Diagnostic Electrocardiograph (ECG) Market Overview

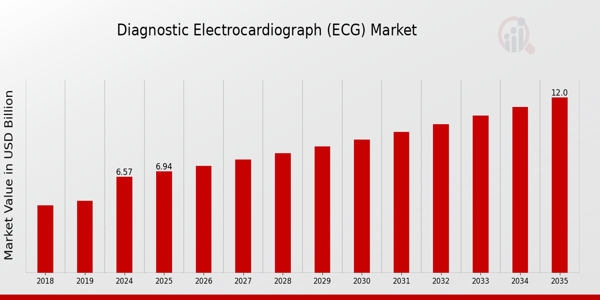

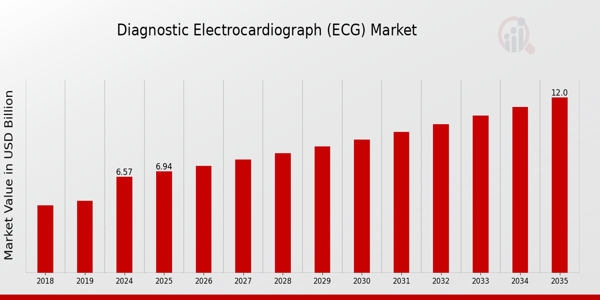

As per MRFR analysis, the Diagnostic Electrocardiograph (ECG) Market Size was estimated at 6.22 (USD Billion) in 2023.

The Diagnostic Electrocardiograph (ECG) Market Industry is expected to grow from 6.57(USD Billion) in 2024 to 12 (USD Billion) by 2035. The Diagnostic Electrocardiograph (ECG) Market CAGR (growth rate) is expected to be around 5.63% during the forecast period (2025 - 2035).

Key Diagnostic Electrocardiograph (ECG) Market Trends Highlighted

The Diagnostic Electrocardiograph (ECG) Market is growing quickly because more and more people of all ages are getting heart disease. As more people have health problems connected to their lifestyles and the population becomes older, the need for reliable and quick diagnostic technologies has grown. Governments all across the globe are putting much attention on preventing health problems, which is why they are giving more money and support to sophisticated ECG technology. This curiosity not only fosters new ideas but also pushes healthcare institutions to have the latest ECG technology, which improves patient care and results.

Developing countries are seeing improvements in their healthcare infrastructure, which opens up some interesting prospects.

These areas are starting to employ digital healthcare solutions, which gives ECG makers an opportunity to make portable, easy-to-use gadgets that may help more patients. As telehealth services grow throughout the world, there is also the possibility of remote ECG monitoring systems that may help patients in distant or underserved locations. This would make the connection between patients and healthcare professionals even stronger. Recent developments show that there is a move toward more complex features, including wireless connectivity, interaction with health applications, and AI capabilities to make diagnoses better.

The emphasis on mobile health solutions has grown, encouraging people to take a more active role in managing their heart health.

This technology makes it easier to find out about heart problems early on and keep an eye on them in real time, which is especially important for good treatment. Also, more and more device makers and software developers are working together, which is making health monitoring systems more complete and better at getting patients involved and analysing data. All of these factors are having an effect on the ECG industry throughout the world.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Diagnostic Electrocardiograph (ECG) Market Drivers

Rising Cardiac Diseases

The prevalence of cardiovascular diseases is a significant driver for the Diagnostic Electrocardiograph (ECG) Market Industry. According to the World Health Organization, cardiovascular diseases are the leading cause of death globally, accounting for approximately 31% of all deaths. In the United States alone, about 697,000 people died from heart disease in 2020, highlighting the urgent need for effective diagnostic tools such as Electrocardiographs (ECGs).As healthcare systems worldwide focus on preventive care and early diagnosis, there is an increased demand for ECG devices, paving the way for growth in the Diagnostic Electrocardiograph (ECG) Market.

Furthermore, organizations like the American Heart Association are advocating for improved screening and management strategies, further amplifying the need for advanced electrocardiographic solutions.

Technological Advancements in ECG Devices

Ongoing technological advancements in the design and functionality of Electrocardiogram devices are significantly boosting the Diagnostic Electrocardiograph (ECG) Market Industry. Innovations such as wearable ECG monitors, mobile health applications, and cloud-based data management systems are making ECG technology more accessible and efficient. Research published by various healthcare technology organizations indicates that the adoption of remote monitoring technologies can increase patient compliance and reduce healthcare costs by up to 30%.

This is reinforced by initiatives from large technology firms that are investing in Research and Development of ECG-related solutions, ensuring that healthcare providers have access to the most advanced diagnostic tools.

