- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

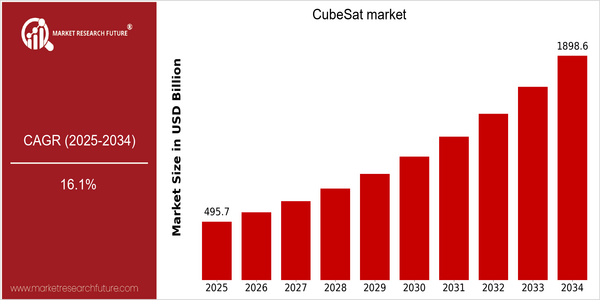

| Year | Value |

|---|---|

| 2025 | USD 495.69332 Billion |

| 2034 | USD 1898.604 Billion |

| CAGR (2025-2034) | 16.1 % |

Note – Market size depicts the revenue generated over the financial year

The CubeSat market is poised for tremendous growth, with a current market value of $ 495.69 billion in 2025 and projected to be worth $ 1,898.60 billion by 2034. This remarkable growth is based on a CAGR of 16.1% for the forecast period. This growth is due to the increasing demand for small satellites, driven by the miniaturization, cost reduction, and increased capabilities of CubeSats, which can be used for a wide range of applications, such as Earth observation, telecommunications, and scientific research. The increasing availability of space for commercial use and the increasing demand for satellite-based services are also contributing to this growth. The availability of new CubeSat launch services, such as ride-sharing and reusability, has reduced the cost of CubeSat launches, which makes them an attractive option for both start-ups and established companies. Strategic initiatives such as acquisitions, mergers, and investments are also contributing to this growth. CubeSat market players, such as Planet, Spire, and NASA, are also working to enhance their capabilities and expand their service offerings. In addition, the collaboration between private companies and government space agencies is creating a robust CubeSat ecosystem that will continue to drive the growth of the market.

Regional Market Size

Regional Deep Dive

The CubeSat market is growing rapidly in different regions, primarily due to technological developments, increasing demand for satellite services, and a growing number of space missions. In North America, especially the United States, the market is characterized by a strong cluster of private companies, government initiatives, and academic institutions, which stimulates innovation and collaboration. This region benefits from substantial investment in space technology and a favorable regulatory environment, which together create a favourable environment for the development and operation of CubeSats. In Europe, the market is characterized by strong government support and international collaboration projects. The Asia-Pacific region is characterized by rapid developments in satellite technology and increasing participation from emerging economies. In the Middle East and Africa, CubeSats are slowly entering the market, mainly driven by growing interest in space exploration and satellite applications. In Latin America, CubeSats are used for different purposes, including disaster monitoring and environment monitoring.

Europe

- The European Space Agency (ESA) has initiated several CubeSat projects, such as the QB50 mission, which aims to deploy a network of 50 CubeSats to study the lower thermosphere, showcasing Europe's commitment to collaborative space research.

- Regulatory frameworks in Europe are evolving to support small satellite launches, with countries like France and Germany investing in launch facilities and infrastructure to facilitate CubeSat deployment.

Asia Pacific

- Countries like Japan and India are making significant strides in CubeSat technology, with the Indian Space Research Organisation (ISRO) successfully launching multiple CubeSats as part of its commercial satellite launch services.

- The rise of private space companies in China, such as GalaxySpace, is accelerating the development of CubeSats for communication and Earth observation, reflecting the region's growing investment in space technology.

Latin America

- Brazil's National Institute for Space Research (INPE) is actively involved in CubeSat projects aimed at environmental monitoring, demonstrating the region's focus on utilizing satellite technology for sustainable development.

- Collaborative initiatives, such as the Latin American Space Agency (ALAE), are promoting the development and deployment of CubeSats across member countries, enhancing regional cooperation in space exploration.

North America

- NASA's CubeSat Launch Initiative (CSLI) continues to support the development of small satellites, providing opportunities for universities and private companies to launch their CubeSat missions, thereby fostering innovation in the sector.

- Companies like Planet Labs and Spire Global are leading the charge in commercializing CubeSat technology, focusing on Earth observation and data analytics, which is reshaping how industries utilize satellite data.

Middle East And Africa

- The UAE's Mohammed bin Rashid Space Centre has launched several CubeSats, including KhalifaSat, which is part of the country's broader strategy to enhance its capabilities in space technology and research.

- In Africa, where the new space agencies are growing, CubeSats are used in agriculture, in the monitoring of the environment, and in disaster prevention and relief, showing a growing interest in space technology.

Did You Know?

“The first CubeSat, called 'CUTE-1.7+', was launched in 2003 by a team of students from Tokyo University, marking the beginning of a new era in small satellite technology.” — NASA

Segmental Market Size

The CubeSat market is a significant part of the general satellite market, which is currently undergoing a major expansion, driven by the miniaturization and cost reduction of satellites. The increasing need for earth observation data, in particular for climate monitoring and disaster management, as well as the growing number of commercial space ventures that use CubeSats for various applications, are the main driving forces behind the CubeSat market. Also, government initiatives to promote the launch of small satellites, such as the U.S. government’s SmallSat Launch Vehicle program, are helping to accelerate the growth of the CubeSat market. Currently, CubeSats are in the implementation stage, with notable examples being Planet Labs, which operates a fleet of CubeSats for earth observation, and the European Space Agency, which is using CubeSats for scientific research. The main applications are remote sensing, communications and technology demonstration. Also, trends such as the drive for sustainable space activities and the increasing collaboration between private and public organizations are promoting growth. Also, the CubeSat market is being shaped by the development of new technologies such as advanced propulsion and miniaturized sensors, which are enabling more sophisticated missions and more widespread use in the space industry.

Future Outlook

Cubesats will be very successful in the market from 2025 to 2034, when the value of the market will grow from $ 495,697,000 to $ 1,896,473,000, a CAGR of 16.1%. This growth is driven by the growing demand for CubeSats from a number of industries, including Earth observation, telecommunications and science. Because governments and companies are looking for cheap solutions to collect and send data, CubeSats are becoming an integral part of satellite constellations, which facilitate worldwide communication and data availability. The CubeSat market is also gaining momentum due to the development of new components, such as miniaturization, improved propulsion and improved communication technology. The government's commitment to innovation in space technology, with the help of subsidies and research programs, will also encourage the growth of the market. Lastly, the increasing number of commercial space ventures and the growing interest in space exploration will boost the CubeSat market, which is expected to exceed 30% of the small satellite market by 2034. The CubeSat ecosystem will continue to develop, and it is up to private companies and government agencies to work together to ensure the long-term growth of this market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 16.09% (2024-2032) |

CubeSat Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.