- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

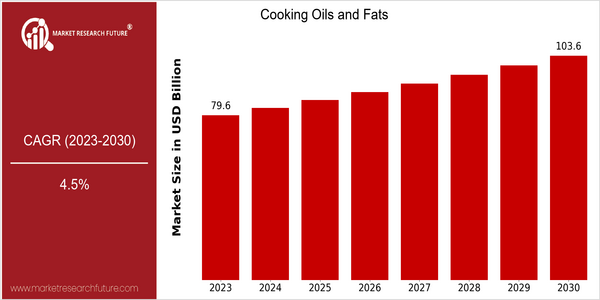

| Year | Value |

|---|---|

| 2023 | USD 79.6 Billion |

| 2030 | USD 103.6 Billion |

| CAGR (2023-2030) | 4.5 % |

Note – Market size depicts the revenue generated over the financial year

The world market for fats and oils is expected to be worth $ 79.6 billion by 2023. By 2030, this figure is expected to rise to $ 103.6 billion. This represents an annual growth rate of 4.5% over the forecast period. This growth can be attributed to several factors, including the increasing awareness of consumers about the importance of diet and health, the growing demand for plant-based oils and the increasing popularity of home cooking, which has been accelerated by the pandemic of COVID-19. Moreover, technological advances in extraction and refining processes are improving the quality and increasing the range of oils available, thus attracting a wider audience. Strategic initiatives by major players such as Cargill, Archer Daniels-Midland Company and Bunge Limited are capitalizing on this growth. For example, these companies are investing in research and development to create healthier oils, and they are establishing strategic alliances to improve their distribution networks. Furthermore, product launches focusing on organic and non-GMO oils are gaining traction as consumers’ preferences change. These strategic moves are expected to have a major impact on the evolution of the market and the competitive landscape.

Regional Market Size

Regional Deep Dive

The Cooking Oils and Fats Market is characterized by a diverse range of consumer preferences and a growing inclination towards health-conscious products across various regions. In North America, the trend toward plant-based oils and organic cooking oils is gaining traction, while Europe is more focused on sustainable products and clean-label products. The Asia-Pacific region is characterized by a mix of modern and traditional cooking oils, which is reflective of the cultural preferences and rapid urbanization in the region. Middle East and Africa are characterized by a growing demand for both domestic and imported oils, which is a result of the changing dietary preferences and the economic growth in the region. Latin America is characterized by a growing demand for healthier cooking oils, which is a result of the changing lifestyles and the growing awareness about the benefits of healthy cooking oils. In general, the market is influenced by the health trends, regulatory framework, and cultural factors of each region.

Europe

- The European Union's Green Deal is pushing for sustainable agricultural practices, which is influencing the cooking oils market to adopt more eco-friendly production methods, with companies like Unilever leading the charge.

- There is a growing trend towards organic and non-GMO oils, with brands like Rapunzel and Bio Planète gaining popularity among health-conscious consumers.

Asia Pacific

- The increasing urbanization in countries like India and China is driving the demand for convenient cooking oils, with local brands such as Fortune and Dhara innovating to meet consumer needs.

- Health awareness campaigns by organizations like the Indian Heart Association are promoting the use of healthier oils, such as mustard and groundnut oil, impacting consumer choices.

Latin America

- The trend towards healthier cooking options is leading to increased consumption of oils like coconut and avocado, with local producers such as La Tourangelle capitalizing on this shift.

- Government initiatives promoting healthy eating, such as Brazil's Food Guide, are encouraging consumers to choose oils with better nutritional profiles, impacting market dynamics.

North America

- The rise of plant-based diets has led to increased demand for oils such as avocado and olive oil, with companies like California Olive Ranch and Chosen Foods expanding their product lines to cater to this trend.

- Regulatory changes, such as the FDA's labeling requirements for trans fats, have prompted manufacturers to reformulate products, leading to a decline in the use of partially hydrogenated oils.

Middle East And Africa

- The demand for palm oil is rising in several African countries, driven by its affordability and versatility, with companies like Wilmar International expanding their operations in the region.

- Cultural preferences for traditional oils, such as sesame and olive oil, are being complemented by a growing interest in imported oils, influenced by expatriate communities and globalization.

Did You Know?

“Did you know that olive oil is the only oil that is classified as a fruit juice? It is extracted from the fruit of the olive tree and is known for its numerous health benefits.” — International Olive Council

Segmental Market Size

The oils and fats sector is a vital part of the food industry, and it is currently experiencing a steady growth, thanks to the growing health awareness of consumers and the demand for plant-based diets. The sector is driven by the increased consumption of healthy oils, such as olive oil and avocado oil, and by government regulations that require trans-fats to be removed from food products. Moreover, technological improvements in the extraction and refining of oils and fats have further improved product quality and shelf life, thereby boosting demand. In general, the switch to healthier cooking oils has reached a mature stage, and companies such as Unilever and Cargill are leading the way in terms of product development and market penetration. Oils and fats are essential for cooking, frying, baking and food preparation. However, they are also used in a wide range of other food products, including cosmetics and pharmaceuticals. As the focus of the market shifts towards clean label and sustainable products, the demand for organic and non-GMO oils is also growing. Cold pressing and supercritical fluid extraction are the latest trends shaping the sector, and they are improving the quality and nutritional value of cooking oils.

Future Outlook

The Cooking Oils and Fats market is expected to grow significantly between 2023 and 2030, with an estimated market value of $79 billion to $ 103 billion, reflecting a CAGR of 4.5%. Rising awareness of health and nutrition has shifted the focus of the market towards healthier cooking oils, such as olive, avocado, and coconut oils. As consumers increasingly seek out products with better fatty acid profiles, the penetration of premium products is expected to increase. In addition, technological advances and government initiatives will continue to shape the market. The quality and shelf life of cooking oils are being improved by new extraction and refining methods. On the other hand, trends towards greater sustainability are driving manufacturers to adopt more eco-friendly practices. Regulations promoting the reduction of trans fats and the use of natural ingredients are also expected to boost the demand for healthier cooking oils. The result is that the market will not only grow in size, but also diversify, with a wider range of products to meet consumers’ preferences and dietary needs.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 76.2 Billion |

| Market Size Value In 2023 | USD 79.6 Billion |

| Growth Rate | 4.5% (2023-2030) |

Cooking Oils Fats Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.