Market Trends

Key Emerging Trends in the Dioctyl Terephthalate Market

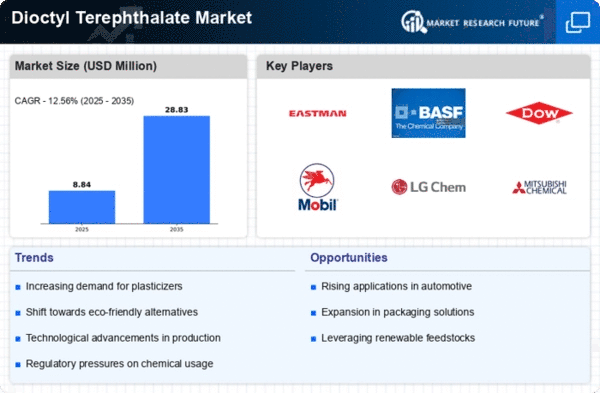

The Dioctyl Terephthalate (DOTP) Market is currently witnessing significant trends that are reshaping the industry across various applications. One notable trend is the increasing demand for DOTP as a phthalate-free plasticizer in the polymer industry. With growing concerns about the environmental and health impacts of traditional phthalate plasticizers, there is a shift towards the adoption of more sustainable alternatives, such as DOTP. This trend is driven by regulatory restrictions on phthalates and the industry's commitment to producing safer and eco-friendly polymer products for applications in flooring, cables, and films.

Environmental sustainability is a key driver influencing market trends in the DOTP Market. As the plastic industry seeks to reduce its carbon footprint and mitigate the environmental impact of plasticizers, there is a growing preference for bio-based and renewable sources of DOTP. Manufacturers are exploring the use of bio-derived feedstocks, such as bio-based terephthalic acid, in the production of DOTP to create a more sustainable and circular economy. This trend aligns with global efforts to transition towards greener and more environmentally friendly plasticizer solutions.

Technological advancements play a pivotal role in shaping market trends in the DOTP Market. Ongoing research and development efforts focus on improving the production processes and properties of DOTP, enhancing its performance as a plasticizer. Innovations in catalyst technologies and reaction engineering contribute to the development of high-quality DOTP with improved thermal stability, low volatility, and enhanced flexibility. These technological trends address the industry's need for advanced plasticizer solutions that meet the diverse requirements of end-users in the polymer sector.

The packaging industry is another significant influencer of market trends in the DOTP Market. DOTP is widely used as a plasticizer in the production of flexible packaging materials, including food packaging films and containers. As the demand for sustainable and safe packaging solutions grows, DOTP gains prominence due to its non-toxic nature and phthalate-free characteristics. This trend is driven by consumer awareness and regulatory measures promoting the use of safer and environmentally friendly packaging materials.

Supply chain dynamics and raw material costs are critical factors impacting market trends in the DOTP Market. The availability and pricing of raw materials, such as terephthalic acid and 2-ethylhexanol, can influence the overall cost of DOTP production. Fluctuations in raw material prices, geopolitical factors affecting the supply chain, and global economic conditions can pose challenges for manufacturers. Companies in the DOTP Market are actively managing their supply chains and exploring strategies to ensure a stable and cost-effective production process.

Moreover, there is a growing trend towards the development of specialty grades and customized formulations in the DOTP Market. As industries demand plasticizers with specific properties and performance characteristics, manufacturers are offering specialty grades of DOTP tailored to meet these requirements. Customized formulations address the need for plasticizers with enhanced features, such as improved UV stability, low-temperature flexibility, and compatibility with different polymers. This trend reflects the industry's commitment to providing versatile and application-specific solutions in response to evolving market demands.

Leave a Comment