- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

The deployable military shelter systems market is influenced by several key factors that drive its growth and development. Deployable military shelter systems are essential components of military operations, providing temporary housing, workspace, and storage facilities for personnel, equipment, and supplies in various operational environments. One of the primary drivers of the deployable military shelter systems market is the increasing demand for rapid deployment and mobility in modern military operations. As military forces face diverse and dynamic threats worldwide, there's a growing need for deployable shelters that can be quickly erected, transported, and reconfigured to support mission-critical activities such as command posts, field hospitals, and logistics hubs.

Moreover, advancements in shelter technology, including developments in lightweight materials, modular construction, and rapid deployment mechanisms, have led to innovations in deployable military shelter systems, driving further adoption across military organizations worldwide. New generations of shelter systems offer features such as quick assembly, collapsible frames, weather-resistant fabrics, and insulation capabilities, enabling soldiers to establish operational bases and facilities in remote and challenging environments with minimal time and effort. This drives demand for deployable military shelter systems that offer enhanced mobility, durability, and functionality to support a wide range of mission requirements and operational scenarios.

Furthermore, the growing trend towards expeditionary warfare and expeditionary logistics is driving investment and innovation in deployable military shelter systems. Military forces are increasingly adopting expeditionary operating concepts and agile logistics practices to enhance responsiveness, flexibility, and sustainability in expeditionary operations. Deployable shelter systems play a crucial role in expeditionary logistics by providing mobile and scalable infrastructure for sustainment, resupply, and support functions in forward operating areas, remote outposts, and austere environments. This creates opportunities for shelter system manufacturers to develop integrated solutions that streamline logistics operations and enhance expeditionary capabilities for military forces worldwide.

Additionally, the increasing emphasis on force protection, survivability, and resilience in military operations is driving demand for deployable military shelter systems that offer enhanced protection against ballistic threats, blast effects, and environmental hazards. Military forces require shelter systems that provide secure and fortified enclosures for personnel and equipment, reducing vulnerability to enemy attacks, natural disasters, and adverse weather conditions. Deployable shelters with integrated armor panels, blast-resistant construction, and chemical, biological, radiological, and nuclear (CBRN) protection capabilities enhance the safety and security of deployed personnel and assets, enabling military forces to maintain operational readiness and mission effectiveness in hostile environments.

Moreover, the growing demand for expeditionary infrastructure in disaster relief, humanitarian assistance, and emergency response missions is driving growth in the deployable military shelter systems market. Military forces are often called upon to provide rapid assistance and support in response to natural disasters, humanitarian crises, and other emergencies around the world. Deployable shelters play a critical role in disaster response operations by providing temporary housing, medical facilities, command centers, and logistics support to affected populations and relief workers. This creates opportunities for shelter system manufacturers to collaborate with government agencies, humanitarian organizations, and disaster response teams to develop specialized solutions tailored to the needs of emergency response and disaster relief missions.

Covered Aspects:

| Report Attribute/Metric | Details |

|---|---|

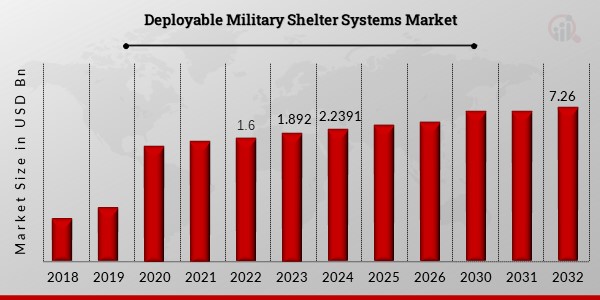

| Market Size Value In 2023 | USD 1.8928 Billion |

| Growth Rate | 15.83% (2024-2032) |

Deployable Military Shelter Systems Market Highlights:

Global Deployable Military Shelter Systems Market Overview

Deployable Military Shelter Systems Market was valued at USD 1.8928 Billion in 2023. The Deployable Military Shelter Systems Market industry is projected to grow from USD 2.2391824 Billion in 2023 to USD 7.26 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 15.84% during the forecast period (2024 - 2032). The defense budget increase is the key market driver for enhancing market growth.

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Deployable Military Shelter Systems Market Trends

An increase in the defense budget is driving the market growth

An increase in the defense budget drives market CAGR for deployable military shelter systems. The market has been experiencing significant growth as many countries are increasing their defense budgets to modernize and enhance their military capabilities. As a result, there was a higher demand for deployable military shelter systems to support military operations and provide appropriate infrastructure in the field. Advancements in technology led to the development of more sophisticated and versatile deployable shelter systems. These shelters integrated advanced materials, automation, and connectivity features to improve mobility, efficiency, and functionality. Military forces worldwide needed rapid deployment and quick response to various situations, including natural disasters, humanitarian crises, and military operations. Deployable military shelters offered a practical solution to establish bases and facilities swiftly in remote and challenging terrains. The increasing emphasis on expeditionary and forward operating capabilities required shelters that could be easily transported and set up in diverse environments. Deployable military shelters fulfilled this need by providing adaptable and flexible infrastructure.

