- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

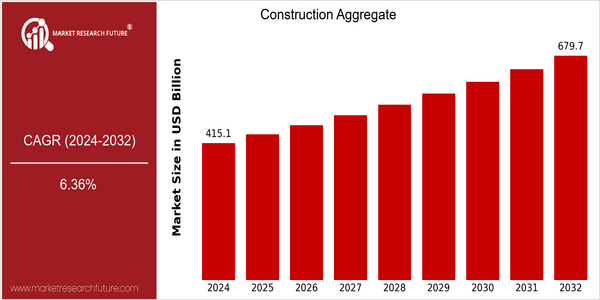

| Year | Value |

|---|---|

| 2024 | USD 415.05 Billion |

| 2032 | USD 679.67 Billion |

| CAGR (2024-2032) | 6.36 % |

Note – Market size depicts the revenue generated over the financial year

The global construction aggregate market is poised for significant growth, with a current market size of USD 415.05 billion in 2024, projected to reach USD 679.67 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 6.36% over the forecast period. The increasing demand for construction materials, driven by urbanization, infrastructure development, and the expansion of the housing sector, is a primary factor propelling this market forward. As countries invest heavily in infrastructure projects to support economic growth, the consumption of aggregates is expected to rise substantially. Technological advancements in the production and recycling of construction aggregates are also contributing to market growth. Innovations such as automated production processes and the use of recycled materials are enhancing efficiency and sustainability in the industry. Key players, including companies like Vulcan Materials Company, Martin Marietta Materials, and HeidelbergCement, are actively pursuing strategic initiatives such as partnerships and investments in sustainable practices to capitalize on this growth trend. These efforts not only align with global sustainability goals but also position these companies favorably in a competitive market landscape.

Regional Market Size

Regional Deep Dive

The Construction Aggregate Market is experiencing dynamic growth across various regions, driven by increasing urbanization, infrastructure development, and a rising demand for sustainable construction practices. Each region exhibits unique characteristics influenced by local economic conditions, regulatory frameworks, and cultural factors. The market is characterized by a mix of traditional materials and innovative alternatives, with a strong emphasis on environmental sustainability and resource efficiency. As governments and private sectors invest in infrastructure projects, the demand for construction aggregates is expected to remain robust, fostering opportunities for market players.

Europe

- The European Union's Green Deal is pushing for a circular economy, leading to increased use of recycled aggregates in construction, with companies like HeidelbergCement investing in innovative recycling technologies.

- Regulatory changes in countries like Germany and the UK are promoting stricter environmental standards, encouraging the use of sustainable materials and practices in construction, which is reshaping the aggregate supply chain.

Asia Pacific

- China's Belt and Road Initiative is driving massive infrastructure projects across Asia, significantly boosting the demand for construction aggregates, with companies like China National Building Material Group playing a pivotal role.

- In India, the government's push for affordable housing and smart city projects is leading to increased investments in aggregate production, with local firms adopting advanced technologies to enhance efficiency and sustainability.

Latin America

- Brazil's infrastructure development is being fueled by government initiatives aimed at improving transportation networks, leading to increased demand for aggregates, with companies like Votorantim Cimentos expanding their operations.

- In Mexico, the construction sector is adapting to new regulations that promote sustainable practices, resulting in a growing market for recycled aggregates and eco-friendly construction materials.

North America

- The U.S. is witnessing a surge in infrastructure spending, particularly with the Biden administration's Infrastructure Investment and Jobs Act, which allocates significant funds for roads, bridges, and public transit, thereby increasing demand for aggregates.

- Sustainability initiatives are gaining traction, with companies like Vulcan Materials and Martin Marietta adopting eco-friendly practices, such as recycled aggregates and reduced carbon emissions, to meet regulatory standards and consumer preferences.

Middle East And Africa

- The UAE is investing heavily in mega-projects like the Expo 2020 and various smart city initiatives, which are creating substantial demand for construction aggregates, with firms like Emirates Global Aluminium diversifying into aggregate production.

- Regulatory frameworks in countries like Saudi Arabia are evolving to promote local sourcing of materials, which is encouraging domestic aggregate production and reducing reliance on imports.

Did You Know?

“Approximately 70% of the total volume of concrete is made up of aggregates, highlighting their critical role in construction and infrastructure development.” — World Business Council for Sustainable Development

Segmental Market Size

The Construction Aggregate Market is currently experiencing stable growth, driven by increasing infrastructure development and urbanization. Key factors propelling demand include the rising need for sustainable construction materials and regulatory policies promoting eco-friendly practices. For instance, the European Union's Green Deal emphasizes the use of recycled aggregates, enhancing their market presence. Currently, the adoption of recycled aggregates is in the scaled deployment stage, with companies like LafargeHolcim and CRH leading initiatives in Europe and North America. Primary applications include road construction, concrete production, and landscaping, where recycled aggregates are increasingly utilized to meet sustainability goals. Trends such as government mandates for lower carbon emissions and the push for circular economy practices are accelerating this segment's growth. Technologies like advanced sorting and processing methods for recycling aggregates are shaping its evolution, ensuring higher quality and performance in construction applications.

Future Outlook

The construction aggregate market is poised for significant growth from 2024 to 2032, with a projected market value increase from $415.05 billion to $679.67 billion, reflecting a robust compound annual growth rate (CAGR) of 6.36%. This growth trajectory is underpinned by the escalating demand for infrastructure development, particularly in emerging economies where urbanization and industrialization are driving the need for high-quality construction materials. As governments worldwide continue to invest in public infrastructure projects, the penetration of construction aggregates in various applications, including roads, bridges, and residential buildings, is expected to rise substantially, enhancing overall market dynamics. Key technological advancements and policy initiatives will play a crucial role in shaping the future of the construction aggregate market. Innovations in sustainable construction practices, such as the use of recycled aggregates and eco-friendly extraction methods, are gaining traction, driven by increasing environmental regulations and a growing emphasis on sustainability. Furthermore, the integration of digital technologies, such as artificial intelligence and automation in quarry operations, is expected to improve efficiency and reduce costs, thereby attracting more investments into the sector. As these trends continue to evolve, the construction aggregate market is likely to experience a paradigm shift, positioning itself as a cornerstone of the global construction industry through 2032.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 386.81 Billion |

| Growth Rate | 6.36% (2024-2032) |

Construction Aggregate Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.