Embolic Protection Devices Market Analysis

Embolic Protection Devices Market Research Report Information By Type (Distal Filter Device, Distal Occlusion Device, and Proximal Occlusion Device), By Material (Nitinol and Polyurethane), By Usage (Disposable Device and Re-Usable Device), By Application (Cardiovascular Diseases, {Coronary Artery Diseases, Trans Cather Aortic Valve Replacement, and Saphenous Vein Graft Diseases}, Neurovascular...

Market Summary

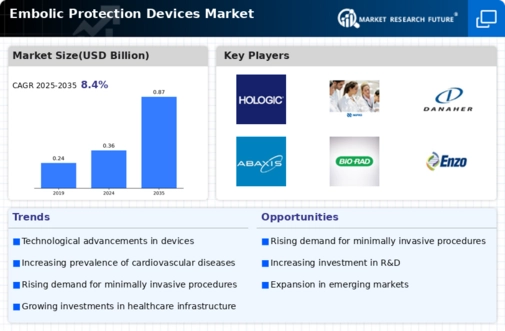

The Global Embolic Protection Devices Market is projected to grow from 0.36 USD Billion in 2024 to 0.87 USD Billion by 2035.

Key Market Trends & Highlights

Embolic Protection Devices Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 8.32 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 0.87 USD Billion, indicating robust growth.

- in 2024, the market is valued at 0.36 USD Billion, laying a solid foundation for future expansion.

- Growing adoption of embolic protection devices due to increasing prevalence of cardiovascular diseases is a major market driver.

Market Size & Forecast

| 2024 Market Size | 0.36 (USD Billion) |

| 2035 Market Size | 0.87 (USD Billion) |

| CAGR (2025-2035) | 8.40% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

Siemens Healthcare GmbH, Hologic, Inc., Sinduri Biotec., SEKISUI MEDICAL CO., LTD., NIPRO, Danaher, Hoffman-La Roche Ltd, Thermo Fischer Scientific Inc., Abaxis, Bio-Rad Laboratories Inc., Enzo Biochem Inc.

Market Trends

The growing incidence of cardiac diseases and the adoption of PCI are driving market growth.

The increasing prevalence of cardiovascular diseases is driving the demand for advanced embolic protection devices, which are essential in minimizing the risk of complications during interventional procedures.

U.S. Food and Drug Administration (FDA)

Embolic Protection Devices Market Market Drivers

Market Growth Projections

The Global Embolic Protection Devices Market Industry is projected to experience robust growth in the coming years. With a market value of 0.36 USD Billion anticipated in 2024, the industry is expected to reach 0.87 USD Billion by 2035, reflecting a compound annual growth rate of 8.32% from 2025 to 2035. This growth trajectory indicates a strong demand for embolic protection devices, driven by factors such as technological advancements, increasing cardiovascular disease prevalence, and an aging population. The market's expansion is likely to create opportunities for innovation and investment in this critical area of healthcare.

Rising Awareness and Education

The growing awareness among healthcare professionals and patients regarding the benefits of embolic protection devices is a significant market driver. Educational initiatives and training programs are being implemented to inform stakeholders about the advantages of these devices during cardiovascular procedures. This heightened awareness is expected to contribute to the expansion of the Global Embolic Protection Devices Market Industry. As more healthcare providers recognize the importance of embolic protection, the adoption rates of these devices are likely to increase, further supporting market growth.

Increasing Geriatric Population

The global demographic shift towards an aging population is a crucial driver for the embolic protection devices market. Older adults are at a higher risk for cardiovascular diseases, necessitating the use of protective devices during surgical interventions. The Global Embolic Protection Devices Market Industry is likely to see substantial growth as the geriatric population expands. This demographic trend indicates a potential increase in market value, aligning with the projected CAGR of 8.32% from 2025 to 2035. Healthcare systems are adapting to meet the needs of this population, further supporting the demand for these devices.

Regulatory Support and Guidelines

Supportive regulatory frameworks and clinical guidelines play a pivotal role in the growth of the Global Embolic Protection Devices Market Industry. Regulatory bodies are increasingly recognizing the importance of embolic protection during cardiovascular procedures, leading to the establishment of guidelines that promote the use of these devices. This regulatory backing not only enhances the credibility of embolic protection devices but also encourages healthcare providers to adopt them in clinical practice. As a result, the market is likely to experience accelerated growth, driven by increased utilization in line with evolving clinical standards.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases globally drives the demand for embolic protection devices. As cardiovascular conditions remain a leading cause of morbidity and mortality, the need for effective interventions becomes paramount. The Global Embolic Protection Devices Market Industry is poised to benefit from this trend, with projections indicating a market value of 0.36 USD Billion in 2024. This surge in demand is likely to be fueled by advancements in medical technology and increased awareness regarding the importance of embolic protection during procedures such as transcatheter aortic valve replacement.

