Market Growth Projections

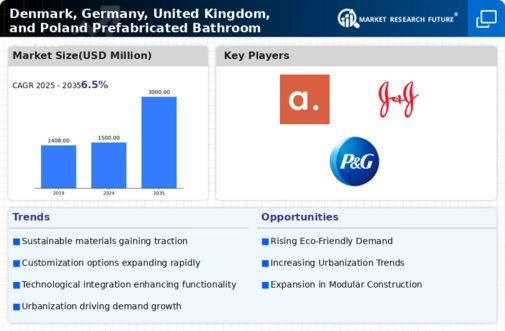

The Global Denmark, Germany, United Kingdom, and Poland Prefabricated Bathroom Market Industry is projected to experience substantial growth in the coming years. With a market value of 1500 USD Million in 2024, it is anticipated to reach 3000 USD Million by 2035, reflecting a robust demand for prefabricated solutions. The compound annual growth rate (CAGR) of 6.5% from 2025 to 2035 indicates a strong upward trend, driven by factors such as urbanization, sustainability, and technological advancements. This growth trajectory suggests a promising future for the prefabricated bathroom market across these key European regions.

Changing Consumer Preferences

Changing consumer preferences significantly impact the Global Denmark, Germany, United Kingdom, and Poland Prefabricated Bathroom Market Industry. Modern consumers increasingly favor convenience, speed, and customization in home improvement projects. Prefabricated bathrooms cater to these preferences by offering quick installation and tailored designs that meet individual needs. This shift in consumer behavior is evident in the rising popularity of prefabricated solutions among homeowners and contractors alike. As the market adapts to these evolving preferences, it is likely to witness sustained growth, reinforcing the trend towards prefabricated construction methods.

Government Initiatives and Support

Government initiatives play a pivotal role in shaping the Global Denmark, Germany, United Kingdom, and Poland Prefabricated Bathroom Market Industry. Various policies aimed at promoting affordable housing and sustainable construction practices encourage the adoption of prefabricated solutions. For instance, financial incentives and grants for developers who incorporate prefabricated bathrooms into their projects are becoming more common. These initiatives not only stimulate market growth but also align with broader goals of increasing housing availability and reducing construction waste. As a result, the market is poised for expansion, driven by supportive government frameworks.

Sustainability and Eco-Friendly Practices

Sustainability emerges as a crucial driver in the Global Denmark, Germany, United Kingdom, and Poland Prefabricated Bathroom Market Industry. With increasing awareness of environmental issues, consumers and businesses alike are prioritizing eco-friendly construction practices. Prefabricated bathrooms often utilize sustainable materials and energy-efficient technologies, aligning with the green building movement. Governments in these regions promote sustainable construction through incentives and regulations, further encouraging the adoption of prefabricated solutions. This shift is expected to contribute to the market's growth, potentially doubling its value to 3000 USD Million by 2035 as more stakeholders embrace environmentally responsible practices.

Rising Demand for Space-Efficient Solutions

The Global Denmark, Germany, United Kingdom, and Poland Prefabricated Bathroom Market Industry experiences a notable increase in demand for space-efficient solutions. Urbanization trends in these countries lead to smaller living spaces, prompting homeowners and developers to seek compact bathroom designs. Prefabricated bathrooms offer a practical solution, as they can be customized to fit various spatial constraints without compromising functionality. This trend is particularly evident in metropolitan areas, where real estate prices are high. As a result, the market is projected to reach 1500 USD Million in 2024, indicating a growing acceptance of prefabricated solutions in urban environments.

Technological Advancements in Manufacturing

Technological advancements significantly influence the Global Denmark, Germany, United Kingdom, and Poland Prefabricated Bathroom Market Industry. Innovations in manufacturing processes, such as automation and modular construction techniques, enhance efficiency and reduce production costs. These advancements enable manufacturers to produce high-quality prefabricated bathrooms at a faster pace, meeting the increasing demand from both residential and commercial sectors. As a result, the market is likely to experience a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035, reflecting the positive impact of technology on the industry's growth trajectory.