- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

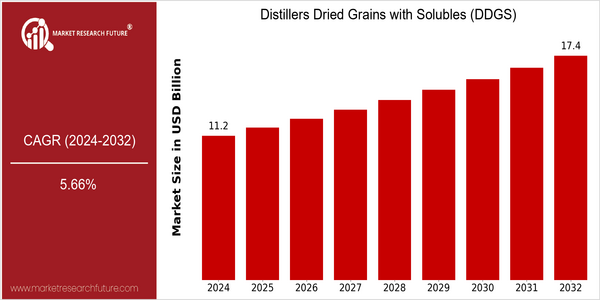

| Year | Value |

|---|---|

| 2024 | USD 11.19 Billion |

| 2032 | USD 17.38 Billion |

| CAGR (2024-2032) | 5.66 % |

Note – Market size depicts the revenue generated over the financial year

The Distillers Dried Grains with Solubles (DDGS) market is poised for significant growth, with a current market size of USD 11.19 billion in 2024 projected to expand to USD 17.38 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 5.66% over the forecast period. The increasing demand for high-protein animal feed, coupled with the rising adoption of sustainable agricultural practices, is driving this upward trend. As livestock producers seek cost-effective and nutritious feed alternatives, DDGS has emerged as a preferred choice due to its favorable nutritional profile and economic viability. Technological advancements in the production and processing of DDGS are also contributing to market expansion. Innovations aimed at enhancing the digestibility and nutritional value of DDGS are attracting interest from feed manufacturers and livestock producers alike. Key players in the market, such as Archer Daniels Midland Company, POET LLC, and Green Plains Inc., are actively engaging in strategic initiatives, including partnerships and investments in research and development, to optimize DDGS production processes and expand their market reach. These efforts not only bolster their competitive positioning but also align with the growing emphasis on sustainability in the agricultural sector.

Regional Market Size

Regional Deep Dive

The Distillers Dried Grains with Solubles (DDGS) market is experiencing dynamic growth across various regions, driven by increasing demand for animal feed and the rising trend of sustainable agricultural practices. In North America, particularly the United States, the market is characterized by a robust supply chain and significant production capacity, largely due to the extensive corn ethanol industry. In Europe, the market is influenced by stringent regulations on feed quality and a growing emphasis on alternative protein sources. Meanwhile, the Asia-Pacific region is witnessing a surge in livestock production, which is propelling the demand for DDGS as a cost-effective feed ingredient. Overall, the DDGS market is poised for growth, supported by innovations in processing technologies and a shift towards more sustainable agricultural practices globally.

Europe

- The European Union has introduced regulations aimed at ensuring the quality and safety of animal feed, which has led to increased scrutiny of DDGS imports. This regulatory environment is pushing producers to enhance the quality of their products.

- There is a growing trend towards the use of DDGS in organic farming, with companies like Tereos and CropEnergies investing in organic certification processes to meet consumer demand for sustainable and organic feed options.

Asia Pacific

- Countries like China and India are ramping up their livestock production, leading to a significant increase in demand for DDGS as a protein-rich feed ingredient. Major players like COFCO and Wilmar International are expanding their operations in this region.

- The rise of aquaculture in Southeast Asia is creating new opportunities for DDGS, as it is increasingly being incorporated into fish feed formulations to enhance growth rates and feed efficiency.

Latin America

- Brazil and Argentina are emerging as key players in the DDGS market, with local ethanol production from sugarcane leading to increased availability of DDGS for animal feed. Companies like Raízen are investing in expanding their production capacities.

- The region is witnessing a shift towards more sustainable livestock practices, with DDGS being recognized as a viable alternative to traditional feed ingredients, thus enhancing its market potential.

North America

- The U.S. is the largest producer of DDGS, with major companies like POET and Archer Daniels Midland (ADM) leading the market. Recent innovations in processing technologies have improved the nutritional profile of DDGS, making it more appealing to livestock producers.

- The U.S. government has implemented programs to promote the use of DDGS in animal feed, which is expected to enhance market penetration and acceptance among farmers, particularly in the poultry and swine sectors.

Middle East And Africa

- In the Middle East, the growing demand for poultry and livestock products is driving the adoption of DDGS, with companies like Al Ain Farms exploring its use in feed formulations to improve nutritional value.

- In Africa, initiatives aimed at improving food security are encouraging the use of locally produced DDGS, with organizations like the Food and Agriculture Organization (FAO) promoting its benefits to smallholder farmers.

Did You Know?

“Did you know that DDGS can contain up to 30% protein, making it a highly nutritious feed option for livestock, particularly in comparison to traditional feed grains?” — U.S. Grains Council

Segmental Market Size

The Distillers Dried Grains with Solubles (DDGS) segment plays a crucial role in the animal feed market, particularly for livestock and poultry, and is currently experiencing stable growth. Key drivers of demand include the increasing need for high-protein feed alternatives due to rising meat consumption and the push for sustainable agricultural practices. Additionally, regulatory policies favoring the use of by-products in feed formulations further bolster this segment's appeal. Currently, DDGS is in a mature adoption stage, with notable leaders such as Archer Daniels Midland Company and POET, LLC actively utilizing DDGS in their feed products across North America and Europe. Primary applications include its use in swine, cattle, and poultry diets, where it serves as a cost-effective protein source. Trends such as the global shift towards sustainable farming and the impact of climate change are accelerating growth, as consumers and producers alike seek environmentally friendly solutions. Technologies like advanced fermentation processes and improved drying techniques are also shaping the evolution of DDGS, enhancing its nutritional profile and market viability.

Future Outlook

The Distillers Dried Grains with Solubles (DDGS) market is poised for significant growth from 2024 to 2032, with a projected market value increase from $11.19 billion to $17.38 billion, reflecting a robust compound annual growth rate (CAGR) of 5.66%. This growth trajectory is underpinned by the rising demand for sustainable animal feed alternatives, as livestock producers increasingly seek cost-effective and nutrient-rich feed options. The penetration of DDGS in the animal feed sector is expected to rise, with usage rates potentially reaching 30% in certain livestock diets by 2032, driven by the need for high-protein feed sources amid fluctuating grain prices and increasing global meat consumption. Key technological advancements in the production and processing of DDGS are anticipated to enhance its nutritional profile and digestibility, making it an even more attractive option for feed manufacturers. Additionally, supportive policies aimed at promoting biofuel production and reducing carbon footprints are likely to bolster the DDGS market, as it is a byproduct of ethanol production. Emerging trends, such as the integration of DDGS in aquaculture and pet food, are also expected to contribute to market expansion. As the industry adapts to these dynamics, stakeholders should remain vigilant to capitalize on the evolving landscape and ensure sustainable growth in the DDGS market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 6.86% (2023-2030) |

Distillers Dried Grains Solubles Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.