Technological Advancements in Device Design

Innovations in the design and functionality of embolic protection devices significantly enhance their efficacy and safety. The integration of advanced materials and engineering techniques has led to the development of devices that are more effective in capturing embolic debris. This trend is expected to propel the Global Embolic Protection Devices Market Industry, with a projected growth to 0.87 USD Billion by 2035. The continuous evolution of these devices, including features such as improved delivery systems and biocompatibility, suggests a promising future for their adoption in clinical settings.

Market Segment Insights

Embolic Protection Devices Type Insights

The embolic protection devices market segmentation, based on type, includes distal filter devices, distal occlusion devices, and proximal occlusion devices. The distal filter device segment dominated the market, accounting for 35% of market revenue (0.12 Billion). In developing economies, category growth is driven by ease of use, lack of interference with lesion visualization, and availability in various specifications. However, the distal occlusion device is the fastest-growing category owing to rising regulatory approvals by federal government agencies and their initiatives to develop these devices.

Embolic Protection Devices Material Insights

The embolic protection devices market segmentation, based on material, includes nitinol and polyurethane. The nitinol category generated the most income (70.4%) owing to its unique properties and versatility in the design of embolic protection devices. However, polyurethane is the fastest-growing category due to its unique combination of properties such as mechanical strength, flexibility, biocompatibility, and low thrombogenicity.

Embolic Protection Devices Usage Insights

The embolic protection devices market segmentation, based on usage, includes disposable devices and re-usable devices. The disposable device category generated the most income due to the rising prevalence of chronic illnesses, such as neurological, cardiovascular, infectious, and urological disorders. However, polyurethane is the fastest-growing category due to its cost-effectiveness.

Embolic Protection Devices Application Insights

The embolic protection devices market segmentation, based on application, includes cardiovascular diseases, {coronary artery diseases, trans cather aortic valve replacement, saphenous vein graft diseases}, neurovascular diseases, and peripheral vascular diseases. The cardiovascular diseases category generated the most income owing to rising cases of this disease. However, peripheral vascular diseases are the fastest-growing category due to the growing vogue of minimally invasive procedures, which offer various advantages over conventional methods, such as reduced complications, quicker recovery times, and minimal invasiveness.

Embolic Protection Devices End-User Insights

The embolic protection devices market segmentation, based on end-user, includes hospitals & clinics, ambulatory surgical centers, and specialty centers. The hospitals & clinics category generated the most income owing to the high prevalence of highly qualified healthcare professionals and staff. However, specialty centers are the fastest-growing category due to the growing emphasis on patient safety, the adoption of technology-based solutions, and favorable reimbursement policies for endovascular procedures in specialty centers.

Source Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Embolic Protection Devices Market Research Report – Forecast to 2034

Regional Insights

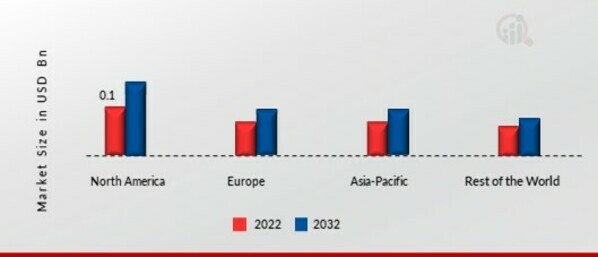

By region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North American embolic protection devices market will dominate this market owing to increasing investments by the government, and the high rate of acceptance of newly developed items among end-users will boost the market growth in this region. Further, the German embolic protection devices market held the largest market share, and the UK embolic protection devices market was the fastest-growing market in the European region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Source Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe's embolic protection devices market accounts for the second-largest market share due to the partnerships of leading companies and technological advancements and several in this region. Further, the German embolic protection devices market held the largest market share, and the UK embolic protection devices market was the fastest-growing market in the European region.