Increasing Aging Population

The global aging population is another critical driver for the Diagnostic Electrocardiograph (ECG) Market Industry. The United Nations projects that the population aged 65 years or older will double from 703 million in 2019 to 1.5 billion by 2050. Older adults face a higher risk of cardiovascular issues, thus increasing the demand for rigorous monitoring solutions like ECGs. Major healthcare organizations are gearing up to address this demographic shift by investing in technologies that facilitate early detection and management of cardiac conditions in the elderly, further solidifying the need for advanced Electrocardiograph devices.

Diagnostic Electrocardiograph (ECG) Market Segment Insights

Diagnostic Electrocardiograph (ECG) Market Product Type Insights

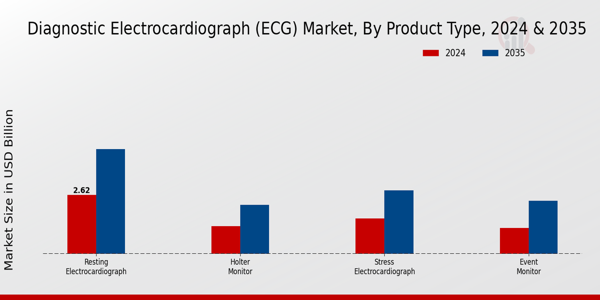

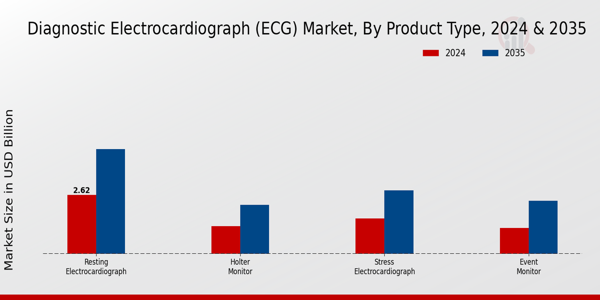

The Diagnostic Electrocardiograph (ECG) Market is characterized by a diverse range of product types, comprising the Resting Electrocardiograph, Stress Electrocardiograph, Holter Monitor, and Event Monitor. By 2024, the market for Resting Electrocardiograph is projected to reach a valuation of 2.62 USD Billion, which reflects its essential role in routine monitoring and assessment of heart function, thus holding a majority share within the overall product segment.

This modality is crucial for diagnosing conditions such as arrhythmias and coronary artery diseases, establishing it as a widely utilized tool in both inpatient and outpatient settings.The Stress Electrocardiograph market, meanwhile, is anticipated to reach 1.57 USD Billion in 2024, emphasizing its significance in evaluating cardiac performance under physical stress and identifying underlying cardiovascular issues that may not be apparent at rest. Holter Monitors, valued at 1.23 USD Billion in the same year, offer continuous monitoring over extended periods, enabling clinicians to capture intermittent cardiac events that can lead to timely interventions, making them increasingly important in outpatient diagnostics.

Lastly, the Event Monitor segment, with a projected value of 1.15 USD Billion in 2024, is designed for patients who experience sporadic heart symptoms; its ability to assist in capturing brief yet critical arrhythmias enhances its relevance in the overall ECG market landscape.These variations in product types not only highlight differing diagnostic capabilities but also reflect broader trends in personalized healthcare and advancements in ECG technology, positioning the Diagnostic Electrocardiograph (ECG) Market for sustained growth as healthcare systems increasingly prioritize early detection and continuous patient monitoring.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Diagnostic Electrocardiograph (ECG) Market Technology Insights

The Diagnostic Electrocardiograph (ECG) Market is witnessing notable advancements within the Technology segment, characterized by an increasing focus on improving patient monitoring and diagnostic accuracy. By 2024, the market is expected to be valued at 6.57 USD Billion, indicating a strong growth trajectory influenced by the rising prevalence of cardiovascular diseases across the globe. This segment encompasses various innovations, including Wireless ECG, Mobile Cardiac Telemetry, and Traditional ECG, each contributing uniquely to market dynamics.Wireless ECG technology is noteworthy for its ability to enhance patient mobility and improve data transmission efficiency, making it particularly significant in remote monitoring scenarios.

Meanwhile, Mobile Cardiac Telemetry has gained traction due to its real-time data collection capabilities, allowing for immediate insights into cardiac health, which is critical for timely medical interventions. Traditional ECG remains a bedrock of cardiac diagnostics, providing essential data that healthcare providers rely on for patient evaluation. Overall, the Diagnostic Electrocardiograph (ECG) Market segmentation reflects a diverse ecosystem where technological innovations are pivotal in addressing the growing demand for efficient and accessible cardiovascular care.With a projected compound annual growth rate of 5.63 from 2025 to 2035, substantial opportunities exist within these segments to enhance the diagnostic landscape globally.

