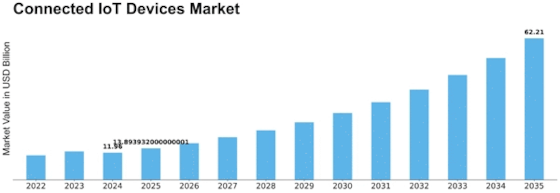

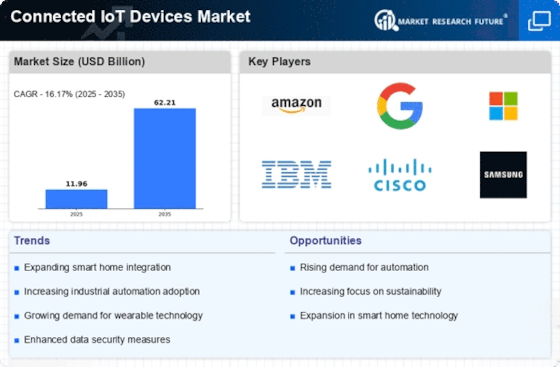

Connected Iot Devices Size

Connected IoT Devices Market Growth Projections and Opportunities

The forces influencing the market for linked Internet of Things (IoT) devices are intricate and have a big influence on the industry's trajectory. The market is mainly driven by the growing demand for enhanced automation and connectivity. Economies of scale result from technological advancements, which reduce production costs and make IoT devices more accessible to a larger variety of users. Saving money is a critical component that propels market penetration and ensures widespread acceptance of IoT solutions across numerous sectors. Considerations about data security and privacy are crucial business factors that should not be ignored. IoT devices generate and exchange enormous amounts of data, therefore securing sensitive data is becoming more and more crucial. Strong security measures must be implemented by manufacturers to address vulnerabilities and protect user data. These techniques consist of regular software updates, secure authentication, and encryption. As the legal landscape evolves, compliance with privacy regulations becomes a vital component of building customer trust and a requirement of the market. Industry participants are realizing the need of open protocols and standardization in ensuring interoperability. This feature promotes a unified and integrated Internet of Things environment by enabling customers to combine devices from various suppliers without running into compatibility issues. Federal laws and regulations are a significant market component that have the potential to impact the growth of the connected IoT device market positively or negatively. The industry is characterized by advancements in sensor technology, communication protocols, and edge computing capabilities. Through the creation of increasingly sophisticated and feature-rich IoT devices, these advancements aid in meeting the evolving needs of consumers and enterprises. It's critical for manufacturers to keep up with technical improvements if they want to remain competitive in the rapidly growing IoT sector. Respecting the laws provides a framework for consistency, security, and privacy regulations in addition to ensuring moral and responsible use. The status of the global economy and macroeconomic factors have an impact on the market for linked IoT devices as well. The rate of adoption and growth of the Internet of Things is primarily influenced by industry spending, consumer purchasing patterns, and economic stability. While prosperous economic times may result in higher spending on connected products and services, recessions may force an interim halt to IoT project investments.

Leave a Comment