The Asia-Pacific embolic protection devices market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to rising clinical trials in this region. Moreover, China’s embolic protection devices market held the largest market share, and the Indian embolic protection devices market was the fastest-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the embolic protection devices market grow even more. Market participants are also undertaking several strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the embolic protection devices industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the embolic protection devices industry to benefit clients and increase the market sector. Major players in the embolic protection devices market, including Siemens Healthcare GmbH, Hologic, Inc., Sinduri Biotec., SEKISUI MEDICAL CO., LTD., NIPRO, Danaher, and others, are attempting to increase market demand by investing in research and development operations.

Abbott Laboratories discovers, creates, manufactures and sells a diversified range of healthcare products, such as branded generic pharmaceuticals, diagnostic systems and tests, and pediatric and adult nutritional products. The firm also offers various medical devices, including heart failure, electrophysiology, vascular and structural heart devices, rhythm management, and neuromodulation devices. The firm also delivers minerals and nutrition products and dietary supplements. It has research and development facilities across the world. In September 2021, Abbott acquired Walk Vascular, a commercial-stage medical device company that develops minimally invasive mechanical aspiration thrombectomy systems to remove peripheral blood clots.

Cardiovascular Systems Inc, a subsidiary of Abbott Laboratories, is a medical device firm that develops and commercializes products for treating peripheral and coronary vascular disease. The company's products include peripheral orbital atherectomy systems, coronary orbital atherectomy systems, crowns, and accessories. Its peripheral artery disease system is a percutaneous orbital atherectomy system used to treat OAS atherosclerotic disease in peripheral arteries. CSI offers accessories such as guide wires, lubricants, infusion pumps and ancillary products. It has developed orbital atherectomy systems technology for peripheral and coronary commercial applications. The company serves patients suffering from peripheral arterial disease and coronary artery diseases.

In November 2021, Cardiovascular Systems, Inc. launched a voluntary recall of the WIRION Embolic Protection System.

Key Companies in the Embolic Protection Devices Market market include

Industry Developments

- Q2 2025: Terumo Interventional Systems launches FDA-approved ROADSAVERTM Carotid Stent System in the U.S. Terumo Interventional Systems announced the U.S. launch of its FDA-approved ROADSAVERTM Carotid Stent System, which is used in conjunction with the Nanoparasol® Embolic Protection System to offer enhanced flexibility and embolization prevention for carotid artery procedures.

Future Outlook

Embolic Protection Devices Market Future Outlook

The Global Embolic Protection Devices Market is projected to grow at an 8.40% CAGR from 2025 to 2035, driven by technological advancements, increasing prevalence of cardiovascular diseases, and rising demand for minimally invasive procedures.

New opportunities lie in:

- Develop next-generation bioresorbable embolic protection devices to enhance patient outcomes.

- Expand market presence in emerging economies through strategic partnerships and localized manufacturing.

- Leverage digital health technologies to integrate embolic protection devices with remote monitoring systems.

By 2035, the market is expected to achieve substantial growth, positioning itself as a leader in innovative cardiovascular solutions.

Market Segmentation

Embolic Protection Devices Type Outlook

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

Embolic Protection Devices Usage Outlook

- Disposable Device

- Re-Usable Device

Embolic Protection Devices End-User Outlook

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Embolic Protection Devices Material Outlook

- Nitinol

- Polyurethane

Embolic Protection Devices Regional Outlook

- US

- Canada

Embolic Protection Devices Application Outlook

- Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | 0.36 (USD Billion) |

| Market Size 2025 | 0.39 (USD Billion) |

| Market Size 2035 | 0.87 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 8.40% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2020 - 2024 |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Material, Usage, Application, End-User and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Siemens Healthcare GmbH, Hologic, Inc., Sinduri Biotec., SEKISUI MEDICAL CO., LTD., NIPRO, Danaher, F. Hoffman-La Roche Ltd, Abbott, Thermo Fischer Scientific Inc., Abaxis, Bio-Rad Laboratories Inc., and Enzo Biochem Inc. |

| Key Market Opportunities | The expansion in the demand for minimally invasive procedures. |

| Key Market Dynamics | Rise in the number of research and development activities |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the embolic protection devices market?

The embolic protection devices market size was valued at USD 0.3 Billion in 2022.

What is the growth rate of the embolic protection devices market?

The market is projected to grow at a CAGR of 8.40% during the forecast period, 2025-2034.

Which region held the largest market share in the embolic protection devices market?

North America had the largest share of the market

Who are the key players in the embolic protection devices market?