Diagnostic Electrocardiograph (ECG) Market End Use Insights

The Diagnostic Electrocardiograph (ECG) Market is projected to reach a valuation of 6.57 USD billion by 2024, highlighting its robust growth driven by various end use applications. The segment comprises Hospitals, Clinics, Home Healthcare, and Ambulatory Surgical Centers, all playing vital roles in enhancing patient care and cardiac health monitoring. Hospitals are significant users of diagnostic ECG systems, as they require advanced technologies to handle acute cases and provide critical diagnostics.

Clinics are also pivotal, offering routine screenings and check-ups to a broad patient base, whilst Home Healthcare is rapidly gaining traction, catering to the increasing demand for remote patient monitoring solutions.Ambulatory Surgical Centers are important as they facilitate outpatient procedures, where the integration of ECG systems ensures immediate heart health assessments. Together, these end use categories reflect the diverse applications of diagnostic ECG in the Diagnostic Electrocardiograph (ECG) Market, underscoring its importance in the pursuit of improved healthcare delivery and patient outcomes.

Trends such as the rise of telemedicine and home health solutions further amplify the growth prospects of the Diagnostic Electrocardiograph (ECG) Market, ensuring ongoing advancements and opportunities in the industry.

Diagnostic Electrocardiograph (ECG) Market Distribution Channel Insights

The Diagnostic Electrocardiograph (ECG) Market is poised for substantial growth, particularly in the Distribution Channel segment, which plays a pivotal role in the overall market dynamics. By 2024, the market is expected to be valued at 6.57 billion USD, with significant contributions from various distribution methods. Direct Sales channels are vital as they often provide manufacturers with better control over pricing and customer relationships, establishing strong brand loyalty.

Distributors play a crucial role in expanding the reach of ECG devices by navigating local regulations and ensuring timely delivery to healthcare facilities, which is particularly important in diverse global regions.Online Sales have emerged as a dominant force, driven by the increasing adoption of e-commerce platforms and a shift towards digital healthcare solutions, making access to ECG devices more convenient. The market trends reflect a growing inclination towards telemedicine and remote monitoring, with significant opportunities for expanding these distribution methods to enhance patient care globally.

Overall, these distribution channels collectively contribute to the Diagnostic Electrocardiograph (ECG) Market dynamics, shaping how medical technologies are accessed and utilized.

Diagnostic Electrocardiograph (ECG) Market Regional Insights

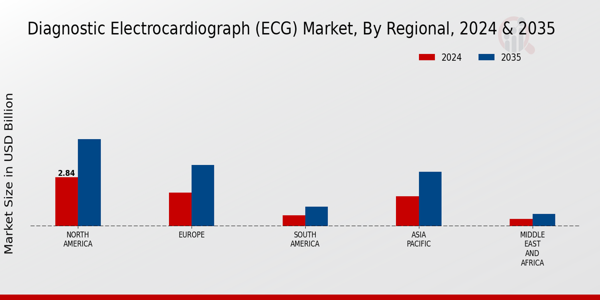

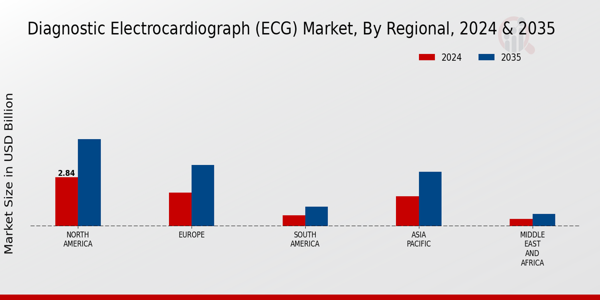

The Diagnostic Electrocardiograph (ECG) Market showcases significant regional diversity, with North America leading the market valued at 2.84 USD Billion in 2024, expected to reach 5.05 USD Billion by 2035, reflecting its majority holding due to advanced healthcare infrastructure and increased prevalence of cardiovascular diseases. Europe follows, with a market value of 1.95 USD Billion in 2024, projected to rise to 3.55 USD Billion by 2035, contributing to innovation and technological advancements in ECG devices.

