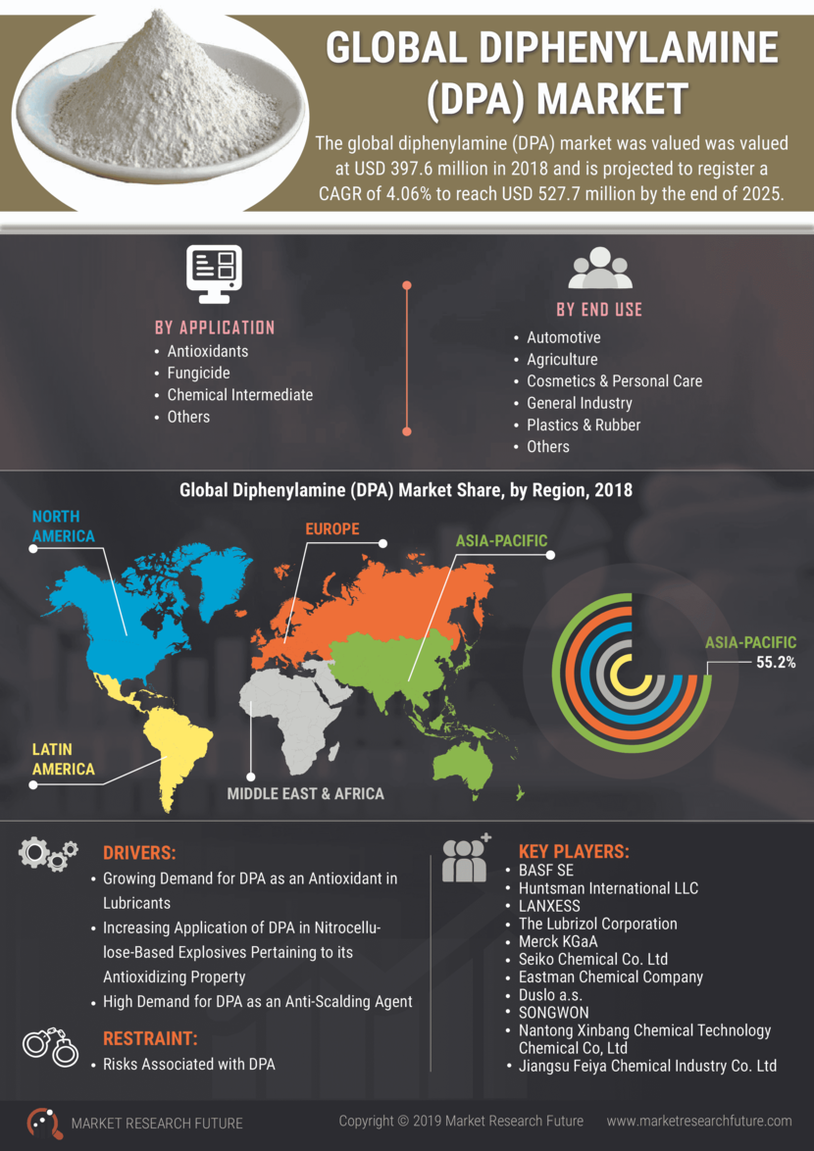

Global Diphenylamine (DPA) Market Overview

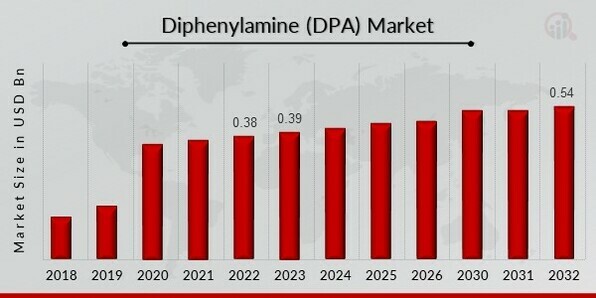

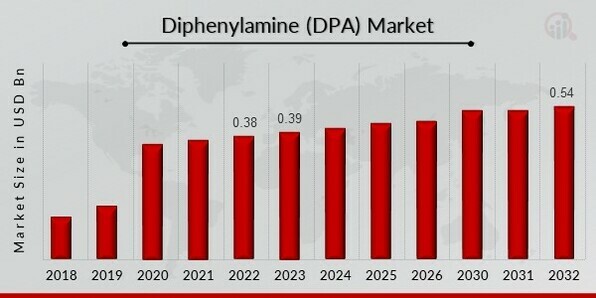

Diphenylamine (DPA) Market Size was valued at USD 0.39 Billion in 2023. The diphenylamine (DPA) industry is projected to grow from USD 0.41 Billion in 2024 to USD 0.54 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.63% during the forecast period (2024 - 2032). Increasing demand for diphenylamine (DPA) as an antioxidant in lubricants and rising usage of rubber and polymer goods in the automotive industry are the key market drivers enhancing the market growth. Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Diphenylamine (DPA) Market Trends

-

The increase in the automotive sector boosts market growth

The automotive industry is one of the primary end-use industries driving the market CAGR for diphenylamine. Rubber is very significant in the automotive industry, which comprises passenger cars, commercial vehicles, and heavy commercial vehicles. Rubber products are widely employed in the automobile industry because of its durability, strength, and heat resistance. Thus, as the automobile industry has grown, so has the demand for rubber, which has fueled the expansion of diphenylamine rubber antioxidant. Furthermore, according to the International Organization of Motor Vehicle Manufacturers, vehicle production in the North Americas and Asia-Pacific region increased by 6% and 3%, respectively, in 2021 compared to the previous year (2020).

According to the German Trade and Invest (GTAI), German automobile manufacturers produced over 16 million vehicles in 2019. Additionally, German passenger car and light commercial vehicle OEM generated foreign market revenue of nearly EUR 282.4 billion (US$ 308 billion) in 2019, a 2% increase over the previous year.

