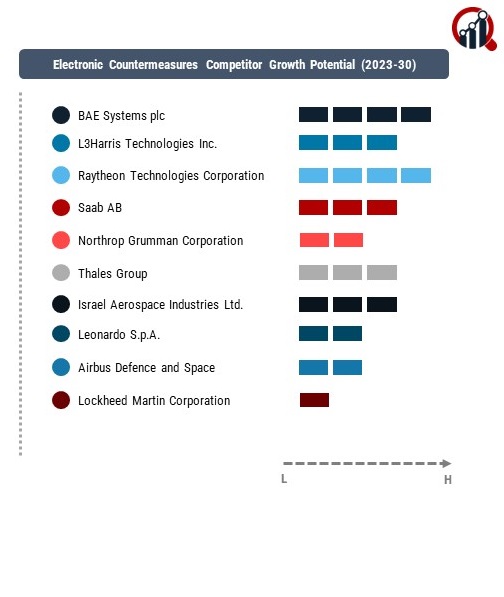

Top Industry Leaders in the Electronic Countermeasures Market

The Electronic Countermeasures (ECM) Market is a critical component of modern defense systems, playing a pivotal role in protecting military assets from hostile electronic threats. This comprehensive overview delves into the competitive landscape, encompassing key players, strategies, market share analysis factors, emerging companies, industry news, and investment trends.

Key Players:

- BAE Systems plc

- L3Harris Technologies Inc.

- Raytheon Technologies Corporation

- Saab AB

- Northrop Grumman Corporation

- Thales Group

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- Airbus Defence and Space

- Lockheed Martin Corporation

- Elbit Systems Ltd.

- Mercury Systems, Inc.

- Cobham plc

- Terma A/S

- Rheinmetall AG

Strategies Adopted:

Key players in the Electronic Countermeasures Market deploy strategic initiatives to maintain and strengthen their market position. Continuous investment in research and development is a common strategy to introduce innovative ECM technologies, including advanced electronic jamming systems, radar decoys, and electronic warfare suites. Additionally, strategic partnerships with defense agencies and international collaborations help expand market reach and ensure the integration of ECM systems with a wide range of military platforms.

Factors for Market Share Analysis:

Market share analysis in the Electronic Countermeasures Market hinges on several critical factors. The effectiveness and adaptability of ECM systems to counter evolving electronic threats, compliance with international defense standards, and the ability to provide tailored solutions for different military applications are pivotal. Companies that excel in developing ECM technologies with low probability of detection, high jamming power, and the capacity to operate in contested electromagnetic environments are likely to secure a significant share of the market.

New and Emerging Companies:

Amid the dominance of established players, new and emerging companies are making strides in the Electronic Countermeasures Market. Start-ups like Mercury Systems and D-Tech Optoelectronics bring innovative approaches to ECM, often focusing on miniaturization, integration with unmanned platforms, and artificial intelligence applications for electronic warfare. These companies contribute agility and niche expertise to the market, challenging traditional approaches and introducing disruptive technologies.

Industry News:

Recent industry news underscores the dynamic nature of the Electronic Countermeasures Market, with reports of successful ECM deployments, collaborations between ECM providers and defense contractors, and advancements in signal processing technologies. Additionally, news regarding the development of next-generation electronic warfare systems, such as cognitive electronic countermeasures capable of adapting in real-time to emerging threats, highlights the industry's commitment to staying ahead of adversarial electronic capabilities. Such developments contribute to the evolving landscape and indicate a shift towards more sophisticated and flexible ECM solutions.

Current Company Investment Trends:

Investments in the Electronic Countermeasures Market reflect a commitment to advancing technology and ensuring the effectiveness of ECM systems in countering electronic threats. Key players are investing significantly in research and development to enhance ECM capabilities, improve signal processing algorithms, and address emerging challenges such as cognitive electronic warfare. Strategic acquisitions and partnerships to broaden solution portfolios and geographic reach are common investment trends. Furthermore, the integration of artificial intelligence and machine learning into ECM systems is a notable focus area, aiming to enhance ECM's adaptive capabilities in response to dynamic electronic threat environments.

Overall Competitive Scenario:

The overall competitive scenario in the Electronic Countermeasures Market is characterized by a blend of established players providing comprehensive ECM solutions and innovative newcomers introducing disruptive technologies. As electronic warfare capabilities become more sophisticated and adversaries employ advanced technologies, the market's competitiveness revolves around delivering ECM systems that can effectively counter a diverse array of electronic threats. The evolving nature of electronic warfare, including the rise of cyber-electromagnetic activities, further shapes the competitive dynamics in the market.

Recent Developments:

Northrop Grumman: Demonstrated its AN/ALQ-199 Next Generation Jammer in December 2023, showcasing advanced capabilities against complex radar threats.

Thales Group: Launched its MIRADOR X radar jammer in October 2023, designed for both fixed and mobile platforms to offer robust protection against air and ground threats.