The key players in the market are SEKISUI MEDICAL CO., LTD., NIPRO, Danaher, F. Hoffman-La Roche Ltd, Abbott, Thermo Fischer Scientific Inc., Abaxis, Bio-Rad Laboratories Inc., and Enzo Biochem Inc.

Which type led the embolic protection devices market?

The distal filter device category dominated the market in 2022.

Which material had the largest market share in the embolic protection devices market?

Nitinol had the largest share in the market.

Which usage led the embolic protection devices market?

The disposable device category dominated the market in 2022.

Which application had the largest market share in the market?

Cardiovascular diseases have the largest share in the market.

Which end-user led the embolic protection devices market?

The hospitals & clinics category dominated the market in 2022.

-

Table Of Content

-

Report Prologue

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Research Methodology

- Introduction

- Primary Research

- Secondary Research

- Market Size Estimation

-

Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Macroeconomic Indicators

- Technology Trends & Assessment

-

Market Factor Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power Of Suppliers

- Bargaining Power Of Buyers

- Threat Of New Entrants

- Threat Of Substitutes

- Intensity Of Rivalry

- Value Chain Analysis

- Investment Feasibility Analysis

- Pricing Analysis

-

Porter’s Five Forces Analysis

-

Global Embolic Protection Devices Market, By Type

- Introduction

- Distal Filter Devices

-

• Market Estimates & Forecast, 2023-2032

-

• Market Estimates & Forecast, By Region/Country, 2023-2032

- Distal Occlusion Devices

-

• Market Estimates & Forecast, 2023-2032

-

• Market Estimates & Forecast, By Region/Country, 2023-2032

- Proximal Occlusion Devices

-

• Market Estimates & Forecast, 2023-2032

-

Global Embolic Protection Devices Market, By Material

- Introduction

- Nitinol

-

• Market Estimates & Forecast, By Region/Country, 2023-2032

- Polyurethane

-

• Market Estimates & Forecast, 2023-2032

-

• Market Estimates & Forecast, By Region/Country, 2023-2032

-

Global Embolic Protection Devices Market, By Usage

- Introduction

- Disposable Devices

-

• Market Estimates & Forecast, 2023-2032

- Re-Usable Devices

-

Global Embolic Protection Devices Market, By Application

- Introduction

-

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Disease

- Neurovascular Diseases

- Peripheral Vascular Diseases

-

Global Embolic Protection Devices Market, By End-User

- Introduction

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

-

• Market Estimates & Forecast, By Region/Country, 2023-2032

-

Global Embolic Protection Devices Market, By Region

- Introduction

- Americas

-

• Market Estimates & Forecast, By Region, 2023-2032

-

• Market Estimates & Forecast, By Type, 2023-2032

-

• Market Estimates & Forecast, By Material, 2023-2032

-

• Market Estimates & Forecast, By Usage, 2023-2032

-

• Market Estimates & Forecast, By Application, 2023-2032

-

• Market Estimates & Forecast, By End-User, 2023-2032

- North America

-

• Market Estimates & Forecast, By Country, 2023-2032

-

• Market Estimates & Forecast, By Type, 2023-2032

-

• Market Estimates & Forecast, By Material, 2023-2032

-

• Market Estimates & Forecast, By Usage, 2023-2032

-

• Market Estimates & Forecast, By Application, 2023-2032

- U.S.

