- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

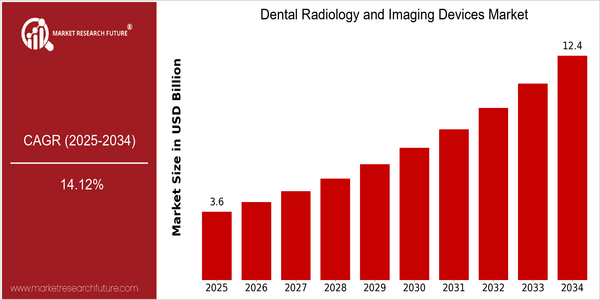

| Year | Value |

|---|---|

| 2025 | USD 3.56 Billion |

| 2034 | USD 12.44 Billion |

| CAGR (2024-2034) | 14.12 % |

Note – Market size depicts the revenue generated over the financial year

The global Dental Radiology and Imaging Devices Market is poised for significant growth, with a current market size of USD 3.56 billion in 2025, projected to expand to USD 12.44 billion by 2034. This remarkable growth trajectory reflects a compound annual growth rate (CAGR) of 14.12% from 2024 to 2034. The increasing demand for advanced diagnostic imaging technologies in dental practices, coupled with the rising prevalence of dental diseases, is driving this market expansion. Furthermore, the integration of digital technologies and artificial intelligence in imaging devices is enhancing diagnostic accuracy and efficiency, thereby attracting more dental professionals to adopt these innovations. Key players in the dental radiology and imaging sector, such as Carestream Health, Dentsply Sirona, and Planmeca, are actively investing in research and development to introduce cutting-edge products that cater to the evolving needs of dental practitioners. Strategic initiatives, including partnerships and collaborations aimed at enhancing product offerings and expanding market reach, are also contributing to the competitive landscape. For instance, recent product launches featuring advanced imaging capabilities and user-friendly interfaces are expected to further stimulate market growth, positioning the sector for a robust future.

Regional Market Size

Regional Deep Dive

The Dental Radiology and Imaging Devices Market is experiencing significant growth across various regions, driven by advancements in technology, increasing awareness of oral health, and a rising demand for diagnostic imaging. In North America, the market is characterized by a high adoption rate of digital imaging technologies and a strong presence of key players. Europe showcases a diverse regulatory landscape that influences market dynamics, while the Asia-Pacific region is witnessing rapid growth due to increasing dental care accessibility and investments in healthcare infrastructure. The Middle East and Africa are gradually adopting advanced imaging technologies, albeit at a slower pace, influenced by economic factors and healthcare policies. Latin America is also emerging as a potential market, driven by improving healthcare systems and rising disposable incomes.

Europe

- The European Union's Medical Device Regulation (MDR) has introduced stricter compliance requirements, prompting manufacturers to innovate and improve the safety and efficacy of dental imaging devices.

- Companies like Sirona Dental Systems and Dentsply Sirona are leading the charge in integrating digital technologies into traditional dental practices, enhancing the overall patient experience and operational efficiency.

Asia Pacific

- Countries like China and India are witnessing a surge in dental clinics adopting advanced imaging technologies, driven by increasing urbanization and a growing middle class with higher disposable incomes.

- Government initiatives aimed at improving healthcare access, such as the National Health Mission in India, are facilitating the adoption of modern dental radiology and imaging devices in rural and underserved areas.

Latin America

- Brazil is emerging as a key market for dental imaging devices, with increasing investments in dental education and technology, leading to a higher demand for advanced imaging solutions.

- Regulatory bodies in countries like Mexico are streamlining approval processes for dental devices, encouraging innovation and market entry for new technologies.

North America

- The FDA has recently approved several innovative dental imaging devices, enhancing diagnostic capabilities and patient outcomes, which is expected to drive market growth in the region.

- Key players like Carestream Dental and Planmeca are investing heavily in R&D to develop advanced imaging solutions, such as 3D imaging and AI-driven diagnostics, which are reshaping the market landscape.

Middle East And Africa

- The UAE is investing in healthcare infrastructure, with initiatives like the Dubai Health Strategy 2021, which aims to enhance dental care services and promote the use of advanced imaging technologies.

- Local companies are collaborating with international firms to bring innovative dental imaging solutions to the region, addressing the growing demand for quality dental care.

Did You Know?

“Did you know that digital radiography can reduce radiation exposure by up to 80% compared to traditional X-ray methods?” — American Dental Association

Segmental Market Size

The Dental Radiology and Imaging Devices segment plays a crucial role in enhancing diagnostic accuracy and treatment planning in dentistry, currently experiencing stable growth. Key drivers of demand include the increasing prevalence of dental diseases, which necessitates advanced imaging for effective diagnosis, and the rising adoption of digital radiography, which offers superior image quality and reduced radiation exposure. Regulatory policies promoting patient safety and technological advancements in imaging modalities further bolster this segment's growth. Currently, the adoption stage of dental radiology devices is transitioning towards mature adoption, with companies like Carestream Dental and Sirona Dental Systems leading in the deployment of digital imaging solutions. Primary applications include intraoral imaging, panoramic imaging, and cone-beam computed tomography (CBCT), which are essential for procedures ranging from routine check-ups to complex surgical planning. Trends such as the ongoing shift towards minimally invasive procedures and the integration of artificial intelligence in imaging analysis are accelerating growth, while sustainability initiatives drive the development of eco-friendly imaging technologies.

Future Outlook

The Dental Radiology and Imaging Devices Market is poised for significant growth from 2025 to 2034, with a projected market value increase from $3.56 billion to $12.44 billion, reflecting a robust compound annual growth rate (CAGR) of 14.12%. This growth trajectory is driven by the increasing adoption of advanced imaging technologies, such as cone beam computed tomography (CBCT) and digital radiography, which enhance diagnostic accuracy and patient outcomes. As dental practices continue to integrate these technologies, the penetration rate of digital imaging devices is expected to rise from approximately 30% in 2025 to over 70% by 2034, indicating a substantial shift towards more efficient and effective imaging solutions in the dental sector. Key technological advancements, including the development of artificial intelligence (AI) algorithms for image analysis and the integration of 3D imaging capabilities, are expected to further propel market growth. Additionally, supportive government policies promoting preventive dental care and the rising awareness of oral health among consumers are likely to contribute to increased demand for dental imaging services. Emerging trends, such as teledentistry and the growing emphasis on minimally invasive procedures, will also shape the market landscape, creating new opportunities for innovation and investment in dental radiology and imaging devices. As the market evolves, stakeholders must remain agile to capitalize on these trends and meet the changing needs of dental professionals and patients alike.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 2.5 Billion |

| Market Size Value In 2023 | USD 2.7 Billion |

| Growth Rate | 14.90% (2023-2032) |

Dental Radiology Imaging Devices Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.