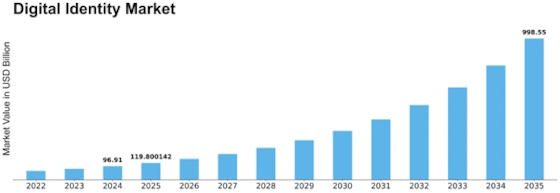

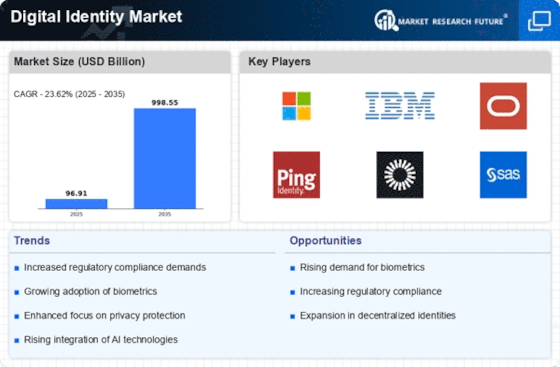

Digital Identity Size

Digital Identity Market Growth Projections and Opportunities

The Digital Identity has become a persuasive part within a dynamically changing environment of online connectivity and services. Markets for digital identity are created through a complex process that involves factors such as the accelerated spread of digital payments, rising concerns for user security, and an effort to ensure that services are comfortable, safe and reliable.

On the surface, the Digital Identity market is without the slightest doubt dedicated to the validating and controlling the identity of people in the digital environment. By this we mean many areas of use, such as cyber-security during online account registration and secured access management, as well as e-commerce and encrypted confidential document verification. Market dynamics showcase an overwhelming need for security in the growing digital environment that is forcefully evolving because of the massive digitalization and threat of cybercrime.

It worth focusing on one of the main drivers that shape market dynamics for Digital Identity - waves of digital transformation that mobile all industries. With businesses and organizations implementing more and more cloud platforms and service as they move to online, the demand for stable and secure digital identity verification entails no exception. Digital identity technologies provide a way to ensure the authentication of users eliminating any chances of exploitation and supporting a world increasingly digitalized.

Additionally, market trends are subject to increasing consumer demand for reducing risks of privacy related activities and protection of data. Hitting the internet data security and personal loss of privacy, people and legal agencies are more concerned with the protection of individual's information. The importance of digital identity solutions that focus on privacy and that experience no data breaches very fast are growing day by day. People and organizations are looking out for answers at a same time, which involve security to ensure identities are verified but also privacy protection.

However, the rapid evolution of the advancement in technology, including biometrics and blockchain, are the key factors in the dynamic market environment of Digital Identity. Biometrics authentication methods which include fingerprint scans and face recognition in this case, provide a better mechanism than the conventional methods of identity verification. The technology behind the blockchain is based on a decentralized and tamper-proof system, thus enabling the enhanced security and integrity of the users' digital identity credentials. The current and future designs and solutions of digital identity technologies are being driven and determined with this technology integration, and are becoming the main factor of the competition.

Leave a Comment