven by the need to feed a growing global population, is a primary factor propelling this market forward. Additionally, advancements in fertilizer technology, such as the development of slow-release and controlled-release fertilizers, are enhancing nutrient efficiency and sustainability, further stimulating market growth. Key players in the complex fertilizers sector, including Nutrien Ltd., Yara International ASA, and The Mosaic Company, are actively engaging in strategic initiatives to capitalize on this growth. These companies are investing in research and development to innovate new products that meet the evolving needs of farmers. Furthermore, partnerships and collaborations aimed at expanding distribution networks and enhancing product offerings are becoming increasingly common. For instance, recent product launches focusing on environmentally friendly formulations are indicative of the industry's shift towards sustainable agricultural practices, aligning with global trends towards eco-conscious farming solutions.

Regional Market Size

Regional Deep Dive

The Complex Fertilizers Market is characterized by a growing demand for high-efficiency fertilizers that enhance crop yield and quality across various regions. In North America, Europe, Asia-Pacific, the Middle East and Africa (MEA), and Latin America, the market dynamics are influenced by factors such as agricultural practices, regulatory frameworks, and technological advancements. The increasing focus on sustainable agriculture and the need to improve soil health are driving innovations in complex fertilizers, making them a critical component in modern farming practices.

Europe

- The European Union's Green Deal has set ambitious targets for sustainable agriculture, leading to increased investment in eco-friendly complex fertilizers, with companies like Yara International actively developing products that align with these goals.

- Innovations in biostimulants and organic complex fertilizers are becoming more prevalent, driven by consumer demand for organic produce and stricter regulations on chemical fertilizers.

Asia Pacific

- Countries like India and China are witnessing a surge in the use of complex fertilizers due to the need for enhanced food security, with local companies such as IFFCO and Sinofert expanding their product lines to meet this demand.

- Government initiatives aimed at promoting balanced fertilization practices are encouraging farmers to adopt complex fertilizers, which are seen as essential for improving crop productivity in the region.

Latin America

- Brazil and Argentina are leading the way in the adoption of complex fertilizers, with local manufacturers like Fertilizantes Heringer and Yara expanding their offerings to cater to the growing agricultural sector.

- The region is also seeing increased collaboration between governments and private sectors to promote the use of advanced fertilizers, driven by the need to enhance crop yields and ensure food security.

North America

- The adoption of precision agriculture technologies is on the rise, with companies like Nutrien and CF Industries leading the way in developing advanced fertilizer formulations that optimize nutrient delivery to crops.

- Recent regulatory changes in the U.S. have emphasized the reduction of nitrogen runoff, prompting manufacturers to innovate in slow-release and controlled-release fertilizers, which are gaining traction among farmers.

Middle East And Africa

- The Middle East is experiencing a shift towards more sustainable agricultural practices, with investments in complex fertilizers from companies like Saudi Basic Industries Corporation (SABIC) aimed at improving soil fertility in arid regions.

- In Africa, initiatives like the African Green Revolution are promoting the use of complex fertilizers to boost agricultural productivity, with support from organizations such as the Alliance for a Green Revolution in Africa (AGRA).

Did You Know?

“Did you know that complex fertilizers can contain multiple nutrients in a single granule, allowing for more efficient nutrient management and reduced application rates?” — International Fertilizer Association (IFA)

Segmental Market Size

The Complex Fertilizers Market is currently experiencing stable growth, driven by the increasing demand for high-efficiency fertilizers that enhance crop yield and quality. Key factors propelling this segment include the rising global population necessitating higher food production and the growing adoption of precision agriculture practices that optimize nutrient application. Additionally, regulatory policies promoting sustainable farming practices further stimulate demand for complex fertilizers, which often contain a balanced mix of essential nutrients. Currently, the adoption of complex fertilizers is in a mature stage, with notable leaders such as Yara International and Nutrien actively promoting innovative formulations tailored to specific crop needs. Primary applications include use in cereals, fruits, and vegetables, where products like NPK (Nitrogen, Phosphorus, Potassium) fertilizers are widely implemented. Trends such as the push for sustainable agriculture and government mandates for reduced chemical usage are accelerating growth in this segment. Technologies like soil health monitoring and nutrient release control methods are shaping the evolution of complex fertilizers, ensuring they meet the demands of modern agriculture.

Future Outlook

The Complex Fertilizers Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $38.74 billion to $59.07 billion, reflecting a robust compound annual growth rate (CAGR) of 5.42%. This growth trajectory is underpinned by the rising global demand for food production, driven by an increasing population and changing dietary preferences. As agricultural practices evolve, the adoption of complex fertilizers, which offer enhanced nutrient efficiency and crop yield, is expected to penetrate deeper into both developed and emerging markets. By 2032, it is anticipated that the usage rate of complex fertilizers in key agricultural regions will exceed 60%, particularly in Asia-Pacific and Latin America, where agricultural intensification is critical to meet food security challenges. Key technological advancements, such as precision agriculture and the development of slow-release fertilizers, are expected to further propel market growth. These innovations not only optimize nutrient delivery but also minimize environmental impact, aligning with global sustainability goals. Additionally, supportive government policies aimed at promoting sustainable agricultural practices and reducing chemical runoff will likely enhance the adoption of complex fertilizers. Emerging trends, including the integration of digital farming technologies and the increasing focus on organic and bio-based fertilizers, will also shape the market landscape, creating new opportunities for manufacturers and stakeholders. As the industry evolves, strategic partnerships and investments in R&D will be crucial for companies looking to maintain a competitive edge in this dynamic market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 6.5% (2023-2030) |

Complex Fertilizers Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.