- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

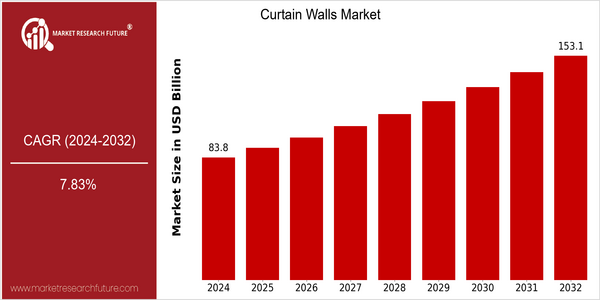

| Year | Value |

|---|---|

| 2024 | USD 83.77 Billion |

| 2032 | USD 153.12 Billion |

| CAGR (2024-2032) | 7.83 % |

Note – Market size depicts the revenue generated over the financial year

By 2032, the global curtain wall market is expected to grow at a CAGR of 5.6%, from US$87.9 billion in 2024, to US$153.1 billion. The growth rate will be even higher for the high-rise curtain wall, which will grow at a CAGR of 7.83%. The demand for energy-saving building solutions, as well as the trend of urbanization and the development of public facilities, will drive the growth of the curtain wall market. In addition, the curtain wall material is also developing, such as high-performance glass and frame systems, which will make the curtain wall more attractive in terms of appearance and function, and thus lead to the use of curtain walls in more commercial and residential buildings. The curtain wall industry has a number of key players, such as Schüco International KG, Kawneer, and Saint-Gobain, and they are constantly developing new products and forming strategic alliances to seize the market. The curtain wall industry has recently invested heavily in green curtain walls and launched new products that are more in line with the development of new regulations. These factors will play an important role in the future development of the curtain wall industry.

Regional Market Size

Regional Deep Dive

The curtain wall market is experiencing significant growth in all regions, mainly due to the growing importance of energy conservation, urbanization and architectural innovations. North America's market is characterized by a strong demand for high-performance building envelopes, while Europe's market is characterized by a focus on sustainability and compliance. Asia-Pacific's construction activities are booming, especially in the emerging economies, and this has led to a higher demand for curtain walls. The Middle East and Africa are experiencing a boom in luxury projects, and Latin America is gradually embracing modern architectural trends, although at a slower pace. Each region has its own opportunities and challenges, which are determined by the local economic conditions, cultural preferences and legal frameworks.

Europe

- The European Union's stringent regulations on energy efficiency and carbon emissions are driving the demand for sustainable curtain wall solutions, leading to increased investments in R&D by companies like Saint-Gobain and Aluk.

- Innovations in materials, such as the use of recycled aluminum and high-performance glazing, are becoming prevalent, with projects like The Edge in Amsterdam showcasing cutting-edge curtain wall designs that prioritize sustainability.

Asia Pacific

- The rapid urbanization in China and India is leading to the construction of high-rise buildings. The China State Construction Engineering Company (CSCEC) is carrying out large-scale curtain wall projects.

- The adoption of smart building technologies is on the rise, with curtain wall systems integrated with IoT solutions for enhanced energy management and building performance, as seen in projects like the Guangzhou International Finance Center.

Latin America

- Brazil's growing middle class and urbanization are driving demand for modern architectural designs, with curtain walls becoming a popular choice in new commercial and residential developments.

- Government initiatives aimed at improving infrastructure, such as the Growth Acceleration Program (PAC), are expected to boost construction activities, indirectly benefiting the curtain walls market.

North America

- The U.S. Green Building Council has introduced new LEED certification standards that encourage the use of energy-efficient curtain wall systems, prompting manufacturers to innovate and adapt their products accordingly.

- Major companies like Kawneer and Schüco are investing in advanced technologies such as automated manufacturing processes and smart glass solutions to enhance the performance and aesthetic appeal of curtain walls.

Middle East And Africa

- The UAE's Vision 2021 initiative is promoting sustainable urban development, resulting in increased demand for innovative curtain wall solutions in iconic projects like the Burj Khalifa and the Museum of the Future.

- Local companies such as Al-Futtaim Engineering are collaborating with international firms to bring advanced curtain wall technologies to the region, focusing on aesthetics and energy efficiency.

Did You Know?

“Did you know that curtain walls can reduce energy consumption in buildings by up to 30% when designed with high-performance glazing and insulation materials?” — U.S. Department of Energy

Segmental Market Size

The curtain wall market is currently experiencing stable growth, driven by the increasing demand for energy-efficient building solutions and aesthetic architectural designs. There is also a strong trend towards the use of sustainable building materials and the introduction of new building regulations that aim to reduce the carbon footprint of cities. Glazing technology, which is constantly improving, is also driving demand. Curtain walls are now widely used, with the most notable projects in North America and Europe. In these regions, companies such as Schuco and Kawneer lead the way in the development of new products. The curtain wall is the most commonly used building material in commercial, high-rise, and public buildings. Curtain walls are used not only for their structural strength, but also for their energy-saving properties. Green building certifications and government regulations aimed at improving energy efficiency are boosting growth. The development of double-skinned façades and smart glass is also influencing the evolution of the market. Double-skinned façades and smart glass offer improved energy efficiency and dynamic energy management.

Future Outlook

The Curtain Walls Market is expected to register a CAGR of 7.83% from 2024 to 2032. The market is mainly driven by the growing demand for energy-efficient building solutions and the growing adoption of sustainable construction practices. As urbanization continues to accelerate, the demand for modern architectural designs that integrate curtain walls is expected to rise, as they enhance the aesthetic and functional performance of commercial and residential buildings. Moreover, technological advancements, such as the integration of smart glass and energy-efficient materials, are also expected to boost the market. Furthermore, innovations in manufacturing processes and the development of lightweight, high-strength materials are expected to enhance the performance and versatility of curtain walls. Government initiatives to promote green building practices and reduce carbon emissions are also expected to drive market growth. By 2032, it is expected that curtain walls will account for a higher share of the building envelope market, with a new construction penetration rate of over 60% in urban areas, which is expected to reflect the growing preference for sustainable and aesthetically appealing architectural solutions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 76.85 Billion |

| Growth Rate | 7.83% (2024-2032) |

Curtain Walls Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.