- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

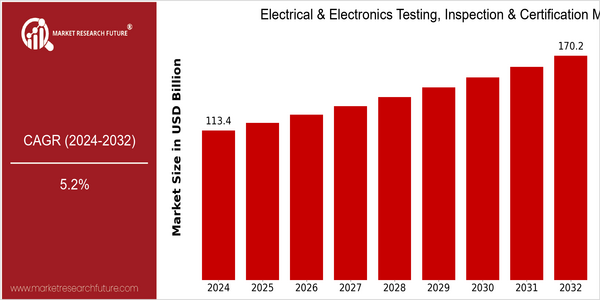

| Year | Value |

|---|---|

| 2024 | USD 113.4 Billion |

| 2032 | USD 170.2 Billion |

| CAGR (2024-2032) | 5.2 % |

Note – Market size depicts the revenue generated over the financial year

The Electrical & Electronics Testing, Inspection & Certification (TIC) market is poised for significant growth, with a current market size of USD 113.4 billion in 2024, projected to reach USD 170.2 billion by 2032. This represents a compound annual growth rate (CAGR) of 5.2% over the forecast period. The steady increase in market size reflects the rising demand for safety and quality assurance in electrical and electronic products, driven by stringent regulatory standards and consumer awareness regarding product safety. Several factors are propelling this market forward, including advancements in technology, the proliferation of smart devices, and the increasing complexity of electronic systems. Innovations such as IoT and AI are reshaping the landscape, necessitating more rigorous testing and certification processes. Key players in the industry, such as SGS, Bureau Veritas, and Intertek, are actively engaging in strategic initiatives, including partnerships and investments in new technologies, to enhance their service offerings and maintain competitive advantage. These efforts not only cater to the growing demand for compliance but also position these companies as leaders in the evolving TIC landscape.

Regional Market Size

Regional Deep Dive

The Electrical & Electronics Testing, Inspection & Certification Market is experiencing significant growth across various regions, driven by increasing regulatory requirements, technological advancements, and the rising demand for quality assurance in electrical and electronic products. Each region exhibits unique characteristics influenced by local regulations, economic conditions, and technological innovation. North America leads in adopting advanced testing technologies, while Europe emphasizes stringent compliance standards. The Asia-Pacific region is rapidly expanding due to its manufacturing capabilities and growing consumer electronics market, while the Middle East and Africa are witnessing increased investments in infrastructure and regulatory frameworks. Latin America is also emerging as a key player, focusing on enhancing product safety and quality standards.

Europe

- The European Union's Green Deal has led to a significant push for sustainability in electrical and electronic products, resulting in increased demand for environmental testing and certification services. Organizations like TÜV Rheinland are actively involved in this transition.

- The introduction of the EU's Ecodesign Directive mandates stricter energy efficiency standards, compelling manufacturers to seek comprehensive testing and certification to ensure compliance, thereby expanding the market for testing services.

Asia Pacific

- China's rapid growth in the electronics manufacturing sector has led to a heightened focus on quality assurance and compliance, with companies like SGS and Bureau Veritas expanding their testing services to meet local and international standards.

- The rise of smart cities in countries like India is driving demand for advanced testing and certification services for electrical infrastructure, as government initiatives promote the adoption of smart technologies.

Latin America

- Brazil's National Institute of Metrology, Quality and Technology (Inmetro) has implemented stricter regulations for electrical products, increasing the demand for testing and certification services among local manufacturers.

- The growing consumer electronics market in Latin America is prompting companies to invest in quality assurance processes, with organizations like Intertek expanding their presence to cater to this rising demand.

North America

- The U.S. has seen a surge in demand for cybersecurity testing services, particularly for IoT devices, driven by increasing concerns over data privacy and security breaches. Companies like UL and Intertek are at the forefront of providing these specialized services.

- Recent regulatory changes, such as the implementation of the National Electrical Code (NEC) updates, have heightened the need for compliance testing and certification, prompting organizations to invest in more robust testing solutions.

Middle East And Africa

- The UAE's Vision 2021 initiative is fostering investments in infrastructure and technology, leading to increased demand for testing and certification services in the electrical and electronics sector, with organizations like Dubai Electricity and Water Authority (DEWA) playing a pivotal role.

- Regulatory bodies in South Africa are enhancing their focus on product safety standards, which is driving local manufacturers to seek certification services to comply with new regulations, thus expanding the market.

Did You Know?

“Did you know that the global market for electrical and electronics testing, inspection, and certification services is expected to grow significantly due to the increasing complexity of electronic devices and the need for compliance with international standards?” — Market Research Future

Segmental Market Size

The Electrical & Electronics Testing, Inspection & Certification (TIC) Market plays a crucial role in ensuring product safety, compliance, and performance across various industries. This segment is currently experiencing growth, driven by increasing consumer demand for high-quality electronic products and stringent regulatory requirements. Key factors propelling this demand include the rapid advancement of technology, which necessitates rigorous testing standards, and heightened awareness of safety and environmental concerns among consumers and manufacturers alike. Currently, the market is in a mature adoption stage, with notable leaders such as SGS, Intertek, and Bureau Veritas spearheading initiatives in regions like North America and Europe. Primary applications include testing for electrical safety, electromagnetic compatibility, and energy efficiency in consumer electronics, automotive components, and industrial equipment. Trends such as the push for sustainability and government mandates for energy-efficient products are accelerating growth in this segment. Additionally, advancements in testing technologies, such as automated testing systems and AI-driven inspection tools, are shaping the future landscape of the Electrical & Electronics TIC Market.

Future Outlook

The Electrical & Electronics Testing, Inspection & Certification (TIC) Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $113.4 billion to $170.2 billion, reflecting a robust compound annual growth rate (CAGR) of 5.2%. This growth trajectory is underpinned by the increasing complexity of electronic devices and the rising demand for safety and compliance across various industries, including automotive, consumer electronics, and renewable energy. As regulatory frameworks become more stringent globally, the need for comprehensive testing and certification services will intensify, driving market penetration rates to an estimated 75% by 2032, up from approximately 60% in 2024. Key technological advancements, such as the integration of artificial intelligence and automation in testing processes, are expected to enhance efficiency and accuracy, further propelling market growth. Additionally, the ongoing transition towards sustainable energy solutions and the proliferation of Internet of Things (IoT) devices will create new opportunities for TIC providers. Emerging trends, including the rise of smart manufacturing and the increasing focus on cybersecurity in electronic products, will also shape the market landscape. As companies prioritize compliance and quality assurance, the Electrical & Electronics TIC Market is set to evolve, positioning itself as a critical component in the global supply chain.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 102.5 Billion |

| Market Size Value In 2023 | USD 107.79 Billion |

| Growth Rate | 5.17% (2023-2032) |

Electrical Electronics Testing Inspection Certification Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.