In addition, concerns about the state of the environment have spurred demand for ecologically friendly items such as eco-friendly tires. Increasing initiatives by numerous manufacturers to build eco-friendly tires have increased demand for rubber, which has influenced the expansion of diphenylamine in recent years. As a result, such initiatives will boost demand for rubber-based products and propel the diphenylamine rubber antioxidant market in the future years.

According to India's National Investment Promotion and Facilitation Agency, electric car demand is likely to expand even further in the near future. Automobile output is estimated to reach US$ 300 billion by 2032.

Furthermore, rising demand for rubber and polymer goods in the automotive industry is expected to provide opportunities for market participants throughout the forecast period. Nonetheless, the health and environmental concerns connected with DPA are expected to be a major impediment to diphenylamine (DPA)market revenue during the forecast period.

Diphenylamine (DPA) Market Segment Insights

Diphenylamine (DPA) Application Insights

The diphenylamine (DPA) market segmentation, based on application includes chemical intermediates, antioxidants, fungicides and others. Antioxidants dominated the market, accounting for 59 % of the total. A similar pattern is anticipated for the projected year of 2032. Antioxidants are a key component in the manufacturing of functional fluids such as lubricants, explosives, and gun powders. The antioxidant segment is anticipated to record a CAGR of over 4.5% during the forecast period.