Asia Pacific holds a notable position, valued at 1.73 USD Billion in 2024 and anticipated to grow to 3.16 USD Billion by 2035, driven by rising health awareness and increasing investments in healthcare.South America, with a market valuation of 0.62 USD Billion in 2024, is expected to reach 1.12 USD Billion by 2035, indicating gradual market expansion fueled by improving healthcare accessibility. The Middle East and Africa exhibit a modest market presence at 0.43 USD Billion in 2024, growing to 0.72 USD Billion by 2035, primarily supported by rising government initiatives for healthcare improvement.

This regional segmentation showcases diverse growth factors and opportunities, positioning the Diagnostic Electrocardiograph (ECG) Market as a critical player in addressing cardiovascular healthcare challenges worldwide.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Diagnostic Electrocardiograph (ECG) Market Key Players and Competitive Insights

The Diagnostic Electrocardiograph (ECG) Market is characterized by rapid advancements in technology and increasing demand for efficient cardiac monitoring solutions. The market is driven by factors such as rising incidences of cardiovascular diseases, increasing geriatric population, and the growth of home healthcare. With a variety of players operating in this landscape, competition is primarily focused on innovation, product quality, pricing strategies, and customer service. Companies emphasize technological advancements such as wireless ECG devices, mobile connectivity, and integration with cloud-based systems, as they seek to address healthcare providers' needs for seamless monitoring and improved patient outcomes.

Understanding the competitive dynamics is essential for businesses looking to thrive in this expansive market, as new entrants and established players vie for market share while navigating regulatory landscapes and fluctuating healthcare demands.Mindray Medical International Limited holds a significant position in the Diagnostic Electrocardiograph (ECG) Market due to its strong emphasis on research and development, allowing it to offer cutting-edge ECG solutions. The company's commitment to innovation has resulted in a robust product portfolio that spans various ECG devices catering to different healthcare settings, from hospitals to outpatient clinics.

Mindray has established an extensive global presence, particularly in emerging markets, capitalizing on its ability to scale production efficiently while ensuring product quality. The strength of Mindray lies in its integrated healthcare solutions, which allow it to combine ECG technology with other diagnostic and monitoring systems, enhancing the overall efficacy of patient care. This holistic approach not only strengthens the company's competitive stance but also cultivates long-term customer loyalty in an increasingly competitive market landscape.Edan Instruments is another noteworthy player in the Diagnostic Electrocardiograph (ECG) Market, known for its dedication to innovative cardiovascular diagnostic solutions.

The company specializes in developing portable and easy-to-use ECG devices that meet the needs of healthcare providers across various settings, from primary care to specialized cardiology units. Edan has cultivated a strong market presence through its focus on high-quality products, such as multi-channel ECG machines and wireless ECG monitors, which provide reliable data for clinical decision-making. The company has made inroads into strategic mergers and acquisitions to expand its product offerings and enhance its technological capabilities.

This strategic approach has enabled Edan to strengthen its position in global markets, ensuring that it remains at the forefront of advancements in ECG technology. The combination of innovative product development, a firm grasp of market needs, and a focus on integrating healthcare solutions has solidified Edan Instruments' role as a key competitor in the global ECG landscape.

Key Companies in the Diagnostic Electrocardiograph (ECG) Market Include:

- Mindray Medical International Limited

- Edan Instruments

- BioTelemetry

- GE Healthcare

- Siemens Healthineers

- Cardionet

- Medtronic

- Nihon Kohden Corporation

- Schiller AG

- Philips Healthcare

- Abbott Laboratories

Diagnostic Electrocardiograph Market Industry Developments

-

Q2 2024: GE HealthCare launches new AI-powered ECG system for hospitals GE HealthCare announced the commercial launch of its new AI-powered electrocardiograph system, designed to improve diagnostic accuracy and workflow efficiency in hospital settings.

-

Q2 2024: Philips receives FDA 510(k) clearance for next-generation wearable ECG patch Philips announced it has received FDA 510(k) clearance for its next-generation wearable ECG patch, expanding its portfolio of ambulatory cardiac monitoring solutions in the U.S.

-

Q3 2024: Medtronic acquires CardioInsight to expand diagnostic cardiology portfolio Medtronic completed the acquisition of CardioInsight, a company specializing in advanced electrocardiographic mapping technology, to strengthen its diagnostic cardiology offerings.

-

Q3 2024: iRhythm Technologies secures $75 million in new funding to accelerate ECG device innovation iRhythm Technologies announced a $75 million funding round led by major institutional investors to support the development and commercialization of its next-generation ambulatory ECG monitoring devices.

-

Q4 2024: Siemens Healthineers opens new ECG device manufacturing facility in Singapore Siemens Healthineers inaugurated a new manufacturing facility in Singapore dedicated to the production of advanced diagnostic electrocardiograph devices for global markets.

