- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

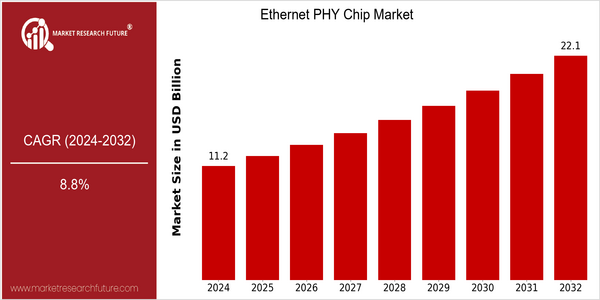

| Year | Value |

|---|---|

| 2024 | USD 11.25 Billion |

| 2032 | USD 22.08 Billion |

| CAGR (2024-2032) | 8.8 % |

Note – Market size depicts the revenue generated over the financial year

The Ethernet PHY market is expected to grow at a rapid pace. The market size of USD 11.25 billion in 2024 is expected to reach USD 21.8 billion in 2032. This growth rate represents a CAGR of 8.8 percent for the forecast period. The primary driving force for this market is the growing demand for high-speed Internet. This demand is primarily driven by the proliferation of IoT devices and the expansion of data centers. Further, the development of 5G technology and the increasing demand for high-speed data transmission are driving the market. Moreover, the major players in the Ethernet PHY chip market, such as Broadcom, Intel, and Marvell, are investing heavily in research and development to enhance their product offerings. Further, they are collaborating with telecommunication companies to ensure their market dominance. Broadcom's recent launch of advanced Ethernet PHY solutions for 5G applications is an example of this approach. The resulting technological developments and strategic initiatives are expected to drive the market.

Regional Market Size

Regional Deep Dive

The market for ethernet phy-chips is growing in all regions of the world. It is mainly driven by the increasing demand for fast Internet and the growing number of IoT devices. In North America, the market is characterized by the advanced technology and the presence of key players, while Europe is characterized by a regulatory framework that promotes energy efficiency and sustainability. Asia-Pacific is experiencing rapid industrialization and urbanization, which is driving the demand for ethernet phy-chips. Meanwhile, digitalization is gradually taking place in the Middle East and Africa, while Latin America is growing due to increasing investment in telecommunications.

Europe

- The European Union's Green Deal is pushing for energy-efficient technologies, prompting manufacturers like NXP Semiconductors to innovate Ethernet PHY chips that consume less power and meet stringent environmental standards.

- Recent collaborations between tech companies and research institutions, such as the partnership between Siemens and the Fraunhofer Institute, are fostering innovation in Ethernet PHY technology, particularly for industrial applications.

Asia Pacific

- China's 'Made in China 2025' initiative is accelerating the development of Ethernet PHY chips, with local companies like Huawei and ZTE leading the charge in creating advanced networking solutions.

- The rapid growth of smart cities in countries like India is driving demand for Ethernet PHY chips, as these cities require robust networking infrastructure to support IoT applications and smart technologies.

Latin America

- Brazil's National Broadband Plan is enhancing internet connectivity across the country, leading to increased demand for Ethernet PHY chips in networking devices.

- The rise of e-commerce in Latin America is driving the need for improved network infrastructure, prompting companies to invest in Ethernet PHY technology to support higher data transmission rates.

North America

- The rise of 5G technology is significantly impacting the Ethernet PHY Chip Market, with companies like Intel and Broadcom investing heavily in developing advanced PHY solutions to support faster data transmission.

- Regulatory initiatives, such as the Federal Communications Commission's (FCC) efforts to expand broadband access, are driving demand for Ethernet PHY chips in networking equipment, particularly in underserved areas.

Middle East And Africa

- The UAE's Vision 2021 is promoting digital transformation, leading to increased investments in telecommunications infrastructure, which in turn boosts the demand for Ethernet PHY chips.

- Emerging tech hubs in Africa, such as Kenya's Silicon Savannah, are fostering innovation and attracting investments in networking technologies, including Ethernet PHY solutions.

Did You Know?

“Did you know that the Ethernet PHY chip market is expected to see a significant shift towards integrated solutions, with many manufacturers focusing on combining PHY functionality with other networking components to reduce space and costs?” — Market Research Future

Segmental Market Size

The Ethernet PHY chip market is a vital part of the Ethernet market, which is currently experiencing stable growth. As a result of the growing demand for fast data transfer and interconnection solutions, the market for Ethernet PHY chips is expected to grow. The main growth drivers are the emergence of IoT and the 5G technology transition, which requires the need for advanced Ethernet solutions to enhance performance. Also, regulatory policies that encourage faster access to the Internet in various regions are expected to drive demand for Ethernet PHY chips. At present, the Ethernet PHY chip is in the stage of mass production, and Intel and Broadcom are the leading vendors of such solutions. North America and Asia-Pacific are the main adopters, especially in the telecommunications and data center industries. Enterprise networking, automobiles, and industrial automation are the main applications. The need for reliable and high-speed data transfer is very high. The trend of smart cities and remote work has driven the growth of this market. Power over Ethernet and the chip design methodology are driving the development of this market.

Future Outlook

In the period 2024–2032 the Ethernet PHY chip market is expected to grow at a robust CAGR of 8.8 %. The escalating demand for high-speed Internet connections and the proliferation of IoT devices in various sectors, such as telecommunications, the automobile industry and the automation industry, are the main drivers of this growth. In the future, as smart technology and cloud-based solutions are increasingly adopted in business and industry, the need for reliable and efficient Ethernet PHY chips will become ever more important, leading to an increased penetration of Ethernet PHY chips in both enterprise and consumer applications. In addition, technological developments such as the development of 5G networks and the continuous evolution of Ethernet standards will further drive the market. The transition to higher data rates, such as 10 Gb/s, 25 Gb/s and beyond, will require the integration of advanced Ethernet PHY chips capable of handling these higher speeds. Furthermore, government initiatives to develop smart cities and digital economies will create favorable conditions for the market. The development of edge computing and the growing focus on energy efficiency will also shape the future of the market and will ensure continued growth and innovation through 2032.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 9.5 Billion |

| Market Size Value In 2023 | USD 10.3 Billion |

| Growth Rate | 8.80% (2023-2032) |

Ethernet PHY Chip Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.