- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

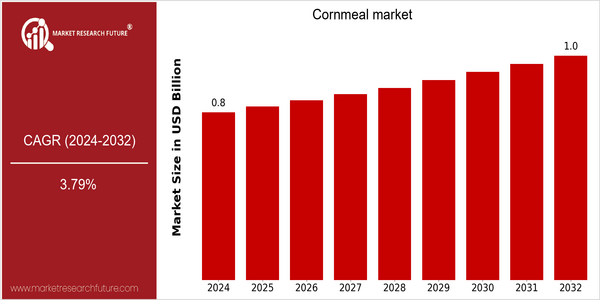

| Year | Value |

|---|---|

| 2024 | USD 0.83032 Billion |

| 2032 | USD 1.0379 Billion |

| CAGR (2024-2032) | 3.79 % |

Note – Market size depicts the revenue generated over the financial year

The global cornmeal market is poised for steady growth, with a current market size of approximately USD 0.83032 billion in 2024, projected to reach USD 1.0379 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.79% over the forecast period. The increasing demand for gluten-free products, coupled with the rising popularity of cornmeal as a versatile ingredient in various culinary applications, is driving this upward trend. Additionally, the growing health consciousness among consumers is leading to a shift towards natural and organic food products, further bolstering the market's expansion. Key players in the industry, such as Archer Daniels Midland Company, Bunge Limited, and General Mills, are actively engaging in strategic initiatives, including partnerships and product innovations, to enhance their market presence. For instance, investments in advanced processing technologies and the launch of new cornmeal variants are expected to cater to the evolving consumer preferences, thereby contributing to the overall growth of the cornmeal market.

Regional Market Size

Regional Deep Dive

The Cornmeal market is characterized by diverse consumption patterns and production methods across different regions. In North America, particularly the United States, cornmeal is a staple ingredient in many traditional dishes, driving steady demand. Europe shows a growing interest in gluten-free products, leading to innovations in cornmeal formulations. The Asia-Pacific region is witnessing an increase in cornmeal usage in both traditional and modern culinary applications, while the Middle East and Africa are experiencing a rise in corn-based products due to population growth and urbanization. Latin America, with its rich agricultural heritage, continues to be a significant producer and consumer of cornmeal, influenced by local cuisines and agricultural practices. Overall, the market dynamics are shaped by cultural preferences, health trends, and economic factors unique to each region.

Europe

- The European market is seeing a surge in organic cornmeal products, driven by consumer demand for healthier and more sustainable food options, with brands like Doves Farm leading the way.

- Regulatory changes in food labeling and safety standards are prompting manufacturers to invest in quality assurance processes, ensuring that cornmeal products meet stringent EU regulations.

Asia Pacific

- In countries like India and China, traditional dishes incorporating cornmeal are gaining popularity, leading to increased production and innovation in local processing methods.

- The rise of e-commerce platforms is facilitating greater access to cornmeal products, allowing small-scale producers to reach a wider audience and compete with larger brands.

Latin America

- In Latin America, traditional dishes such as arepas and polenta are driving consistent demand for cornmeal, with local producers focusing on preserving traditional recipes while modernizing production techniques.

- The region's agricultural policies are increasingly supporting sustainable farming practices, which are expected to improve the quality and availability of cornmeal products.

North America

- The rise of gluten-free diets has led to increased demand for cornmeal as a substitute for wheat flour, with companies like Bob's Red Mill expanding their product lines to cater to this trend.

- Innovations in packaging and distribution, such as eco-friendly packaging initiatives by companies like Ardent Mills, are enhancing the market's sustainability profile and attracting environmentally conscious consumers.

Middle East And Africa

- The growing urban population in Africa is driving demand for convenient and ready-to-eat cornmeal products, with companies like Pioneer Foods expanding their offerings to meet this need.

- Government initiatives aimed at boosting local agriculture are encouraging the cultivation of corn, which is expected to enhance the supply chain for cornmeal production in the region.

Did You Know?

“Cornmeal is not only a staple in many cuisines but also serves as a key ingredient in various gluten-free products, making it a versatile choice for health-conscious consumers.” — Food and Agriculture Organization (FAO)

Segmental Market Size

The cornmeal market segment plays a crucial role in the broader grain and flour industry, currently experiencing stable growth driven by increasing consumer demand for gluten-free and health-conscious food options. Key factors propelling this demand include the rising popularity of plant-based diets and the growing awareness of the nutritional benefits of cornmeal, such as its high fiber content and versatility in cooking. Additionally, regulatory policies promoting whole grain consumption further support this segment's expansion. Currently, the adoption of cornmeal is in a mature stage, with notable companies like Bob's Red Mill and Quaker Oats leading the market. Primary applications include baking, cooking, and as a thickening agent in various cuisines, particularly in Latin American and Southern U.S. dishes. Trends such as the shift towards sustainable agriculture and local sourcing are catalyzing growth, while technological advancements in milling processes enhance product quality and shelf life. Overall, the cornmeal segment is well-positioned to meet evolving consumer preferences and industry demands.

Future Outlook

The cornmeal market is poised for steady growth from 2024 to 2032, with a projected market value increase from approximately $0.83 billion to $1.04 billion, reflecting a compound annual growth rate (CAGR) of 3.79%. This growth trajectory is underpinned by rising consumer demand for gluten-free and health-conscious food options, as cornmeal is increasingly recognized for its nutritional benefits, including high fiber content and essential vitamins. As more consumers shift towards plant-based diets, the penetration of cornmeal in various food applications, such as baking, cooking, and as a thickening agent, is expected to rise significantly, potentially reaching usage rates of over 25% in mainstream food products by 2032. Key technological advancements in agricultural practices and processing methods are anticipated to further enhance the cornmeal market. Innovations such as precision agriculture and improved milling techniques will not only increase yield efficiency but also improve the quality and shelf-life of cornmeal products. Additionally, supportive policies promoting sustainable agriculture and local sourcing are likely to bolster market growth. Emerging trends, including the rise of organic and non-GMO cornmeal options, will cater to the evolving preferences of health-conscious consumers, thereby expanding market opportunities. Overall, the cornmeal market is set to thrive, driven by a combination of consumer trends, technological advancements, and favorable policy frameworks.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 3.79% (2023-2030) |

Cornmeal Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.