The US Navy granted BAE Systems a contract in 2022 for the upkeep and upgrading the amphibious assault ship USS Kearsarge (LHD 3). According to this arrangement, the 843-foot-long USS Kearsarge will begin its maintenance availability in April and spend a year in dry dock at BAE Systems' Norfolk shipyard.

The defense spending for China will be $225.5 billion in 2022. For its regionally held businesses to continue to see robust revenue growth over the projection period, the nation works to develop its domestic defense industry. The People's Liberation Army (PLA) continues to modernize its military equipment. It acquires military, aeronautical, and naval capabilities, as seen by the strong rise of defense-related profits in Chinese SOEs. Companies that provide body armor and armored vehicles for the military are anticipated to have cutting-edge defense electronics and weapons that have had rapid growth. Over the projected period, it is anticipated that China's massive defense expenditure will increase sales of ballistic protection.

With a surge in defense budgets, armed forces have the financial capacity to invest in modern military equipment to enhance their capabilities and readiness. Deployable military shelter systems with advanced technologies and materials become integral to this modernization process. These shelters offer improved protection, mobility, and flexibility, making them indispensable assets in supporting military operations. In an increasingly uncertain geopolitical landscape, nations are prioritizing their defense preparedness. Geopolitical tensions, security threats, and regional conflicts compel governments to allocate more funds to their defense sectors. Deployable military shelters are crucial in providing tactical advantages to military forces, allowing them to establish bases and facilities quickly in response to changing geopolitical dynamics. Higher defense budgets also drive innovation in the defense industry, leading to the development of advanced shelter systems. Research and development efforts focus on integrating cutting-edge materials, smart technologies, and energy-efficient solutions into deployable military shelters. These advancements improve the shelters' overall performance, durability, and sustainability, aligning them with the modern military. Thus, an increase in the defense budget is driving the Deployable Military Shelter Systems Market revenue.

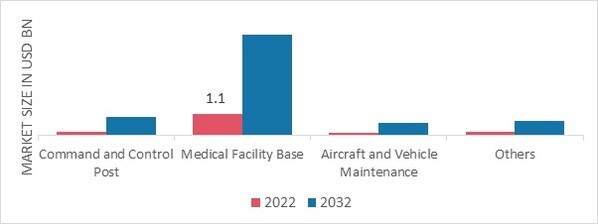

Deployable Military Shelter Systems Market Segment Application Insights

Deployable Military Shelter Systems is Application Type Insights

Based is application type, the Deployable Military Shelter Systems Market segmentation includes command and control posts, medical facility bases, aircraft and vehicle maintenance, and others. Aircraft and vehicle maintenance category has dominated the market, accounting for 35% of market revenue. Aircraft and vehicle maintenance are integral aspects of military operations, and the availability of suitable infrastructure greatly impacts operational readiness. Deployable military shelter systems offer a versatile and practical solution for providing on-site maintenance facilities in remote and challenging environments. As the need for rapid deployment, flexibility, and secure maintenance facilities continues to grow, the deployable military shelter systems market is expected to experience sustained demand and innovation.

Figure 1: Deployable Military Shelter Systems Market, by Application, 2022 & 2032 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Deployable Military Shelter Systems in Product Insights

The Deployable Military Shelter Systems segmentation in product market include small shelter system and large shelter system. The small shelter system category grew faster and generated the most income (65.4%). The rapid deployment, versatility, and specialized functions drive the growth of the small shelter system. Small shelter systems are designed to be compact, lightweight, and highly portable. They are ideal for providing tactical and mobile support to military personnel during various missions and operations.

Deployable Military Shelter Systems Market, shelter type, 2022 & 2032 (USD Billion)

The Deployable Military Shelter Systems by shelter type market segmentation includes hard wall shelter and soft wall shelter. The soft wall shelter generated the most income (65.4%). Soft wall shelters are driven by several factors, including; Portability Soft shelters can be quickly set up and taken down, allowing for rapid deployment and movement of military forces. Flexibility They can be adapted to different environments and terrains, making them suitable for various military operations.Cost-effectiveness Compared to hard shelters, soft shelters are generally more affordable, making them a preferred choice when budget constraints concern them.

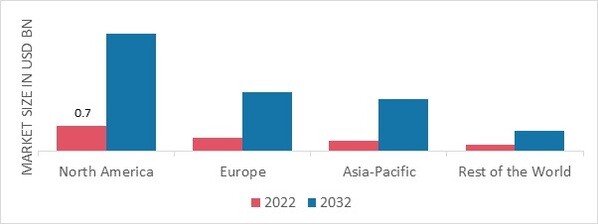

Deployable Military Shelter Systems Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North American Deployable Military Shelter Systems Market area will dominate this market, owing to an increase in the defense budget. In addition, an increase in the modernization of military and law enforcement agencies will boost the Deployable Military Shelter Systems market.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: DEPLOYABLE MILITARY SHELTER SYSTEMS MARKET SHARE BY REGION 2022 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe's Deployable Military Shelter Systems Market accounts for the second-largest market share due to the government's increased military budget. Further, the German Deployable Military Shelter Systems Market held the largest market share, and the UK Deployable Military Shelter Systems Market was the fastest-growing market in the European Region.

