- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

E Commerce Logistics Market Size Snapshot

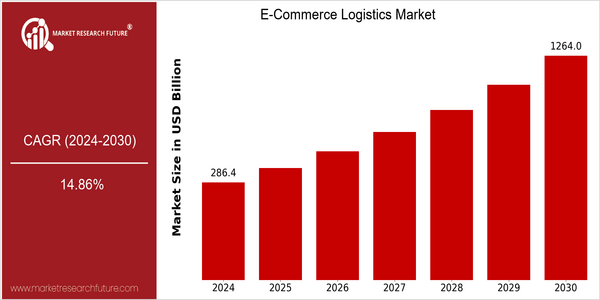

| Year | Value |

|---|---|

| 2024 | USD 286.45 Billion |

| 2030 | USD 1264.0 Billion |

| CAGR (2024-2030) | 14.86 % |

Note – Market size depicts the revenue generated over the financial year

The e-commerce logistics market is expected to grow to $1,264 billion by 2024, with a CAGR of 21.1% from 2024 to 2030. This is an amazing growth rate. The growth of e-commerce platforms and the increasing demand for fast and convenient delivery services are the main reasons for this growth. E-commerce logistics has adapted to the needs of both consumers and businesses. There are many technological developments that will boost the e-commerce logistics market. automation, artificial intelligence, big data and other innovations are expected to improve the efficiency of logistics operations and optimize supply chain management. Amazon and Alibaba are the leaders in this field, and they have made considerable investments in logistics and technology to optimize their supply chains. The strategic cooperation with local delivery companies and the investment in last-mile delivery solutions are also the key to coping with the challenges of increasing order volume and rising customer expectations. This will also help shape the future of e-commerce logistics.

Regional Deep Dive

E-commerce logistics is undergoing major changes in many regions, owing to the rapid growth of e-commerce and the technological advances in this field. In North America, the market is characterized by a high level of demand for fast and reliable delivery services, which has led to an increase in investment in logistics equipment and technology. In Europe, the cross-border e-commerce boom has led to the development of a variety of e-commerce logistics services. In Asia-Pacific, the large population and rising penetration of mobile phones are changing consumers’ shopping habits and bringing about a boom in e-commerce. Middle East and Africa are also seeing a rise in e-commerce, but challenges such as poor infrastructure and regulatory barriers remain. Latin America is catching up gradually. With the improvement in logistics and the growing penetration of the Internet, the market is expanding.

North America

- The same-day delivery services of Amazon and Walmart have been a game-changer.

- And now we are seeing the delivery companies, like UPS and FedEx, making use of drones and unmanned vehicles to optimize their delivery systems.

- The stricter regulations in force and the resulting more restrictive standards for the environment are forcing logistics operators to adopt a more green attitude and this has an effect on their business strategies.

Europe

- The e-commerce regulations of the European Union are still evolving. Several initiatives are underway to improve cross-border logistics, which is crucial to the functioning of e-commerce in the Member States.

- DPD and DHL have also invested in smart logistics solutions that use IoT and AI to optimize their operations and enhance the customer experience.

- Green Deal: a logistics programme for Europe, a green economy for the European Union, a new kind of transport, electric vehicles, green packaging.

Asia-Pacific

- It is obvious that the market of e-commerce logistics is still dominated by China, and the development of logistics and information technology in China is still in the forefront.

- Social commerce is transforming logistics in India and elsewhere. Companies are reorganizing to meet the new habits of consumers, who are influenced by the social media.

- Government initiatives such as the ‘Digital India’ project are enhancing the digital backbone of the country, which is crucial for the development of e-commerce logistics in the country.

MEA

- The United Arab Emirates is becoming a major logistics hub, thanks to its huge investments in technology and logistics, and government initiatives like the Dubai Logistic City project.

- The mobile payment solution is also a key driver of e-commerce growth in Africa.

- Challenges such as inadequate physical and regulatory constraints are being addressed through public-private partnership projects aimed at improving the efficiency of the logistics chain.

Latin America

- Brazil is the leading country in Latin America for e-commerce logistics, with companies such as MercadoLibre investing in the logistics network and expanding their delivery capabilities.

- Mobile commerce is influencing logistics strategies as companies adapt to the growing use of mobile phones for shopping.

- Government projects to improve the transportation system will facilitate the movement of goods throughout the region.

Did You Know?

“The study also predicted that by 2022, e-commerce logistics would account for 10 percent of the world’s total logistics costs, indicating the significance of the Internet’s impact on the logistics industry.” — Statista

Segmental Market Size

The e-commerce logistics market is growing at a rapid pace, fueled by the increasing demand for efficient delivery solutions. This is especially true as the trend towards online shopping continues to grow. The rapid growth of e-commerce platforms, coupled with increasing customer demand for fast delivery, has led to the rapid growth of the e-commerce logistics market.

In the market, the logistics industry has already entered the stage of maturity. The market is led by Amazon and Alibaba in logistics innovation. Their main business is to develop last-mile delivery, automation, and real-time tracking. The emergence of the Cov19 epidemic has also accelerated the trend of e-commerce, which has led to a corresponding increase in the demand for logistics. The trend of green logistics is also a major trend. The combination of IoT, AI, and BAT will optimize the supply chain, and the e-commerce logistics industry will be able to meet the needs of a new generation of consumers.

Future Outlook

From 2024 to 2030, the E-commerce logistics market will grow from $286.45 billion to $1,264.0 billion, with a compound annual growth rate of 14.86 percent. The growth is mainly driven by the continuous penetration of e-commerce into various industries, driven by changes in consumers' consumption behavior and the continuous digital transformation of the industry. By 2030, e-commerce logistics will account for more than 25 percent of the total logistics market, which shows the importance of logistics in promoting the development of e-commerce.

In the future, automation, artificial intelligence and blockchain are expected to be the mainstay of the logistics industry, greatly increasing its efficiency and transparency. The rise of same-day and next-day delivery services will also intensify competition among logistics companies, forcing them to optimize their supply chains. The drive for a sustainable future and a regulatory push towards carbon-free logistics will also help shape the future of e-commerce logistics. It is expected that logistics companies that can seize these opportunities will be able to take a bigger share of the market and grow faster than their rivals.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.98 billion |

| Growth Rate | 14.86% (2024-2030) |

E Commerce Logistics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.