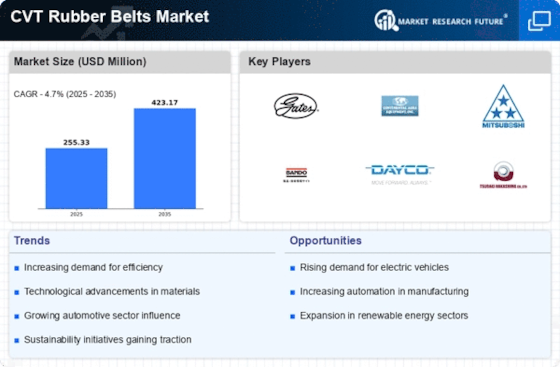

Rising Adoption of Electric Vehicles

The transition towards electric vehicles (EVs) is reshaping the CVT Rubber Belts Market. As automakers pivot to produce more electric models, the demand for efficient transmission systems, including continuously variable transmissions (CVTs), is expected to rise. CVTs are particularly advantageous in electric vehicles due to their ability to optimize power delivery and enhance energy efficiency. This shift is likely to create new opportunities for manufacturers of CVT rubber belts, as they will need to cater to the unique requirements of electric drivetrains. Market data suggests that the EV segment is projected to grow significantly, which may lead to an increased demand for specialized rubber belts designed for these applications, thereby influencing the overall dynamics of the CVT Rubber Belts Market.

Growing Focus on Fuel Efficiency Regulations

The CVT Rubber Belts Market is significantly influenced by the tightening fuel efficiency regulations imposed by various governments. As regulatory bodies worldwide implement stricter emissions standards, automotive manufacturers are compelled to enhance the fuel efficiency of their vehicles. CVTs, known for their ability to provide seamless acceleration and optimal engine performance, are increasingly being adopted as a solution to meet these regulations. Consequently, the demand for high-quality CVT rubber belts is likely to rise, as these components play a crucial role in the overall efficiency of the transmission system. Market analysis indicates that the push for compliance with fuel economy standards will continue to drive innovation and investment in the CVT Rubber Belts Market.

Technological Innovations in CVT Rubber Belts

The CVT Rubber Belts Market is experiencing a surge in technological innovations that enhance the performance and durability of rubber belts. Advancements in materials science have led to the development of high-performance rubber compounds that offer improved resistance to wear and tear. This is particularly relevant as the automotive sector increasingly demands components that can withstand higher torque and stress levels. Furthermore, the integration of smart technologies into CVT systems is likely to drive the demand for specialized rubber belts that can adapt to varying operational conditions. As a result, manufacturers are investing in research and development to create belts that not only meet but exceed current performance standards, thereby positioning themselves competitively within the CVT Rubber Belts Market.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the CVT Rubber Belts Market. As competition intensifies, manufacturers are focusing on developing innovative products that offer enhanced performance and longevity. R&D efforts are directed towards creating rubber belts that can withstand extreme conditions, such as high temperatures and varying loads. This focus on innovation is likely to result in the introduction of advanced materials and designs that improve the overall efficiency of CVTs. Furthermore, as consumer preferences shift towards high-performance vehicles, the demand for cutting-edge CVT rubber belts is expected to rise. Thus, the commitment to R&D within the CVT Rubber Belts Market may play a pivotal role in shaping its future trajectory.

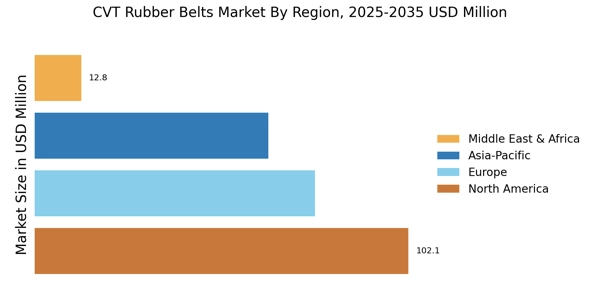

Expansion of Automotive Production in Emerging Markets

The CVT Rubber Belts Market is poised for growth due to the expansion of automotive production in emerging markets. Countries in Asia and South America are witnessing a surge in vehicle manufacturing, driven by rising disposable incomes and urbanization. This trend is likely to increase the demand for various automotive components, including CVT rubber belts. As manufacturers in these regions ramp up production to meet local and international demand, the need for reliable and efficient transmission systems becomes paramount. Consequently, the CVT Rubber Belts Market may experience a boost as suppliers seek to establish partnerships with automotive producers in these burgeoning markets, thereby enhancing their market presence.