- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

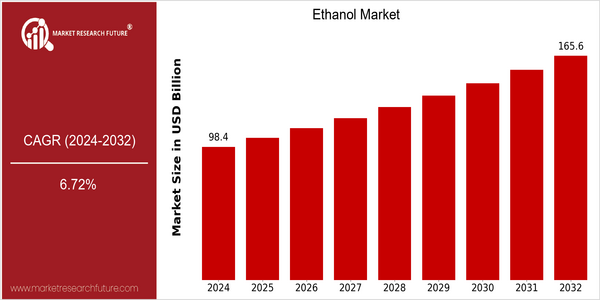

| Year | Value |

|---|---|

| 2024 | USD 98.44 Billion |

| 2032 | USD 165.62 Billion |

| CAGR (2024-2032) | 6.72 % |

Note – Market size depicts the revenue generated over the financial year

The global ethanol market is poised for significant growth, with a current market size of USD 98.44 billion in 2024, projected to reach USD 165.62 billion by 2032. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 6.72% over the forecast period. The increasing demand for renewable energy sources, coupled with stringent environmental regulations aimed at reducing greenhouse gas emissions, is driving the adoption of ethanol as a cleaner alternative to fossil fuels. Additionally, the rising popularity of biofuels in the transportation sector is further propelling market expansion. Technological advancements in ethanol production, such as improved fermentation processes and the development of second-generation biofuels, are also contributing to market growth. Key players in the industry, including Archer Daniels Midland Company, POET LLC, and Green Plains Inc., are actively investing in research and development to enhance production efficiency and product quality. Strategic initiatives, such as partnerships for sustainable sourcing and investments in innovative technologies, are expected to play a crucial role in shaping the future of the ethanol market, ensuring its alignment with global sustainability goals.

Regional Market Size

Regional Deep Dive

The Ethanol Market is experiencing dynamic growth across various regions, driven by increasing demand for renewable energy sources, government mandates for biofuels, and advancements in production technologies. Each region exhibits unique characteristics influenced by local regulations, economic conditions, and cultural attitudes towards sustainability. The market is particularly buoyed by innovations in cellulosic ethanol production and the integration of ethanol into transportation fuels, which are reshaping the energy landscape globally.

Europe

- The European Union has implemented stringent regulations aimed at reducing greenhouse gas emissions, which has led to increased investments in biofuels, including ethanol. The European Commission's Fit for 55 package aims to increase the share of renewable energy in transport, further driving market growth.

- Countries like Germany and France are investing in advanced biofuels, with companies such as CropEnergies and TotalEnergies leading initiatives to produce sustainable ethanol from waste materials, reflecting a shift towards circular economy practices.

Asia Pacific

- Countries like China and India are rapidly expanding their ethanol production capabilities, driven by government policies aimed at energy security and reducing air pollution. The National Biofuel Policy in India aims to achieve a 20% ethanol blending target by 2025, significantly impacting local markets.

- Innovations in fermentation technology, such as those developed by companies like Novozymes, are enhancing the efficiency of ethanol production, making it more economically viable and appealing to emerging markets in the region.

Latin America

- Brazil is a global leader in ethanol production, primarily from sugarcane, and has a well-established infrastructure for biofuel distribution. The country's Proálcool program has been pivotal in promoting ethanol as a viable alternative to gasoline.

- Recent innovations in hybrid vehicles and flex-fuel technology, spearheaded by companies like Volkswagen and Fiat, are enhancing the adoption of ethanol in the automotive sector, further solidifying Brazil's position in the global ethanol market.

North America

- The U.S. is a leader in ethanol production, with the Renewable Fuel Standard (RFS) mandating the blending of biofuels into gasoline, significantly boosting demand. Major companies like Archer Daniels Midland and POET are at the forefront of production and innovation in this sector.

- Recent advancements in technology, such as the development of carbon capture and storage (CCS) systems by companies like Carbon Clean Solutions, are enhancing the sustainability of ethanol production, making it more appealing to environmentally conscious consumers.

Middle East And Africa

- The Middle East and Africa are witnessing a gradual shift towards biofuels, with countries like South Africa exploring ethanol production as part of their renewable energy strategies. The South African government has set a target for biofuels to comprise 2% of the total fuel supply by 2025.

- Collaborations between local governments and international companies, such as the partnership between the South African government and the Brazilian company Raízen, are fostering knowledge transfer and investment in ethanol production technologies.

Did You Know?

“Ethanol can reduce greenhouse gas emissions by up to 50% compared to gasoline, making it a crucial component in the fight against climate change.” — U.S. Department of Energy

Segmental Market Size

The Ethanol Market is primarily segmented into fuel ethanol, industrial ethanol, and beverage ethanol, with fuel ethanol currently experiencing robust growth due to increasing demand for renewable energy sources. Key drivers include stringent regulatory policies aimed at reducing greenhouse gas emissions, rising consumer preference for sustainable fuels, and advancements in production technologies that enhance efficiency. Regions like the United States and Brazil lead in fuel ethanol adoption, with companies such as POET and Raízen spearheading large-scale production initiatives. Primary applications of fuel ethanol include its use as a gasoline additive to improve octane ratings and reduce emissions, while industrial ethanol finds utility in manufacturing solvents and chemicals. Notable trends accelerating growth include government mandates for biofuel blending and global sustainability initiatives that promote cleaner energy alternatives. Technologies such as advanced fermentation processes and cellulosic ethanol production are shaping the segment's evolution, enabling more efficient conversion of biomass into fuel-grade ethanol.

Future Outlook

The Ethanol Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $98.44 billion to $165.62 billion, reflecting a robust compound annual growth rate (CAGR) of 6.72%. This growth trajectory is underpinned by a rising global demand for renewable energy sources, driven by increasing environmental concerns and stringent government regulations aimed at reducing greenhouse gas emissions. As countries strive to meet their climate goals, the adoption of ethanol as a cleaner alternative to fossil fuels is expected to gain momentum, particularly in the transportation sector where biofuels are becoming a critical component of energy strategies. By 2032, ethanol's penetration in the fuel market is anticipated to reach approximately 15%, up from around 10% in 2024, indicating a substantial shift towards sustainable fuel options. Key technological advancements, such as the development of second and third-generation biofuels, are likely to enhance the efficiency and sustainability of ethanol production. Innovations in feedstock utilization, including the use of agricultural waste and non-food crops, will not only improve the economic viability of ethanol but also address food security concerns. Furthermore, supportive policies and incentives from governments worldwide, including tax credits and subsidies for biofuel production, will play a crucial role in fostering market growth. As consumer preferences shift towards greener alternatives, the ethanol market is set to evolve, driven by both technological progress and a favorable regulatory landscape, positioning it as a cornerstone of the future energy mix.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 90.10 billion |

| Growth Rate | 4.90% (2022-2030) |

Ethanol Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.