- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

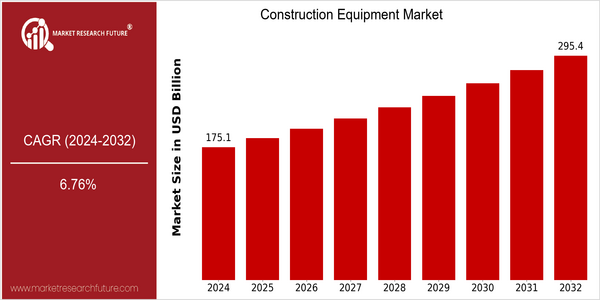

| Year | Value |

|---|---|

| 2024 | USD 175.09 Billion |

| 2032 | USD 295.4 Billion |

| CAGR (2024-2032) | 6.76 % |

Note – Market size depicts the revenue generated over the financial year

The world construction equipment market is expected to reach $ 169.4 billion in 2024 and grow to $ 295.40 billion by 2032. This growth rate is a solid CAGR of 6.8 %. In emerging economies, a growing demand for public works, a need for technological progress and the need to develop the construction industry is expected to boost the market. The need for efficient and technologically advanced equipment is also increasing due to the growing pace of urbanization. There are several reasons for this expansion. One is the integration of smart technology such as the Internet of Things and artificial intelligence in construction equipment, which increases efficiency and safety. In addition, the rising awareness of sustainable development has prompted manufacturers to develop eco-friendly equipment, which has also contributed to the growth of the market. Caterpillar, Komatsu and Volvo Construction Equipment have been actively involved in strategic cooperation and R & D activities to meet market demands. These companies have launched new products that have advanced automation and telematics capabilities, which have shown their determination to use technology to increase performance and productivity.

Regional Market Size

Regional Deep Dive

The construction equipment market is experiencing significant growth across various regions, driven by the growing urbanization, development of infrastructure, and technological developments. North America is characterized by a strong demand for advanced machinery and equipment, especially in the US and Canada, where the government is investing heavily in the construction of the new and rehabilitation of the old. Europe is experiencing a shift towards sustainable building, which is influencing the development of equipment and its use. The Asia-Pacific region is the fastest growing market, driven by the rapid industrialization and urbanization. The Middle East and Africa are also experiencing growth due to large-scale building projects and government initiatives. Latin America is slowly emerging from the economic crisis, with the focus on developing the country’s economy and improving its infrastructure.

Europe

- The European Union's Green Deal is pushing for sustainable construction practices, leading to increased demand for eco-friendly construction equipment.

- Major players like Volvo Construction Equipment are innovating with electric machinery to meet regulatory standards and consumer demand for sustainability.

Asia Pacific

- China's Belt and Road Initiative continues to drive massive infrastructure projects across Asia, significantly boosting the demand for construction equipment.

- Japanese companies are leading in robotics and automation technology, influencing the development of advanced construction machinery in the region.

Latin America

- Brazil's government is implementing programs to improve infrastructure, which is expected to increase the demand for construction equipment in the region.

- Local companies are increasingly adopting rental models for construction equipment, driven by economic constraints and the need for cost-effective solutions.

North America

- The U.S. government has launched the Infrastructure Investment and Jobs Act, which allocates significant funding for infrastructure projects, thereby increasing demand for construction equipment.

- Companies like Caterpillar and John Deere are investing heavily in automation and smart technology, enhancing the efficiency and productivity of construction equipment.

Middle East And Africa

- The UAE is hosting Expo 2020, which has spurred a surge in construction activities, leading to increased demand for heavy machinery and equipment.

- Saudi Arabia's Vision 2030 initiative is focusing on diversifying the economy, with significant investments in construction and infrastructure projects.

Did You Know?

“Did you know that the construction equipment market is increasingly integrating IoT technology, allowing for real-time monitoring and predictive maintenance of machinery?” — Market Research Future

Segmental Market Size

The construction machinery market is currently experiencing a period of steady growth, driven by the rapid development of public works and urbanization. In addition, the need for efficient construction and the automation of construction machinery are the main driving forces. Regulations promoting green building also play a major role in the development of this market. The market has entered a mature period of growth, and the major equipment manufacturers, such as Caterpillar and Komatsu, are deploying advanced equipment with the Internet of Things. There are many notable projects in North America and Asia-Pacific that have integrated smart equipment with large-scale public works. The main applications are earthwork, material handling, and demolition, and the use of excavators and bulldozers to improve efficiency. The trend of sustainable development and the implementation of green building policies have also driven the development of this industry. In addition, telematics and big data analysis are expected to play an important role in improving the efficiency of this industry.

Future Outlook

The world market for construction machinery is set to grow at a substantial CAGR of 6.76 per cent from 2024 to 2032, with a projected growth from $175.09 billion to $295.4 billion. This growth is largely driven by a boom in construction activity in the developing world, where urbanization and industrialization are spurring the demand for more sophisticated construction machinery. By 2032, the share of smart machinery equipped with IoT and AI will reach about 30 per cent of the market, further improving the efficiency and safety of the equipment. Meanwhile, the introduction of automation and telematics is expected to revolutionize the machinery industry. In addition to the productivity gains, these technological developments are in line with the goal of sustainable development, as companies increasingly adopt eco-friendly machinery to meet the stricter requirements of the new environment laws. Meanwhile, government initiatives to boost the construction of roads and other projects, especially those involving renewable energy, will also boost the market. Against this backdrop, the industry must remain agile to keep up with the times, for example, by integrating more electric and hybrid machinery into the market, a move which is both regulatory driven and driven by the changing preferences of consumers.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 150.9 Billion |

| Market Size Value In 2023 | USD 162.5 Billion |

| Growth Rate | 7.75% (2023-2032) |

Construction Equipment Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.