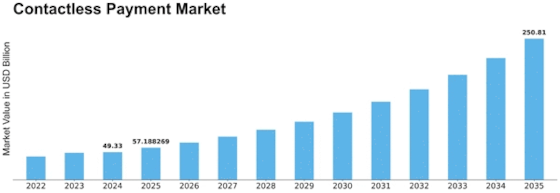

Contactless Payment Size

Contactless Payment Market Growth Projections and Opportunities

A sudden wave of contactless payments has changed global shopping. Innovative developments have a major role in market factors in this domain. The need for convenience and efficiency in daily transactions has led to the rise of contactless payment methods. The inclusion of contactless payment options in cell phones has driven market growth as they become ubiquitous. This integration has streamlined payments and promoted contactless cards and wearables.

The growing emphasis on security affects the contactless payment business. Buyers want strong security features in contactless payment systems as data breaches and fraud rise. These concerns are driving market companies to develop secure technologies like tokenization and biometric verification. This emphasis on security is essential for maintaining consumer trust and administrative requirements in many locations, affecting market factors.

The Coronavirus outbreak has also boosted contactless payments as purchasers seek safer alternatives to traditional money transfers. Due to concerns about illness transmission through currency, many individuals now use contact-free payment methods. This unanticipated global event has boosted the contactless payment sector and changed consumer preferences.

Regardless of individual preferences, significant payment biological system partners' collaborative work shapes market aspects. Financial institutions, innovative firms, and merchants are integrating contactless payment systems into their strategies. This cooperative approach improves contactless payment framework compatibility, making them more accessible.

Administrative environment also affects contactless payment market. States and administrative entities are promoting electronic payment methods to accelerate monetary consideration and reduce cash dependence. Contactless payments have thrived due to administrative support and foundation-building efforts.

In the contactless payment business, key players are battling fiercely for market share. Financial foundations, innovation giants, and fintech startups are contributing their unique assets and technologies. This severe situation is driving ongoing developments in contactless payment advances, resulting in a variety of arrangements to meet customer wants.

Customer education also shapes market factors. Buyers need broad awareness and comprehension as contactless payment options grow. Market companies are investing in educational campaigns to educate customers about contactless payments' benefits and security, increasing adoption.

The global concept of contactless payments complicates its components. Local differences in consumer behavior, foundation development, and administrative systems create diverse markets. Organizations intending to establish global contactless payment market strengths must understand and explore these geographical differences.

Leave a Comment