- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

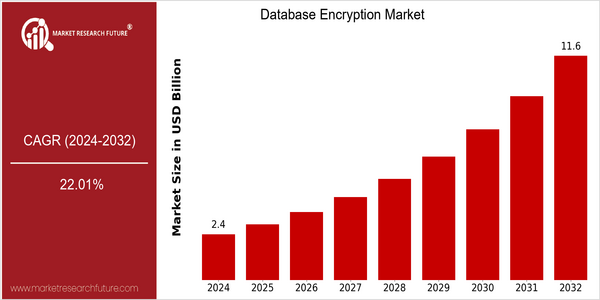

| Year | Value |

|---|---|

| 2024 | USD 2.3594 Billion |

| 2032 | USD 11.584 Billion |

| CAGR (2024-2032) | 22.01 % |

Note – Market size depicts the revenue generated over the financial year

The market for encryption of data in the database is undergoing a rapid growth. The market is expected to reach $11.58 billion in 2032, from $2.359 billion in 2024. This significant growth is a result of a CAGR of 22.01% for the forecast period. In this market, the increasing generation of sensitive data in various industries, coupled with the need to comply with the strictest regulatory requirements for data protection, is a key driver for the encryption market. The increasing importance of data security and the need to mitigate the risks associated with cyber-attacks and data breaches is also driving the market for encryption of data in the database. Artificial intelligence and machine learning are also contributing to the growth of the market. These innovations increase the efficiency and effectiveness of encryption methods and make them more accessible to organizations of all sizes. The leading players in the market, such as IBM, Microsoft and Thales, are investing heavily in research and development, establishing strategic alliances and launching new products. Among other things, recent collaborations on cloud security solutions have emphasized the importance of encryption in the protection of data in motion and at rest. As the market for data encryption evolves, it is expected to continue to grow, mainly driven by technological innovations and growing awareness of data privacy.

Regional Market Size

Regional Deep Dive

The Database Encryption Market is experiencing considerable growth across various regions. The rising number of data breaches, the tightening of regulatory requirements, and the increasing adoption of cloud services are the main growth drivers for this market. Each region has its own unique characteristics, including the level of technological development, regulatory framework, and cultural attitude towards data privacy. The demand for strong encryption solutions is expected to increase as organizations continue to place a high priority on data security.

Europe

- The European market is shaped by the GDPR, which imposes strict penalties for data breaches, driving organizations to adopt comprehensive encryption solutions to ensure compliance.

- Innovations in encryption technology, such as quantum encryption, are being explored by European research institutions and companies like Thales, aiming to future-proof data security against emerging threats.

Asia Pacific

- Rapid digital transformation in countries like India and China is leading to increased data generation, prompting businesses to adopt encryption solutions to protect sensitive information.

- Government initiatives, such as the Personal Data Protection Bill in India, are pushing organizations to implement robust encryption measures to safeguard personal data, thereby expanding the market.

Latin America

- Latin America is experiencing a surge in data protection regulations, such as Brazil's General Data Protection Law (LGPD), which is driving the demand for encryption solutions among businesses.

- The region is seeing collaborations between local tech firms and global encryption providers, enhancing the availability of advanced encryption technologies tailored to local market needs.

North America

- The North American market is heavily influenced by the stringent regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR), which require a high degree of data security and encryption.

- Major technology companies like IBM and Microsoft are investing in advanced encryption technologies, including homomorphic encryption, which allows computations on encrypted data without needing to decrypt it, thus enhancing data security.

Middle East And Africa

- In the Middle East, the rise of cyber threats has led to increased government focus on data protection, with initiatives like the UAE's National Cybersecurity Strategy promoting the adoption of encryption technologies.

- The African market is witnessing growth due to the increasing awareness of data privacy and security, with local startups emerging to provide tailored encryption solutions for businesses.

Did You Know?

“Approximately 60% of small to medium-sized enterprises (SMEs) in North America have reported experiencing a data breach, highlighting the critical need for effective database encryption solutions.” — Cybersecurity & Infrastructure Security Agency (CISA)

Segmental Market Size

The Database Encryption Market is growing rapidly, driven by growing concerns about data breaches and stricter regulatory requirements. A growing amount of sensitive data across industries and the need to comply with regulations such as the General Data Protection Regulation and HIPAA are the main factors driving the market. Also, companies are prioritizing data protection to counter the risk of cyber threats, making encryption an important part of their security strategy. This market is currently at a mature stage of development, with market leaders such as IBM and Microsoft deploying advanced encryption solutions in a number of industries, including finance and health care. The main applications are to secure customer data in the cloud and to protect the intellectual property of internal databases. However, the increasing trend towards working remotely and the increasing focus on data privacy are increasing the rate of adoption. The development of new encryption methods such as homomorphic encryption and tokenization is also driving the market, as they allow companies to enhance security while preserving data usability.

Future Outlook

The encrpytion of the database is going to grow at a CAGR of 22.11% from 2024 to 2032. The main reason for this growth is the growing need for data security, which is in line with the growing cybercrime threat and the strict regulations of the various industries. The companies are increasingly prioritizing data security, and as a result, the adoption of encryption technology is expected to penetrate more deeply into the finance, health and government industries, where sensitive data is prevalent. By 2032, more than 60% of companies will have encrypted their databases, compared to only 30% in 2024, which is a significant change in data security. The key technological developments, such as the integration of artificial intelligence and machine learning into encryption solutions, are expected to boost the market's growth. These new methods will lead to the improvement of encryption efficiency and the reduction of the performance cost of encryption. The rapid development of cloud computing and the increasing use of hybrid cloud environments will also increase the demand for encryption to protect data at rest and in transit. The other trends such as the increasing use of zero-trust security and the need to comply with the regulations such as the General Data Protection Regulation and the Californian Personal Data Protection Act will also play an important role in shaping the future landscape of the encryption of the database. , the company's data security strategy is still very vigilant.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.5 Billion |

| Market Size Value In 2023 | USD 1.88 Billion |

| Growth Rate | 25.50% (2023-2032) |

Database Encryption Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.