- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

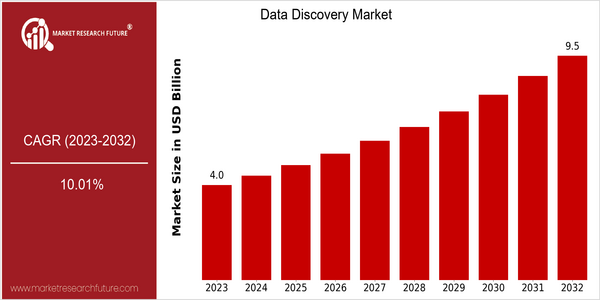

| Year | Value |

|---|---|

| 2023 | USD 4.03 Billion |

| 2032 | USD 9.5 Billion |

| CAGR (2024-2032) | 10.01 % |

Note – Market size depicts the revenue generated over the financial year

The Data Discovery Market is currently valued at USD 4.03 billion in 2023 and is projected to reach USD 9.5 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 10.01% from 2024 to 2032. This growth trajectory indicates a significant increase in demand for data discovery solutions, driven by the escalating need for organizations to harness and analyze vast amounts of data effectively. As businesses increasingly recognize the value of data-driven decision-making, the market is poised for substantial expansion over the coming years. Several factors are propelling this market growth, including the rapid adoption of advanced analytics, artificial intelligence, and machine learning technologies. These innovations enable organizations to uncover insights from complex datasets, thereby enhancing operational efficiency and strategic planning. Additionally, the rise of cloud computing and the growing emphasis on data governance and compliance are further stimulating demand for data discovery tools. Key players in the market, such as Tableau Software, Qlik, and Microsoft, are actively investing in product development and strategic partnerships to enhance their offerings and capture a larger market share. For instance, recent collaborations aimed at integrating AI capabilities into data discovery platforms highlight the industry's commitment to innovation and meeting evolving customer needs.

Regional Market Size

Regional Deep Dive

The Data Discovery Market is experiencing significant growth across various regions, driven by the increasing need for organizations to harness data for strategic decision-making. In North America, the market is characterized by a high adoption rate of advanced analytics and business intelligence tools, fueled by a robust technology infrastructure and a strong emphasis on data-driven strategies. Europe showcases a diverse landscape with varying regulatory frameworks, particularly with GDPR influencing data handling practices, while Asia-Pacific is rapidly emerging as a key player due to its expanding digital economy and increasing investments in data analytics. The Middle East and Africa are witnessing a gradual shift towards data-centric approaches, supported by government initiatives aimed at digital transformation. Latin America, while still developing, is beginning to recognize the importance of data discovery in enhancing business operations and competitiveness.

Europe

- The implementation of the General Data Protection Regulation (GDPR) has significantly influenced data discovery practices, pushing companies to adopt more robust data governance frameworks, with organizations like SAP and Informatica at the forefront.

- Innovations in AI and machine learning are enhancing data discovery capabilities, enabling organizations to uncover insights more efficiently, as seen in projects by companies like Qlik and Sisense.

Asia Pacific

- The rapid digital transformation in countries like India and China is driving demand for data discovery tools, with local startups and established firms like Alibaba and TCS investing heavily in analytics capabilities.

- Government initiatives, such as Singapore's Smart Nation program, are promoting the use of data analytics and discovery to improve public services and drive economic growth.

Latin America

- The increasing penetration of mobile internet and smartphones is facilitating access to data discovery tools in Latin America, with companies like Totvs and Neoway leading the market.

- Government programs aimed at digital transformation, such as Brazil's Digital Transformation Strategy, are encouraging businesses to adopt data analytics and discovery solutions to improve operational efficiency.

North America

- The rise of cloud-based data discovery solutions is transforming the market, with companies like Tableau and Microsoft Power BI leading the charge in providing scalable and user-friendly platforms.

- Regulatory changes, particularly around data privacy and security, are prompting organizations to invest in data discovery tools that ensure compliance, with firms like IBM and Oracle developing solutions tailored to meet these new standards.

Middle East And Africa

- Countries in the Middle East, particularly the UAE and Saudi Arabia, are investing in smart city initiatives that leverage data discovery to enhance urban planning and services, with companies like SAP and Microsoft playing key roles.

- The African continent is seeing a rise in data literacy programs, supported by organizations like the African Development Bank, which aim to empower businesses with data-driven decision-making tools.

Did You Know?

“Over 80% of data generated by organizations is unstructured, making data discovery tools essential for extracting valuable insights from this vast resource.” — Gartner

Segmental Market Size

The Data Discovery Market is experiencing robust growth, driven by the increasing need for organizations to harness vast amounts of data for strategic decision-making. Key factors propelling this segment include the rising demand for data-driven insights across industries and stringent regulatory policies that necessitate better data governance and compliance. Additionally, technological advancements in artificial intelligence and machine learning are enhancing data discovery capabilities, making them more accessible and efficient for businesses. Currently, the market is in a phase of scaled deployment, with companies like Tableau and Microsoft leading the charge in integrating data discovery tools into their platforms. Primary applications include business intelligence, customer analytics, and risk management, particularly in sectors such as finance and healthcare. Trends such as the shift towards remote work and the increasing emphasis on data privacy are catalyzing growth, as organizations seek to optimize their data strategies. Relevant technologies shaping this segment include cloud computing, natural language processing, and advanced analytics tools, which collectively enhance the ability to discover and utilize data effectively.

Future Outlook

The Data Discovery Market is poised for significant growth from 2023 to 2032, with a projected market value increase from $4.03 billion to $9.5 billion, reflecting a robust compound annual growth rate (CAGR) of 10.01%. This growth trajectory is driven by the increasing volume of data generated across industries, coupled with the rising need for organizations to derive actionable insights from this data. As businesses continue to prioritize data-driven decision-making, the adoption of advanced data discovery tools is expected to penetrate deeper into various sectors, including healthcare, finance, and retail, with usage rates potentially reaching over 60% by 2032 among large enterprises and 40% among SMEs. Key technological drivers such as artificial intelligence (AI) and machine learning (ML) are set to revolutionize the data discovery landscape, enabling more sophisticated data analysis and visualization capabilities. Additionally, the growing emphasis on data governance and compliance, spurred by regulations like GDPR and CCPA, will further propel the demand for data discovery solutions that ensure data integrity and security. Emerging trends, including the integration of natural language processing (NLP) for enhanced user interaction and the rise of cloud-based data discovery platforms, will also shape the market dynamics, making data discovery more accessible and efficient for organizations of all sizes.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 4.5% |

Data Discovery Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.