April 2025: BAE Systems has been awarded a $188.5 million full-rate production (FRP) contract from the U.S. Marine Corps for 30 ACV-30mm vehicles, which includes fielding support, spares and test equipment. The ACV-30 includes an integrated medium caliber Remote Turret System which the government is procuring separately and integrating at Naval Information Warfare Integration Center Atlantic. The ACV-30 enables transport of troops, mission essential equipment, and other payloads, while providing the lethality and protection Marines need. The lightweight turret system also ensures platform mobility is preserved.

February 2025: L3Harris Technologies and Bharat Forge Limited's subsidiary Kalyani Strategic Systems Limited (KSSL) inked a Memorandum of Understanding (MOU) for further cooperation in aiding sophisticated defence and security hardware in India.Under the two-year partnership, both firms will collaborate closely to offer solutions for jointly agreed-upon opportunities within Command, Control, Communications, Intelligence, Surveillance and Reconnaissance (C4ISR) technology.

January 2024: Teledyne FLIR Defense, part of Teledyne Technologies Incorporated, unveiled its long range cooled thermal sniper sight, The ThermoSight HISS-HD is lightweight, high-performance thermal weapon sight allows precision shooters to detect, identify and engage targets more than 2,200 meters away with unparalleled accuracy. HISS-HD can interface with various day scopes and weapon platforms, offering long-range optics and a high-definition display that delivers exceptionally clear imagery for snipers and machine gun crews. HISS-HD is an ideal option for long range snipers and missions involving reconnaissance, force protection, surveillance, and forward observation.

February 2025: With its wide array of cutting-edge military equipment, ASELSAN, the top defense company in Turkey, is scheduled to make its biggest appearance to date at IDEX & NAVDEX 2025, which will take place in Abu Dhabi, United Arab Emirates, from February 17–21. ASELSAN will showcase its most recent defense inventions to global audiences at IDEX, such as the YENER 100-G ground-penetrating radar, ASAF 155 CCF, ASAF 155 MOFA, and ATOM 25 ABM smart ammunitions, and the ALKAR 100/81 and ALKAR 110/81 artillery and mortar systems.

Dismounted Soldier System Market Segmentation

Dismounted Soldier System Market by Type Outlook

- Thermal Weapon Sight

- Monocular and Binocular Night Vision Devices

- Fusion Devices (Night + Fusion)

- Electro-Optical (EO) Sensors Systems

- Rangefinders

- Cameras

- GPS

- Others

- Others

Dismounted Soldier System Market by End User Outlook

- Homeland Security/ Law Enforcement Agencies

- Military

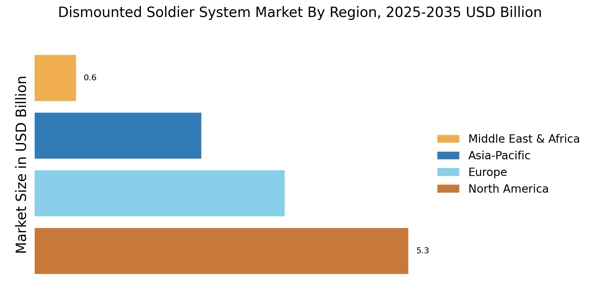

Dismounted Soldier System Market Regional Outlook

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Turkey

- Russia

- Poland

- Czech Republic

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Chile

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- Israel

- Jordan

- South Africa

- Rest of Middle East & Africa