- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

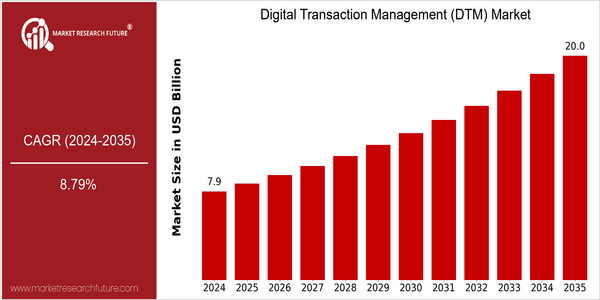

| Year | Value |

|---|---|

| 2024 | USD 7.92 Billion |

| 2035 | USD 20.0 Billion |

| CAGR (2025-2035) | 8.79 % |

Note – Market size depicts the revenue generated over the financial year

The digital transaction management market is projected to grow at a significant rate. It is expected to grow from US$7.92 billion in 2024 to US$20 billion by 2035. The CAGR from 2025 to 2035 is a strong 8.79 per cent. This growth is a result of the rising demand for digitized transactions, combined with the need for enhanced security and compliance in those transactions. Also, organizations are increasingly adopting DTM solutions to improve operational efficiency and customer experience, which is a further growth driver for the market. Also, there are several technology trends that are driving the DTM market. These include the rise of cloud computing, mobile technology, and artificial intelligence. These innovations are enabling organizations to automate and secure their transactional processes, reducing costs and improving speed. The leading DTM vendors, including DocuSign, Adobe, and HelloSign, are enhancing their offerings through strategic investments and acquisitions. In particular, DocuSign has bolstered its position in the DTM market through a series of strategic acquisitions and collaborations. The DTM market is expected to continue to grow as a result of the technological advancements and the rising expectations of consumers.

Regional Market Size

Regional Deep Dive

The Digital Transaction Management (DTM) Market is expected to witness significant growth on account of the increasing need for safe, efficient and paperless transaction processes. North America is characterized by high adoption of digital solutions, owing to the advanced technological environment and strong focus on security and compliance. Europe has a diverse landscape, with different regulatory frameworks influencing DTM adoption. Asia-Pacific is emerging as a key region, owing to the growing digital economy and rising smartphone penetration. Middle East and Africa are characterized by a gradual shift towards digital solutions, driven by government initiatives to promote digital transformation. Latin America, though underdeveloped, is witnessing a rise in demand for DTM solutions, as businesses seek to improve operational efficiency and enhance the customer experience.

Europe

- The European Union's eIDAS regulation is a significant development, providing a legal framework for electronic signatures and transactions, which is expected to boost the adoption of DTM solutions across member states.

- Companies such as Signicat and Yousign are leading the charge in Europe, offering tailored DTM solutions that comply with local regulations and cater to specific market needs.

Asia Pacific

- Countries like India and China are witnessing a surge in digital payment solutions, with government initiatives such as Digital India and the Digital Currency Electronic Payment (DCEP) project promoting the use of DTM technologies.

- Local players like eMudhra and Signzy are innovating in the DTM space, focusing on identity verification and secure digital transactions to cater to the growing demand in the region.

Latin America

- The rise of fintech companies in Brazil and Mexico is driving the demand for DTM solutions, as these firms seek to streamline their operations and offer better services to customers.

- Government programs aimed at increasing financial inclusion are also encouraging the adoption of digital transaction solutions, particularly in underserved markets.

North America

- The U.S. government has implemented the Federal Risk and Authorization Management Program (FedRAMP), which encourages the adoption of cloud services, including DTM solutions, by ensuring compliance with security standards.

- Major companies like DocuSign and Adobe Sign are continuously innovating their platforms, integrating AI and machine learning to enhance user experience and streamline transaction processes.

Middle East And Africa

- The UAE's Vision 2021 initiative aims to enhance the country's digital infrastructure, promoting the adoption of DTM solutions among businesses and government entities.

- Companies like DocuSign and local startups are collaborating with governments to implement DTM solutions that align with regional regulations and enhance operational efficiency.

Did You Know?

“As of 2023, over 70% of organizations in North America have adopted some form of digital transaction management solution, reflecting a significant shift towards paperless operations.” — Gartner Research

Segmental Market Size

The digital transaction management (DTM) segment is currently experiencing a high growth rate. DTMs are used in many industries to optimize and secure digital transactions. The growing need for efficient document processes and the need to comply with regulations such as the eIDAS regulation in Europe or the ESIGN Act in the U.S. are the main drivers of this growth. The trend towards remote work has also accelerated the adoption of digital solutions, as companies seek to ensure continuity of operations. The DTM market is currently in the midst of a large-scale implementation phase, with the market leaders DocuSign and Adobe Sign setting the standard for customer acceptance. The main areas of application are contract management in real estate, e-signatures in the financial services industry and secure document exchange in the health care sector. The pandemic caused by the influenza virus COVID 19 has also accelerated the trend towards digitized processes. In the future, the DTMs will be able to meet the requirements of the digital economy using the help of new technologies such as blockchain for secure transactions and artificial intelligence for document analysis.

Future Outlook

The Digital Transaction Management (DTM) Market is expected to reach a significant growth by 2035, with a CAGR of 8.79% from the years 2024 to 2035. The DTM Market is expected to be driven by the increasing demand for digitized processes in various industries, such as finance, health care, and real estate. In the coming years, the DTM solution is expected to penetrate 60% of the companies by 2035, from 30% in 2024, driven by the need for compliance and customer experience. The integration of new technology, such as artificial intelligence and blockchain, is expected to drive the DTM market. These new technologies will not only improve the security and transparency of transactions, but will also enable real-time processing and analysis, which is critical for companies to remain competitive in a digital economy. The government is also encouraging the digitisation of processes and the implementation of e-signature regulations, which will further support the DTM market. The rise in remote working and the growing importance of sustainable development in business will also drive the DTM market, as companies seek to reduce paper consumption and improve efficiency. The DTM market is expected to evolve significantly as a result of technological development and changing business needs.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 7.9 Billion |

| Market Size Value In 2023 | USD 8.39 Billion |

| Growth Rate | 6.30% (2023-2032) |

Digital Transaction Management Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.