-

• Market Estimates & Forecast, By Type, 2023-2032

-

• Market Estimates & Forecast, By Material, 2023-2032

-

• Market Estimates & Forecast, By Usage, 2023-2032

-

• Market Estimates & Forecast, By Application, 2023-2032

-

• Market Estimates & Forecast, By End-User, 2023-2032

- Canada

-

• Market Estimates & Forecast, By Type, 2023-2032

-

• Market Estimates & Forecast, By Usage, 2023-2032

-

• Market Estimates & Forecast, By Application, 2023-2032

-

• Market Estimates & Forecast, By End-User, 2023-2032

- South America

-

Europe

- Western Europe

-

• Market Estimates & Forecast, By Type, 2023-2032

-

• Market Estimates & Forecast, By Material, 2023-2032

-

• Market Estimates & Forecast, By End-User, 2023-2032

-

Italy

- Spain

- Eastern Europe

-

Italy

-

• Market Estimates & Forecast, By Material, 2023-2032

-

• Market Estimates & Forecast, By Usage, 2023-2032

-

Asia Pacific

- Japan

- China

- India

- Australia

- Republic Of Korea

-

Asia Pacific

-

• Market Estimates & Forecast, By Type, 2023-2032

- Rest Of Asia Pacific

- The Middle East & Africa

-

• Market Estimates & Forecast, By Region, 2023-2032

-

United Arab Emirates

- Saudi Arabia

- Oman

- Kuwait

- Qatar

- Rest Of The Middle East & Africa

-

United Arab Emirates

-

Company Landscape

- Introduction

- Market Share Analysis

-

Key Development & Strategies

- Key Developments

-

Company Profiles

-

Medtronic

- Company Overview

- Product Overview

- Financials

- SWOT Analysis

-

Abbott Laboratories

- Company Overview

- Product Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

Boston Scientific

- Company Overview

- Product Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

Cordis

- Company Overview

- Product/Business Segment Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

Contego Medical

- Company Overview

- Product Overview

- Financial Overview

- Key Developments

-

Silk Road Medical

- Company Overview

- Product Overview

- Financial Overview

- Key Developments

-

Edwards Lifesciences Corporation

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

Allium Medical Solutions Ltd.

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

Cardinal Health

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

Angioslide

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

Claret Medical

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

LEPU MEDICAL TECHNOLOGY

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

W. L. Gore & Associates

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

Medtronic

-

MRFR Conclusion

-

Key Findings

- From CEO’s View Point

- Unmet Needs Of The Market

- Key Companies To Watch

- Prediction Of Pharmaceutical Industry

-

Key Findings

-

Appendix

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Embolic Protection Devices Industry Synopsis, 2023-2032

- Table 2 Global Embolic Protection Devices Market Estimates And Forecast, 2023-2032, (USD Million)

- Table 3 Global Embolic Protection Devices Market, By Region, 2023-2032, (USD Million)

- Table 5 Global Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 5 Global Embolic Protection Devices Market, By Material, 2023-2032, (USD Million)

- Table 6 Global Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 7 Global Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 8 North America Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 9 North America Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 9 North America Embolic Protection Devices Market, By Material, 2023-2032, (USD Million)

- Table 10 North America Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 11 U.S. Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 12 U.S. Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 12 U.S. Embolic Protection Devices Market, By Material, 2023-2032, (USD Million)

- Table 13 U.S. Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 14 Canada Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 14 Canada Embolic Protection Devices Market, By Material, 2023-2032, (USD Million)

- Table 15 Canada Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 16 Canada Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 17 South America Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 18 South America Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 19 South America Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 20 Europe Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 21 Europe Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 22 Europe Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 23 Western Europe Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 24 Western Europe Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 25 Western Europe Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 26 Eastern Europe Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 27 Eastern Europe Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 28 Eastern Europe Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 29 Asia Pacific Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 30 Asia Pacific Embolic Protection Devices Market, By Application, 2023-2032, (USD Million)

- Table 31 Asia Pacific Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million)

- Table 32 Middle East & Africa Embolic Protection Devices Market, By Type, 2023-2032, (USD Million)

- Table 33 Middle East & Africa Embolic Protection Devices Market, By Diagnoses, 2023-2032, (USD Million)

- Table 34 Middle East & Africa Embolic Protection Devices Market, By End-User, 2023-2032, (USD Million) LIST OF FIGURES

- Figure 1 Research Process

- Figure 2 Segmentation For Global Embolic Protection Devices Market

- Figure 3 Segmentation Market Dynamics For Embolic Protection Devices Market

- Figure 4 Global Embolic Protection Devices Market Share, By Type 2020

- Figure 5 Global Embolic Protection Devices Market Share, By Material 2020

- Figure 6 Global Embolic Protection Devices Market Share, By End-User, 2020

- Figure 7 Global Embolic Protection Devices Market Share, By Region, 2020

- Figure 8 North America Embolic Protection Devices Market Share, By Country, 2020

- Figure 9 Europe Embolic Protection Devices Market Share, By Country, 2020

- Figure 10 Asia Pacific Embolic Protection Devices Market Share, By Country, 2020

- Figure 11 Middle East & Africa Embolic Protection Devices Market Share, By Country, 2020

- Figure 12 Global Embolic Protection Devices Market: Company Share Analysis, 2020 (%)