-

Q1 2025: Hillrom (Baxter) launches cloud-connected ECG platform for remote diagnostics Hillrom, now part of Baxter, introduced a cloud-connected ECG platform aimed at enabling remote cardiac diagnostics and telehealth integration for healthcare providers.

-

Q1 2025: AliveCor partners with Mayo Clinic to co-develop AI algorithms for ECG interpretation AliveCor announced a strategic partnership with Mayo Clinic to jointly develop and validate artificial intelligence algorithms for enhanced ECG data interpretation.

-

Q2 2025: Nihon Kohden receives CE Mark for portable 12-lead ECG device Nihon Kohden received CE Mark approval for its new portable 12-lead ECG device, enabling expanded access to advanced cardiac diagnostics in European markets.

-

Q2 2025: Bittium wins major contract to supply ECG monitoring solutions to German hospital network Bittium announced it has secured a multi-year contract to provide its ECG monitoring solutions to one of Germany’s largest hospital networks, supporting digital transformation in cardiac care.

-

Q2 2025: Boston Scientific appoints new head of diagnostic cardiology division Boston Scientific named Dr. Lisa Chen as the new head of its diagnostic cardiology division, signaling a renewed focus on innovation in ECG and cardiac monitoring technologies.

-

Q3 2025: Abbott launches smartphone-connected ECG device in India Abbott announced the launch of its new smartphone-connected ECG device in India, targeting both clinical and consumer markets for early cardiac event detection.

-

Q3 2025: CardioComm Solutions receives Health Canada approval for cloud-based ECG management platform CardioComm Solutions received regulatory approval from Health Canada for its cloud-based ECG management platform, enabling secure remote cardiac diagnostics for Canadian healthcare providers.

Diagnostic Electrocardiograph (Ecg) Market Segmentation Insights

Diagnostic Electrocardiograph (ECG) Market Product Type Outlook

- Resting Electrocardiograph

- Stress Electrocardiograph

- Holter Monitor

- Event Monitor

Diagnostic Electrocardiograph (ECG) Market Technology Outlook

- Wireless ECG

- Mobile Cardiac Telemetry

- Traditional ECG

Diagnostic Electrocardiograph (ECG) Market End Use Outlook

- Hospitals

- Clinics

- Home Healthcare

- Ambulatory Surgical Centers

Diagnostic Electrocardiograph (ECG) Market Distribution Channel Outlook

- Direct Sales

- Distributors

- Online Sales

Diagnostic Electrocardiograph (ECG) Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

6.22(USD Billion)

|

|

Market Size 2024

|

6.57(USD Billion)

|

|

Market Size 2035

|

12.0(USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

5.63% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Mindray Medical International Limited, Edan Instruments, BioTelemetry, GE Healthcare, Siemens Healthineers, Cardionet, Medtronic, Nihon Kohden Corporation, Schiller AG, Philips Healthcare, Abbott Laboratories

|

|

Segments Covered

|

Product Type, Technology, End Use, Distribution Channel, Regional

|

|

Key Market Opportunities

|

Telemedicine integration growth, Advanced wearable ECG devices, Rising geriatric population demand, AI-driven ECG interpretation tools, Expanding emerging market accessibility

|

|

Key Market Dynamics

|

rising cardiovascular diseases, technological advancements in ECG, increasing geriatric population, favorable reimbursement policies, growing healthcare expenditure

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Diagnostic Electrocardiograph Market Highlights:

Frequently Asked Questions (FAQ):

The Diagnostic Electrocardiograph (ECG) Market is projected to be valued at 6.57 USD Billion in 2024.

By 2035, the Diagnostic Electrocardiograph (ECG) Market is expected to reach a value of 12.0 USD Billion.

The expected CAGR for the Diagnostic Electrocardiograph (ECG) Market from 2025 to 2035 is 5.63%.

North America is projected to have the largest market size valued at 2.84 USD Billion in 2024.

The market size for Resting Electrocardiographs is valued at 2.62 USD Billion in 2024.

Major players include Mindray Medical, GE Healthcare, Siemens Healthineers, and Philips Healthcare, among others.

The Stress Electrocardiograph segment is expected to reach a market size of 2.82 USD Billion by 2035.

The Asia Pacific region is projected to grow from 1.73 USD Billion in 2024 to 3.16 USD Billion in 2035.

Holter Monitors are expected to have a market value of 1.23 USD Billion in 2024.

The market size for Event Monitors is projected to be 2.35 USD Billion by 2035.