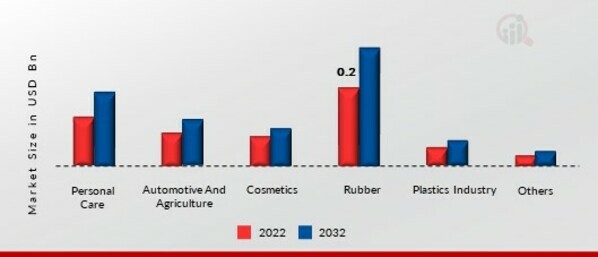

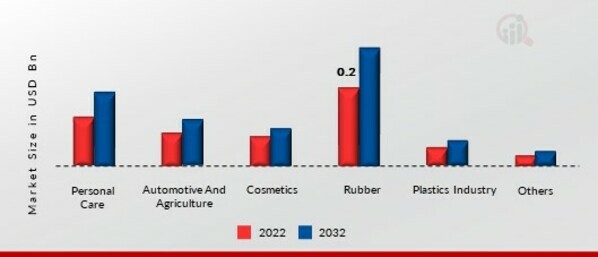

Diphenylamine (DPA) End-Use Industry Insights

The diphenylamine (DPA) market segmentation, based on End-Use Industry, includes personal care, automotive and agriculture, cosmetics, rubber and plastics industry. Rubber dominated the diphenylamine market and is predicted to maintain its dominance between 2022 and 2032. Diphenylamine is the most often utilized antioxidant in Chloroprene Rubber (CR)-based rubber compounds since it has no effect on bin storage qualities. The increasing use of chloroprene rubber pads in reinforced concrete structures in the construction sector is estimated to fuel market growth over the forecast period. Also propelling industrial growth is an increase in demand for chloroprene rubber in the electrical and electronic industries due to its beneficial qualities such as low weight, dielectric capacity, high temperature resistance, and superior impact quality.

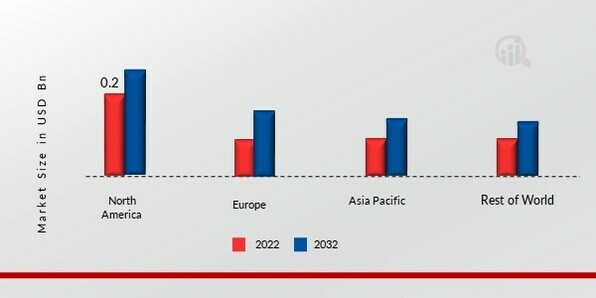

Figure1: Diphenylamine (DPA) Market, by End-User Industry, 2022&2032 (USD billion) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

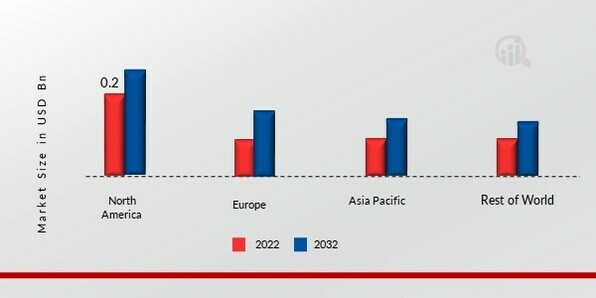

Diphenylamine (DPA) Regional Insights

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. In terms of value, the North America region dominated the diphenylamine rubber antioxidant market in 2022, accounting for 45% of the total. The market in the region is expanding due to increased investment in a variety of end-use sectors. Furthermore, enterprises in this region are presented with profitable prospects to enhance their production capacity, hence stimulating market growth.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure2: DIPHENYLAMINE (DPA) MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe’s diphenylamine (DPA) market accounts for the second-largest market share due to increase their production capacity and, in turn, to stimulate market growth. Further, the German diphenylamine (DPA) market held the largest market share, and the UK diphenylamine (DPA) market was the fastest-growing market in the European region

The Asia-Pacific Diphenylamine (DPA) Market is expected to grow at the fastest CAGR from 2023 to 2032. This is Due to significant industrial growth associated with the expansion of automotive production units and assembly lines in the region's rising economies. Moreover, China’s diphenylamine (DPA) market held the largest market share, and the Indian diphenylamine (DPA) market was the fastest-growing market in the Asia-Pacific region.

Diphenylamine (DPA) Key Market Players & Competitive Insights

Leading market players are investing heavily in R&D in order to expand their product lines, which will help the diphenylamine (DPA) market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, diphenylamine (DPA)industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the diphenylamine (DPA) industry to benefit clients and increase the market sector. In recent years, the diphenylamine (DPA) industry has offered some of the most significant advantages to medicine. Major players in the diphenylamine (DPA) market, including Eastman Chemical Company (US), Duslo a.s. (Slovakia), SONGWON (South Korea), Nantong Xinbang Chemical Technology Chemical Co, Ltd (China) and others, are attempting to increase market demand by investing in R&D operations.

Kumho Petrochemical Co., Ltd. is a South Korean multinational chemical corporation headquartered in Seoul. It was established in 1970 as a result of Kumho Group's inability to source raw materials for its bus and tire businesses. Kumho Petrochemical leads the market in the production of synthetic rubbers, with the world's highest production capacity based on SBR and BR according to IISRP 2012. As its core business, it concentrates on synthetic rubbers, synthetic resins, speciality chemicals, electronic chemicals, energy, construction materials, and advanced materials. Forbes rated Kumho Petrochemical 1806th among 'the 2000' in 2011. It became a component of the KOSPI 100 index, which monitors 100 significant businesses listed on the Korea Stock Exchange. in August 2021, Kumho Petrochemical has announced the usage of environmentally friendly basilica derived from rice bran in its high-performance synthetic rubbers, including S-SBR.

