Cyber Insurance Size

Market Size Snapshot

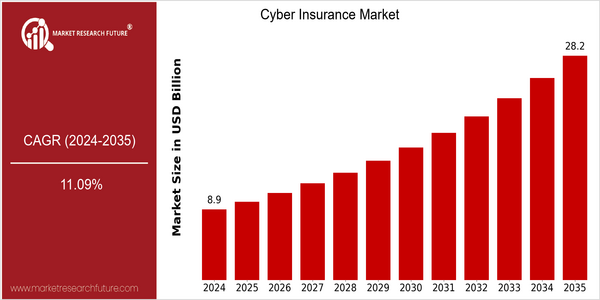

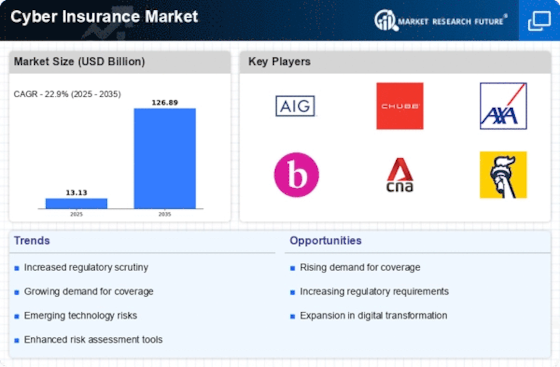

| Year | Value |

|---|---|

| 2024 | USD 8.88 Billion |

| 2035 | USD 28.24 Billion |

| CAGR (2025-2035) | 11.09 % |

Note – Market size depicts the revenue generated over the financial year

CYBER INSURANCE IS GROWING: The global cyber insurance market is expected to grow to $ 28.24 billion by 2035. A robust CAGR of 11.09% is projected from 2025 to 2035. The growing frequency and sophistication of cyber attacks and the growing awareness of the business community of the risks of cyber risks are driving this market. Companies are increasingly seeing cyber insurance as an essential part of their risk management strategy, resulting in the demand for comprehensive coverage. The spread of cloud computing, the Internet of Things and artificial intelligence is also driving the need for cyber insurance. These new technologies are exposing companies to new cyber risks, which in turn increases their reliance on insurance solutions to protect themselves from potential losses. The leading players in the market, such as AIG, Chubb and Allianz, are involved in strategic initiatives, such as strategic alliances, investments in the development of new risk assessment tools and the development of tailored insurance products, to meet the changing needs of their customers. These efforts not only strengthen their market position but also help to increase the overall growth of the cyber insurance industry.

Regional Market Size

Regional Deep Dive

The cyber insurance market is growing rapidly across all regions, driven by increasing cyber threats and growing awareness of the need for risk management solutions. North America has a mature insurance market, with high penetration of cyber insurance products, while Europe is experiencing a surge in demand as a result of strict data protection regulations such as the General Data Protection Regulation (GDPR). In the Asia-Pacific region, companies are increasingly aware of the importance of risk management. The Middle East and Africa are gradually adopting cyber insurance, as digital transformation initiatives grow. Latin America is also a potential market, but the growth rate is slower. Despite this, Latin American companies are starting to understand the value of cyber insurance in protecting their operations against cyber incidents.

Europe

- The implementation of the General Data Protection Regulation (GDPR) has led to a heightened focus on data security, prompting organizations to seek cyber insurance as a means of compliance and risk management.

- Companies such as Allianz and AXA are developing tailored cyber insurance products that address specific regional risks, reflecting the diverse regulatory environments across European countries.

Asia Pacific

- The rise of digital transformation initiatives in countries like India and Australia is driving demand for cyber insurance, as businesses seek to protect themselves against increasing cyber threats.

- Government programs, such as the Cyber Security Strategy in Australia, are promoting awareness and encouraging organizations to adopt cyber insurance as part of their risk management strategies.

Latin America

- The increasing frequency of cyberattacks in Brazil and Mexico is prompting businesses to consider cyber insurance as a critical component of their risk management strategies.

- Organizations like Grupo Nacional Provincial (GNP) are starting to offer cyber insurance products, reflecting a growing recognition of the need for protection against cyber risks in the region.

North America

- The introduction of the Cyber Insurance Framework by the National Association of Insurance Commissioners (NAIC) is shaping the market by providing guidelines for insurers and policyholders, enhancing transparency and trust.

- Major players like AIG and Chubb are innovating their offerings by incorporating advanced risk assessment tools and incident response services, which are expected to improve customer engagement and retention.

Middle East And Africa

- The UAE's National Cybersecurity Strategy is fostering a supportive environment for the growth of cyber insurance, as it emphasizes the importance of risk management in the face of rising cyber threats.

- Local insurers are beginning to collaborate with global firms to develop customized cyber insurance products that cater to the unique challenges faced by businesses in the region.

Did You Know?

“As of 2023, nearly 60% of small to medium-sized enterprises (SMEs) in the U.S. have reported that they do not have cyber insurance, despite the increasing frequency of cyberattacks targeting this segment.” — Cybersecurity & Infrastructure Security Agency (CISA)

Segmental Market Size

The cyber insurance market is growing strongly as organizations increasingly understand the importance of protecting themselves against cyber risks. It is driven by the increasing frequency of cyber-attacks, the growing regulatory requirements such as the General Data Protection Regulation (GDPR) and the Californian Data Protection Act (CCPA), and the increasing dependence of companies on digital platforms. These factors are driving a need to secure operations and data, which is driving the demand for comprehensive cyber insurance solutions. At present, the market is in a stage of scale deployment, with AIG, Chubb and Allianz being the main players in the field of bespoke cyber insurance solutions. These products cover the main use cases such as data breaches, ransomware attacks and business interruptions caused by cyber incidents, especially in the finance, health and retail industries. The growing complexity of cyber-threats and the increasing regulatory pressure are driving the market forward. The evolution of this market is being driven by the emergence of new technologies, such as artificial intelligence (AI)-based risk assessment tools and incident response platforms, which allow insurers to offer more precise and comprehensive coverage and support to their customers.

Future Outlook

The cyber insurance market is expected to grow significantly from 2024 to 2035, with a CAGR of 11.09% from $8.88 billion to $28.24 billion. The main driving force for this growth is the increasing frequency and complexity of cyber-attacks, which has raised the awareness of enterprises to implement comprehensive risk management strategies. The penetration of cyber insurance is expected to rise rapidly, from 30.0% in 2024 to more than 60.0% in 2035. Artificial intelligence and machine learning in the underwriting and risk assessment process will further increase the attractiveness of cyber insurance products. Moreover, stricter data protection laws and the resulting compliance requirements will force companies to adopt cyber insurance as an important component of their risk management strategy. Also, the trend of remote work and the increasing use of cloud services will also contribute to the constantly changing cyber threat landscape, which will also lead to the demand for a variety of tailored insurance products to meet these new risks. In summary, the cyber insurance market is expected to grow significantly, driven by a combination of rising awareness of cyber risks, technological innovations, and regulatory requirements.

Leave a Comment