- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

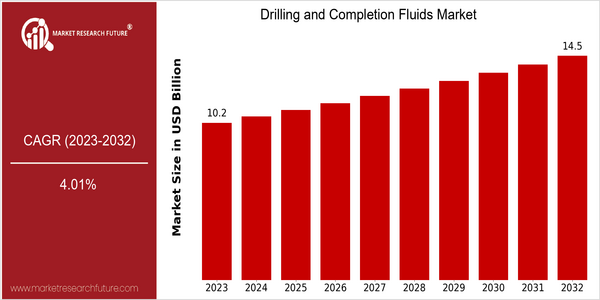

| Year | Value |

|---|---|

| 2023 | USD 10.18 Billion |

| 2032 | USD 14.5 Billion |

| CAGR (2024-2032) | 4.01 % |

Note – Market size depicts the revenue generated over the financial year

The global drilling and completion fluids market is currently valued at approximately USD 10.18 billion in 2023, with projections indicating a growth to USD 14.5 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.01% from 2024 to 2032. The market's expansion can be attributed to several key factors, including the increasing demand for energy resources, advancements in drilling technologies, and the rising complexity of drilling operations that necessitate the use of specialized fluids. As oil and gas exploration continues to evolve, the need for efficient and effective drilling fluids becomes paramount, driving investment and innovation in this sector. Technological advancements, such as the development of environmentally friendly and high-performance drilling fluids, are also contributing to market growth. Companies like Halliburton, Schlumberger, and Baker Hughes are at the forefront of these innovations, often engaging in strategic partnerships and investments to enhance their product offerings. For instance, recent product launches focusing on sustainable fluid solutions have positioned these companies to meet the evolving regulatory standards and environmental concerns, further solidifying their market presence. As the industry adapts to changing dynamics, the drilling and completion fluids market is poised for sustained growth, driven by both demand and innovation.

Regional Market Size

Regional Deep Dive

The Drilling and Completion Fluids Market is experiencing dynamic growth across various regions, driven by increasing exploration and production activities in oil and gas, as well as advancements in drilling technologies. Each region exhibits unique characteristics influenced by local regulations, economic conditions, and technological innovations. North America, for instance, is characterized by a robust shale oil and gas sector, while Asia-Pacific is witnessing a surge in offshore drilling activities. The Middle East and Africa are focusing on sustainable practices, and Europe is adapting to stringent environmental regulations, all of which are shaping the market landscape significantly.

Europe

- Europe is increasingly focusing on the transition to renewable energy sources, which is influencing the drilling fluids market to innovate towards more sustainable and biodegradable options, with companies like BASF investing in green technologies.

- The European Union's stringent regulations on emissions and waste management are prompting drilling companies to adopt advanced fluid management systems, enhancing operational efficiency and compliance.

Asia Pacific

- The Asia-Pacific region is witnessing a significant increase in offshore drilling activities, particularly in countries like Australia and India, leading to a demand for specialized completion fluids that can handle complex geological formations.

- Government initiatives in countries such as China to boost domestic oil production are driving investments in drilling technologies and fluid formulations, with state-owned enterprises like Sinopec playing a pivotal role.

Latin America

- Latin America is experiencing a resurgence in oil exploration, particularly in Brazil and Colombia, leading to increased demand for drilling fluids that can operate in challenging environments, with companies like Petrobras investing in innovative fluid solutions.

- Regulatory frameworks in countries like Mexico are evolving to attract foreign investment in the oil sector, which is expected to enhance the market for drilling and completion fluids as new projects are initiated.

North America

- The rise of hydraulic fracturing and horizontal drilling in North America has led to an increased demand for advanced drilling fluids that can withstand high pressures and temperatures, with companies like Halliburton and Schlumberger leading the innovation.

- Regulatory changes in the U.S. regarding environmental protection are pushing companies to develop eco-friendly drilling fluids, with initiatives from organizations like the American Petroleum Institute promoting sustainable practices.

Middle East And Africa

- The Middle East is focusing on enhancing oil recovery techniques, which is driving the demand for high-performance drilling fluids, with companies like Saudi Aramco investing heavily in research and development.

- In Africa, the discovery of new oil reserves is prompting investments in drilling infrastructure, with local companies collaborating with international firms to improve fluid technologies and practices.

Did You Know?

“Did you know that the composition of drilling fluids can vary significantly based on the geological conditions of the drilling site, with some fluids containing up to 30 different components to optimize performance?” — Society of Petroleum Engineers

Segmental Market Size

The Drilling and Completion Fluids Market is a critical segment within the oil and gas industry, currently experiencing stable growth due to increasing exploration and production activities. Key drivers of demand include the rising need for efficient drilling operations and the push for environmentally friendly solutions, as regulatory policies increasingly favor sustainable practices. Additionally, technological advancements in fluid formulations enhance performance and reduce environmental impact, further propelling market interest. Currently, the adoption stage of drilling and completion fluids is at a mature phase, with companies like Halliburton and Schlumberger leading in innovative applications. Regions such as North America and the Middle East are notable for their extensive use of advanced drilling fluids in complex reservoirs. Primary applications include offshore drilling, shale gas extraction, and enhanced oil recovery, where specialized fluids play a vital role in optimizing performance. Trends such as the global shift towards renewable energy and stringent environmental regulations are catalyzing the development of biodegradable and non-toxic fluid alternatives, shaping the future landscape of this segment.

Future Outlook

The Drilling and Completion Fluids Market is poised for significant growth from 2023 to 2032, with a projected market value increase from $10.18 billion to $14.5 billion, reflecting a compound annual growth rate (CAGR) of 4.01%. This growth trajectory is underpinned by the rising demand for energy resources, particularly in emerging economies, and the ongoing advancements in drilling technologies. As the global energy landscape evolves, the need for efficient and environmentally friendly drilling fluids will drive innovation and adoption rates, with penetration expected to reach approximately 60% in unconventional drilling applications by 2032. Key technological drivers, such as the development of bio-based and synthetic drilling fluids, are anticipated to reshape the market dynamics. These innovations not only enhance drilling efficiency but also address environmental concerns, aligning with stricter regulatory frameworks aimed at reducing the ecological footprint of drilling operations. Additionally, the increasing focus on sustainable practices within the oil and gas industry will further propel the demand for advanced completion fluids. As companies invest in research and development to create high-performance fluids that meet both operational and environmental standards, the market is expected to witness a robust transformation, positioning itself for a sustainable future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | (2023-2030 |

Drilling and Completion Fluids Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.