- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

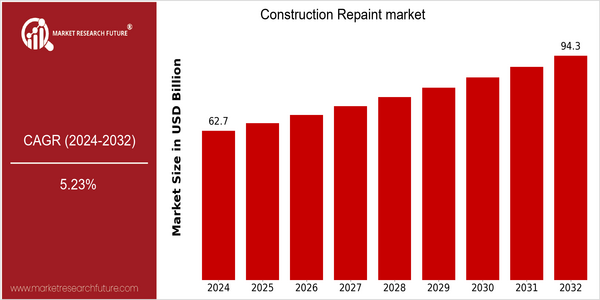

| Year | Value |

|---|---|

| 2024 | USD 62.7 Billion |

| 2032 | USD 94.27 Billion |

| CAGR (2024-2032) | 5.23 % |

Note – Market size depicts the revenue generated over the financial year

By 2032, the global construction paint market is expected to reach a size of $ 94,273,773,800,000. A CAGR of 5.23% has been established for the forecast period. The increasing demand for aesthetic enhancements in residential and commercial properties, as well as the increasing trend towards sustainable building practices, are driving the growth of the construction paint market. The need for high-quality painting solutions is increasing, as both property owners and property managers place a higher value on visual appearance and the environment. The development of low-VOC and eco-friendly products, which are expected to contribute to the growth of the market, is also a significant factor. These innovations not only meet regulatory standards, but also meet the growing demand for sustainable solutions. The market is characterized by a large number of players, such as Sherwin-Williams, PPG Industries, AkzoNobel, etc., which are active in a variety of strategies, such as strategic alliances and product launches, in order to enhance their market presence. For example, Sherwin-Williams has recently launched a new line of eco-friendly paints in line with the trend towards sustainable solutions. These strategic moves are expected to further boost the market's growth and position it favourably in the coming years.

Regional Market Size

Regional Deep Dive

The construction repaint market is growing dynamically in various regions, driven by factors such as urbanization, the development of the transport network and the increasing emphasis on the importance of a sustainable environment. In North America, the market is characterized by a strong demand for eco-friendly paints and coatings, while in Europe innovations in low-VOC and water-based products are gaining momentum. In Asia-Pacific, the market is growing rapidly due to increasing construction activity and rising incomes, while the Middle East and Africa are experiencing strong growth, mainly driven by government initiatives to improve the infrastructure. In Latin America, the economy is recovering, investment in residential and commercial real estate is growing and the market for repainting in construction is therefore favorable.

Europe

- The European Union's Green Deal is pushing for sustainable construction practices, leading to increased demand for environmentally friendly repaint solutions that comply with stringent regulations.

- Innovations in smart coatings, such as self-cleaning and temperature-regulating paints, are being developed by companies like AkzoNobel, which are expected to reshape consumer preferences and drive market growth.

Asia Pacific

- Rapid urbanization in countries like India and China is leading to a surge in construction activities, significantly boosting the demand for repainting services in both residential and commercial sectors.

- Local manufacturers are increasingly adopting advanced technologies and sustainable practices, with companies like Nippon Paint focusing on eco-friendly products to cater to the growing environmental awareness among consumers.

Latin America

- Brazil's economic recovery is leading to increased investments in residential and commercial construction, which is positively impacting the repaint market.

- Local companies are focusing on developing cost-effective and durable paint solutions to cater to the diverse needs of the market, with a growing emphasis on sustainability.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced stricter regulations on VOC emissions, prompting manufacturers to innovate and produce low-VOC and eco-friendly paint options, which are gaining popularity among consumers.

- Major companies like Sherwin-Williams and PPG Industries are investing heavily in R&D to develop advanced coatings that offer better durability and environmental performance, thus enhancing their market position.

Middle East And Africa

- Government initiatives, such as Saudi Arabia's Vision 2030, are driving infrastructure development, which is expected to increase the demand for construction repaint services in the region.

- The rise of green building certifications in the UAE is encouraging the use of sustainable paints, with companies like Jotun leading the way in providing eco-friendly solutions.

Did You Know?

“Did you know that the global construction repaint market is increasingly shifting towards water-based paints, which are not only more environmentally friendly but also offer better performance in terms of durability and ease of application?” — Market Research Future

Segmental Market Size

In the field of building, the repainting of buildings plays a significant role. It is a segment of the industry which is currently in good health, due to the constant need for the maintenance and embellishment of the buildings. It is a segment which is bolstered by the increasing importance of retaining the value of the building and the rising trend towards eco-friendly paints, which are in line with the growing desire for sustainable development. It is also a segment which is bolstered by the regulatory policy which favours the use of low-VOC products, which are both health-friendly and meet the relevant regulations. The market is currently in a state of maturity, with companies such as Sherwin-Williams and PPG Industries leading the field in terms of product development and the introduction of sustainable practices. The most important applications are in the repainting of residential and commercial buildings, where both aesthetics and quality are paramount. The trend towards renovation, in response to the pandemic, is expected to increase the number of repaintings. The further development of the paint technology, such as self-cleaning and anti-microbial paints, will also shape the future of this segment, with an increase in functionality and the life of the coating.

Future Outlook

In the period from 2024 to 2032, the turnover of the construction paint market is expected to grow from $ 62,7 billion to $ 94,27 billion, with an average annual growth rate (CAGR) of 5.23%. In the future, the paint market is expected to be driven by the rising demand for the maintenance and beautification of residential and commercial buildings. The need to repaint existing buildings to meet the modern standards and preferences of the population will also stimulate the market. The most significant growth in the use of paints is expected in emerging economies, where the development of the industry is a priority. The development of new technological solutions, such as the development of eco-friendly and high-performance coatings, will also contribute to the growth of the market. The innovation in the composition of paints, increasing their resistance, reducing their impact on the environment, and facilitating the application, will be attractive to both contractors and consumers. The support of the government for the development of sustainable building will also contribute to the development of the paint market. The growing popularity of home improvement and the integration of smart technology into the construction industry will also affect consumer behavior, thereby changing the dynamic and competitive nature of the construction paint market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 59.15 billion |

| Growth Rate | 5.23%(2024-2032) |

Construction Repaint Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.