The Asia-Pacific Deployable Military Shelter Systems Market is expected to grow at the fastest CAGR from 2023 to 2032. Delopyable military shelter system is expanding due to increased military budgets in countries. Moreover, China’s Deployable Military Shelter Systems Market held the largest market share, and the Indian Deployable Military Shelter Systems Market was the fastest-growing market in the Asia-Pacific region.

Deployable Military Shelter Systems Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their products and services, which will help the Deployable Military Shelter Systems Market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The Deployable Military Shelter Systems industry must offer cost-effective items to expand and survive in a more competitive and rising market.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the Deployable Military Shelter Systems industry to benefit clients and increase the market sector. The Deployable Military Shelter Systems industry has offered some of the most significant medical advantages in recent years. Major players in the Deployable Military Shelter Systems Market, HDT , Alasaka structures, CAMSS shelter, Federal-Fabrics fiber, RDD USA, Shelter tent manufacturing company ltd, Marshall Aerospace and defense group, Losberger Gmbh and others.

HDT is a company that specializes in providing advanced solutions for military, government, and commercial customers worldwide. HDT is a well-established company with a long defense industry history. It has developed a reputation for producing innovative and high-quality solutions to address military and government agencies' challenges. The company's diverse product range includes shelters, tents, power generators, heaters, air filtration systems, robotics, and other mission-critical equipment. These products are designed to enhance the capabilities and efficiency of military and government operations in various environments and conditions. HDT manufactures a wide range of expeditionary shelters and tents that are durable, lightweight, and easy to deploy. These shelters provide protection and support for military personnel and equipment during field operations. Military forces, emergency response teams, and other government agencies worldwide use HDT 's products. Their focus on quality, reliability, and adaptability has contributed to their success in providing essential equipment and support to various missions. In March 2023, Private equity company Nexus Capital Management LP (Nexus), based in Los Angeles, today announced the purchase of aircraft Ground Equipment Corp. (AGEC), a privately held manufacturer and distributor of aircraft ground support equipment for the commercial and military markets. Key military aircraft programs, such as the F35 Lightning and B21 Raider, can now receive comprehensive aviation ground power and thermal management support from HDT due to the acquisition of AGEC, which is organized as a separate business within the HDT portfolio.

CAMSS (Containerized Air Mobile Shelters) is a brand and product line under HDT that specializes in manufacturing and providing mobile, modular, and containerized shelters for various applications, including military, government, and commercial uses. CAMSS Shelters offers a range of expeditionary shelters designed for rapid deployment and use in various environments. These shelters are often used by military forces, emergency response teams, and other organizations requiring mobile and deployable structures to support their operations. In October 2022, Dole collected the George Catlett Marshall Medal, given for exceptional and selfless service for her deep commitment to service people and their families, at the closing event of AUSA's 2022 Annual Meeting and Exposition in Washington, D.C.

Key Companies in the Deployable Military Shelter Systems Market include

- HDT

- Alaska structures

- CAMSS shelter

- Federal- Fabrics fiber

- RDD USA

- Shelter tent manufacturing company ltd

- Marshall Aerospace and defense group

- Losberger Gmbh and others.y

- ArmorSource, LLC

Deployable Military Shelter Systems Industry Developments

For Instance, February 2023 3M disclosed that it has successfully sold its advanced-Deployable Military Shelter Systems division to Avon Rubber p.l.c. for $91 million, excluding closing costs and other costs. Depending on the results of pending tenders, a further contingent consideration of up to $25 million is due.

For Instance, March 2022 The U.S. Army awarded BAE Systems a contract in 2022 to undertake sustainment and technical support services for its M993 Multiple Launch Rocket System carriers and a fleet of Bradley Fighting Vehicles. Under the terms of this contract, the Sustainment System Technical Support and System Technical Support teams will provide ongoing engineering services and logistics to get the Bradley Fighting Vehicle family ready for the tasks of the Soldiers.

For Instance, March 2023 Private equity company Nexus Capital Management LP (Nexus), based in Los Angeles, today announced the purchase of aircraft Ground Equipment Corp. (AGEC), a privately held manufacturer and distributor of aircraft ground support equipment for the commercial and military markets. Key military aircraft programs, such as the F35 Lightning and B21 Raider, can now receive comprehensive aviation ground power and thermal management support from HDT due to the acquisition of AGEC, which is organized as a separate business within the HDT portfolio.

Deployable Military Shelter Systems Market Segmentation

Deployable Military Shelter Systems by application Outlook (USD Billion, 2018-2032)

- Command and control post

- Medical facility base

- Aircraft and vehicle maintenance

- Others

Deployable Military Shelter Systems by Product Type (USD Billion, 2018-2032)

- Small Shelter system

- Large Shelter system

Deployable Military Shelter Systems by Shelter Type (USD Billion, 2018-2032)

- Hard wall shelter

- Soft wall shelter

Deployable Military Shelter Systems by Regional Outlook (USD Billion, 2018-2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.