- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

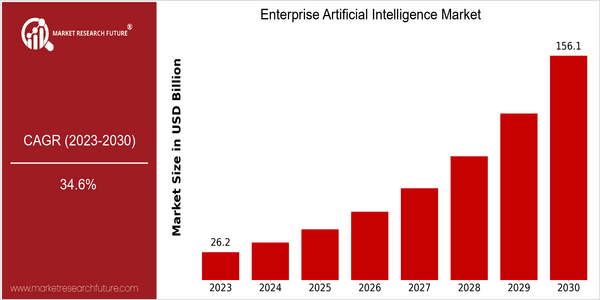

| Year | Value |

|---|---|

| 2023 | USD 26.247 Billion |

| 2030 | USD 156.080997 Billion |

| CAGR (2024-2032) | 34.6 % |

Note – Market size depicts the revenue generated over the financial year

Enterprise AI market is set to grow at a rapid pace with a current market size of $26,247 million in 2023, which is projected to grow to $156 billion by the year 2030. This translates into a CAGR of 36% from 2023 to 2030, indicating a significant increase in the adoption and investment in the technology across industries. Enterprises are primarily driven by the need for automation, improved data analytics, and enhanced customer experiences. Artificial intelligence is being increasingly used to optimize business processes, reduce costs, and gain a competitive advantage. Machine learning, natural language processing, and computer vision are the key contributors to the growth of this market. The major players in the market, such as Google, IBM, and Microsoft, are investing heavily in R&D and launching new products to acquire a dominant position in the market. The likes of IBM’s Watson and Microsoft’s Azure AI are examples of such platforms. The market is set to grow rapidly with the advancement of technology and the increasing need for digital transformation.

Regional Market Size

Regional Deep Dive

Enterprise Artificial Intelligence Market is experiencing significant growth in various regions of the world, owing to technological advancements, the increasing demand for automation, and the need for data-driven decision making. Each region has its own characteristics, influenced by local economic conditions, regulations, and cultural trends towards the use of technology. Enterprises are increasingly recognizing the value of AI in enhancing their operational efficiency and customer engagement. Enterprise Artificial Intelligence Market will grow at a rapid pace, with varying degrees of maturity and innovation in North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America.

Europe

- The European Union has made a strong commitment to becoming a world leader in artificial intelligence. The Member States are being provided with substantial funding for research and development projects in this field.

- The General Data Protection Regulation (GDPR) has created a new regulatory environment that influences the way in which artificial intelligence is developed and implemented, especially in the context of data privacy and security. These regulations are influencing the way companies are adjusting their strategies for artificial intelligence, which is expected to increase consumers’ trust in artificial intelligence.

Asia Pacific

- In the Asia-Pacific region, China and Japan are investing heavily in research and development of artificial intelligence, and have been applying it to various fields such as industry, finance and health care. China’s “Next Generation Artificial Intelligence Development Plan” is aimed at making China a world leader in AI by 2030.

- In countries such as South Korea and Singapore, the general cultural attitude towards technology is very positive, and there is a high degree of digital literacy and the government supports the development of the industry. This trend will accelerate the integration of artificial intelligence into the business processes and customer services.

Latin America

- Latin America is slowly beginning to adopt AI, with countries such as Brazil and Mexico leading the way in areas such as agriculture, finance and retail. There are now a number of local AI start-ups that are tackling the region’s challenges, such as food security and financial inclusion.

- Its economic conditions and its technological diversity present both challenges and opportunities for the growth of A.I. The digital transformation of companies is a priority, and as companies try to make A.I. a source of competitive advantage, they will invest more in it.

North America

- North America is characterized by a high concentration of IT companies and start-ups, with the leading players being Google, Microsoft and IBM. In recent years, research and development in the field of AI has been boosted, especially in the health and finance industries.

- The United States and Canada are preparing to regulate the ethical aspects of artificial intelligence. They are already considering bills such as the Algorithmic Accountability Act. This regulatory focus will shape the development and use of artificial intelligence in the region.

Middle East And Africa

- Throughout the Middle East and Africa, governments are beginning to recognize the potential of AI to diversify their economies and spur innovation. The United Arab Emirates’ “AI Strategy 2031” aims to make the country a world leader in AI by promoting the growth of AI-related businesses and research.

- It is precisely because of the unique challenges facing the region, such as the development of the industrial structure and the training of the workforce, that the emergence of artificial intelligence is being influenced by the situation in the region. The government and private sector will work together to develop the technology and drive its application in different industries.

Did You Know?

“Did you know that by 2025, it is estimated that 75% of organizations will be using AI in some form, significantly transforming their operations and customer interactions?” — Gartner

Segmental Market Size

Artificial intelligence is a new technology, which is being developed by the industry. The enterprise artificial intelligence market is growing at a rapid pace. This market is driven by factors such as the need for greater efficiency in operations, the growth of big data and the demand for customer personalization. Artificial intelligence solutions are increasingly being used to optimize business processes and services, and are therefore a key element in the overall market. The current development of enterprise artificial intelligence is at the deployment stage, where major players such as IBM, Microsoft and Google have already developed and launched AI-based solutions for different industries, such as finance, health care and industry. The solutions are used for example for predictive maintenance in industry, chatbots for customer service and patient diagnostics in health care. The market is also influenced by macro-developments such as the digital transformation, the impact of the COVID-09 pandemic and green initiatives. Machine learning, natural language processing and robotization are shaping the development of the market, making it possible for companies to take advantage of the full potential of artificial intelligence.

Future Outlook

From 2023 to 2030, the Enterprise Artificial Intelligence market is expected to grow from $26 billion to about $ 156 billion, at a CAGR of 36%. This growth is mainly due to the increase in the use of artificial intelligence in various industries such as finance, health and manufacturing, in order to improve efficiency, improve decision-making and provide a more individualized service experience for customers. By 2030, more than 70% of companies will use AI in their core business processes, and the market penetration of AI technology will be greatly improved. The key technology will continue to develop, such as deep learning, natural language processing, and automation tools. In addition, the introduction of supportive government policies and the increase in investment in artificial intelligence will also create a favorable environment for innovation. The competition will be more intense, and new trends such as the emergence of AI as a service and the increase in the number of ethical AI practices will emerge. The enterprise artificial intelligence market is expected to drive innovation and productivity in the next 20 years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 19.5 Billion |

| Market Size Value In 2023 | USD 26.247 Billion |

| Growth Rate | 34.60% (2023-2030) |

Enterprise Artificial Intelligence Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.