Lanxess AG is a German specialty chemicals firm headquartered in Cologne, Germany. It was created in 2004 following the spin-off of Bayer AG's chemicals division and sections of its polymers business. The company's origins may be traced back to 1863, the year Bayer AG was founded. As part of a major restructuring, the Bayer Group chose to spin off big parts of its chemical activities and roughly one-third of its polymer business into an independent company in November 2003. Lanxess AG shares were listed in Germany's DAX from September 24, 2012 to September 21, 2015, and are now part of the MDAX, a midcap index. The Dow Jones Sustainability Index and the FTSE4Good Index both include the company. April 2019, LANXESS, a market player, has acquired Chemtura Corporation, a well-known company noted for its DPA production levels. LANXESS is also expanding its market dominance by entering the organometallics and additives industries.

Key Companies in the diphenylamine (DPA) market include

-

BASF SE (Germany)

-

Huntsman International LLC (US)

-

LANXESS (Germany)

-

The Lubrizol Corporation (US)

-

Merck KGaA (Germany)

-

Seiko Chemical Co. Ltd (Tokyo)

-

Eastman Chemical Company (US)

-

Duslo a.s. (Slovakia)

-

SONGWON (South Korea

-

Nantong Xinbang Chemical Technology Chemical Co, Ltd (China)

-

Jiangsu Feiya Chemical Industry Co. Ltd (Austria)

Diphenylamine (DPA) Industry Developments

In August 2021, Kumho Petrochemical has announced the usage of environmentally friendly biosilica derived from rice bran in its high-performance synthetic rubbers, including S-SBR.

In October 2021, GRI, an Indian tyre manufacturer, has announced the release of the Ultimate Green XT, a solid material handling tyre that is environmentally friendly. The latest GRI tyre, constructed of pure natural rubber and silica, is designed to improve energy economy by having a 20.4% lower rolling resistance than currently available tyres.

In August 2020, SONGNOX L670 was introduced by notable player SONGWON. It is expected that SONGNOX L670 will be used in conjunction with SONGNOX L135 to stabilize autos, engines, gear oils, and greases.

Diphenylamine (DPA) Market Segmentation

Diphenylamine (DPA) Market Application Outlook

-

Chemical Intermediates

-

Antioxidants

-

Fungicides

-

Others.

Diphenylamine (DPA) Market End-Use Industry Outlook

Diphenylamine (DPA) Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 0.39 billion |

| Market Size 2024 |

USD 0.41 billion |

| Market Size 2032 |

USD 0.54 billion |

| Compound Annual Growth Rate (CAGR) |

3.63% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Application, End-Use Industry, and Region |

| Geographies Covered |

North America, Europe, AsiaPacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

BASF SE (Germany), Huntsman International LLC (US), LANXESS (Germany), The Lubrizol Corporation (US), Merck KGaA (Germany), Seiko Chemical Co. Ltd (Tokyo), Eastman Chemical Company (US), Duslo a.s. (Slovakia), SONGWON (South Korea), Nantong Xinbang Chemical Technology Chemical Co, Ltd (China), Jiangsu Feiya Chemical Industry Co. Ltd (Austria). |

| Key Market Opportunities |

The Market for Diphenylamine Producers increases the usage of diphenylamine as a fungicide. |

| Key Market Dynamics |

The demand for explosives and nitrocellulose-based propellants. |

Diphenylamine Market Highlights:

Frequently Asked Questions (FAQ) :

The diphenylamine (DPA) market size was valued at USD 0.39 Billion in 2023

The market is projected to grow at a CAGR of 3.63% during the forecast period, 2024-2032

North America had the largest share of the market

The key players in the market are Eastman Chemical Company (US), Duslo a.s. (Slovakia), SONGWON (South Korea), Nantong Xinbang Chemical Technology Chemical Co, Ltd (China)

The Rubber diphenylamine (DPA) category dominated the market in 2023

The Antioxidants had the largest share of the market

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review