- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

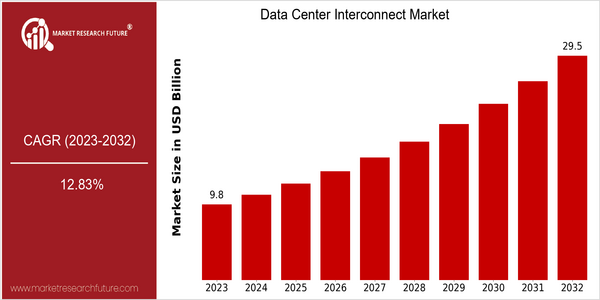

| Year | Value |

|---|---|

| 2023 | USD 9.78 Billion |

| 2032 | USD 29.5 Billion |

| CAGR (2024-2032) | 12.83 % |

Note – Market size depicts the revenue generated over the financial year

The market for data center interconnections is growing at a rapid pace, with a current market size estimated at $ 9.78 billion in 2023 and estimated to reach $ 29.50 billion in 2032. A CAGR of 12.83% from 2024 to 2032 demonstrates a strong upward trend, driven by the increasing demand for high-speed data transmission and interconnection solutions. With the expansion of digital enterprises, the need for efficient interconnection between data centers is becoming increasingly urgent, so as to facilitate data transmission and increase the efficiency of the data center. This is mainly due to the rising popularity of cloud computing, the growing popularity of big data, and the increasing demand for disaster recovery. Also, the application of SDN and NFV technology has played an important role in the interconnection between data centers. The major players in the market, such as Cisco, Juniper, and Arista, are actively investing in innovation and forming strategic alliances to enhance their service capabilities. Among them, there are several recent joint efforts in the field of optical network technology. These companies have become the leading force in the field of data center interconnection.

Regional Market Size

Regional Deep Dive

The Data Center Interconnection Market is expected to witness significant growth across all regions, driven by the increasing demand for high-speed data transfer, cloud computing, and the proliferation of big data. Each region has its own characteristics, influenced by the technological developments, regulatory framework, and economic conditions. North America leads in innovation and interconnection, Europe is characterized by regulatory and compliance concerns, and Asia-Pacific is experiencing strong growth, driven by the digital economy. Middle East and Africa is characterized by increasing investment in data center facilities, and Latin America is slowly adopting interconnection solutions to support its digital transformation.

Europe

- The European Union's General Data Protection Regulation (GDPR) is shaping the Data Center Interconnect Market by necessitating enhanced data security measures, prompting companies to invest in compliant interconnect solutions.

- Sustainability initiatives are gaining traction, with organizations like Equinix and Digital Realty focusing on energy-efficient interconnect technologies to meet regulatory requirements and corporate social responsibility goals.

Asia Pacific

- The rapid digital transformation in countries like China and India is driving the demand for advanced data center interconnect solutions, with local players such as Alibaba Cloud and Tencent leading the charge.

- Government initiatives, such as India's National Digital Communications Policy, are promoting the development of robust data center infrastructure, which is expected to boost interconnect services in the region.

Latin America

- Brazil's growing tech startup ecosystem is increasing the demand for data center interconnect solutions, with local companies like Oi and Algar Telecom expanding their services to meet this need.

- Regulatory changes aimed at improving internet connectivity and data privacy are encouraging investments in data center infrastructure, which will likely enhance interconnect capabilities across the region.

North America

- The rise of 5G technology is significantly impacting the Data Center Interconnect Market in North America, with companies like AT&T and Verizon investing heavily in infrastructure to support faster data transmission and lower latency.

- Major cloud service providers such as Amazon Web Services and Microsoft Azure are expanding their data center footprints, leading to increased demand for interconnect solutions that facilitate seamless data transfer between facilities.

Middle East And Africa

- The UAE's Vision 2021 is fostering investments in data center infrastructure, with companies like du and Etisalat enhancing their interconnect capabilities to support the growing digital economy.

- The region is witnessing a surge in public-private partnerships aimed at developing smart city projects, which are expected to drive demand for efficient data center interconnect solutions.

Did You Know?

“As of 2023, it is estimated that over 80% of global internet traffic is generated by data centers, highlighting their critical role in the digital economy.” — International Data Corporation (IDC)

Segmental Market Size

Data center interconnection is a vital component of the data center market, facilitating the transfer of data between data centers and enabling redundancy and data recovery. This segment is currently experiencing strong growth, driven by the increasing demand for cloud services, the rise of big data, and the need for disaster recovery solutions. Data volumes are growing at an enormous rate, and low-latency connections are essential for supporting real-time applications. This is why data center interconnection is in a state of expansion, with large players like Microsoft and Amazon Web Services leading the way in deploying the latest interconnection solutions. In North America and Europe, the deployment of interconnection solutions is especially strong, and these solutions are being used for hybrid cloud and multi-cloud applications. The drive for sustainability and the need for security are also contributing to this growth, while technological developments such as optical and software-defined networks are enabling more efficient and flexible interconnection solutions.

Future Outlook

From 2023 to 2032, the data center interconnection (DCI) market is expected to grow at a CAGR of 12.83% from the projected market size of $ 9.78 billion to $29.5 billion. The market growth is driven by the increasing demand for high-speed data transmission and the growing need for data management solutions in various industries. In addition, the migration of enterprises to cloud services and the construction of hybrid IT environments will increase the reliance on DCI solutions and drive the penetration rate and market share of DCI. In 2032, it is expected that more than 60% of enterprises will use DCI to improve their operational efficiency and connectivity, compared to an expected penetration rate of more than 30% in 2023. The development of 5G and the evolution of optical fiber communications will also promote the development of the DCI market. The innovations will provide a faster transmission speed and lower latency, which are important for the development of real-time data, IoT and AI. The report also cites the important role of the government in promoting digital infrastructure and green development. In addition, the trend of edge computing and the increasing demand for energy-saving solutions will also promote the DCI market and the development of next-generation interconnection technology. In summary, the DCI market will have a bright future and there will be considerable opportunities for innovation and growth in the next 10 years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 8.52 Billion |

| Market Size Value In 2023 | USD 9.78 Billion |

| Growth Rate | 14.80% (2023-2032) |

Data Center Interconnect Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.