- Figure 13 Abbott Laboratories: Key Financials

- Figure 14 Abbott Laboratories: Segmental Revenue

- Figure 16 Abbott Laboratories: Geographical Revenue

- Figure 17 Medtronic. Key Financials

- Figure 18 Medtronic: Segmental Revenue

- Figure 19 Medtronic: Geographical Revenue

- Figure 20 Contego Medical: Key Financials

- Figure 21 Contego Medical: Segmental Revenue

- Figure 22 Contego Medical: Geographical Revenue

- Figure 23 Claret Medical Key Financials

- Figure 24 Claret Medical. Segmental Revenue

- Figure 25 Claret Medical. Geographical Revenue

- Figure 26 Edwards Lifesciences Corporation: Key Financials

- Figure 27 Edwards Lifesciences Corporation: Segmental Revenue

- Figure 28 Edwards Lifesciences Corporation. Geographical Revenue

- Figure 29 Angioslide. Key Financials

- Figure 30 Angioslide. Segmental Revenue

- Figure 31 Angioslide. Geographical Revenue

- Figure 32 Merit Medical Systems, Inc.: Key Financials

- Figure 33 Merit Medical Systems, Inc.: Segmental Revenue

- Figure 34 Merit Medical Systems, Inc.: Geographical Revenue

Embolic Protection Devices Market Segmentation

Embolic Protection Devices Type Outlook (USD Billion, 2018-2032)

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

Embolic Protection Devices Material Outlook (USD Billion, 2018-2032)

- Nitinol

- Polyurethane

Embolic Protection Devices Usage Outlook (USD Billion, 2018-2032)

- Disposable Device

- Re-Usable Device

Embolic Protection Devices Application Outlook (USD Billion, 2018-2032)

- Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

Embolic Protection Devices End-User Outlook (USD Billion, 2018-2032)

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Embolic Protection Devices Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- North America Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- North America Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- North America Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- North America Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- North America Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

US Outlook (USD Billion, 2018-2032)

- US Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- US Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- US Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- US Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- US Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

CANADA Outlook (USD Billion, 2018-2032)

- CANADA Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- CANADA Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- CANADA Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- CANADA Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- CANADA Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

- North America Embolic Protection Devices by Type

Europe Outlook (USD Billion, 2018-2032)

- Europe Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Europe Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Europe Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Europe Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Europe Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Germany Outlook (USD Billion, 2018-2032)

- Germany Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Germany Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Germany Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Germany Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Germany Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

France Outlook (USD Billion, 2018-2032)

- France Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- France Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- France Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- France Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- France Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

UK Outlook (USD Billion, 2018-2032)

- UK Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- UK Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- UK Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- UK Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- UK Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

ITALY Outlook (USD Billion, 2018-2032)

- ITALY Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- ITALY Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- ITALY Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- ITALY Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- ITALY Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

SPAIN Outlook (USD Billion, 2018-2032)

- Spain Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Spain Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Spain Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Spain Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Spain Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Rest Of Europe Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Rest Of Europe Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Rest Of Europe Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- REST OF EUROPE Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

- Europe Embolic Protection Devices by Type

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Asia-Pacific Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Asia-Pacific Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Asia-Pacific Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Asia-Pacific Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

China Outlook (USD Billion, 2018-2032)

- China Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- China Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- China Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- China Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- China Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Japan Outlook (USD Billion, 2018-2032)

- Japan Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Japan Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Japan Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Japan Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Japan Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

India Outlook (USD Billion, 2018-2032)

- India Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- India Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- India Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- India Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- India Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Australia Outlook (USD Billion, 2018-2032)

- Australia Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Australia Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Australia Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Australia Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Australia Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Rest of Asia-Pacific Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Rest of Asia-Pacific Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Rest of Asia-Pacific Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Rest of Asia-Pacific Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

- Asia-Pacific Embolic Protection Devices by Type

Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Rest of the World Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Rest of the World Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Rest of the World Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Rest of the World Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Middle East Outlook (USD Billion, 2018-2032)

- Middle East Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Middle East Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Middle East Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Middle East Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Middle East Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Africa Outlook (USD Billion, 2018-2032)

- Africa Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Africa Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Africa Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Africa Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Africa Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

Latin America Outlook (USD Billion, 2018-2032)

- Latin America Embolic Protection Devices by Type

- Distal Filter Device

- Distal Occlusion Device

- Proximal Occlusion Device

- Latin America Embolic Protection Devices by Material

- Nitinol

- Polyurethane

- Latin America Embolic Protection Devices by Usage

- Disposable Device

- Re-Usable Device

- Latin America Embolic Protection Devices by Application

Cardiovascular Diseases

- Coronary Artery Diseases

- Trans Cather Aortic Valve Replacement

- Saphenous Vein Graft Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

- Latin America Embolic Protection Devices by End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

- Rest of the World Embolic Protection Devices by Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment