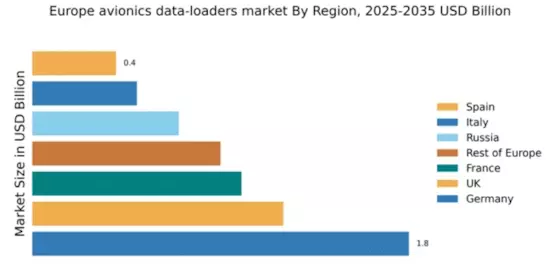

Germany : Strong Demand and Innovation Drive Growth

Key markets include cities like Hamburg, known for its aerospace industry, and Munich, a center for technology and innovation. The competitive landscape features major players like Airbus S.A.S. and Thales Group, which have established significant operations in the region. Local dynamics are characterized by a strong emphasis on R&D and collaboration between industry and academia, particularly in sectors like commercial aviation and defense.

UK : Innovation and Investment Propel Market

Key markets include regions like the South East, particularly around London and Bristol, which are known for their aerospace clusters. The competitive landscape features major players such as BAE Systems and Rolls-Royce, which are heavily involved in avionics development. The local business environment is characterized by strong partnerships between industry and government, fostering innovation in sectors like commercial aviation and military applications.

France : Aerospace Leadership and Innovation

Key markets include Toulouse, home to Airbus, and Paris, a hub for aerospace innovation. The competitive landscape features major players like Thales Group and Airbus S.A.S., which dominate the market. Local dynamics are characterized by a collaborative environment between industry and research institutions, particularly in sectors like commercial aviation and defense.

Russia : Defense Spending Fuels Demand

Key markets include Moscow and Kazan, which are central to the aerospace industry. The competitive landscape features local players alongside international firms like Boeing and Honeywell. The business environment is influenced by government policies promoting local manufacturing and innovation, particularly in defense and commercial aviation sectors.

Italy : Aerospace Innovation and Collaboration

Key markets include Turin and Rome, known for their aerospace clusters. The competitive landscape features players like Leonardo S.p.A. and Thales Group, which have a significant presence in the region. Local dynamics emphasize collaboration between industry and research institutions, particularly in sectors like commercial aviation and defense.

Spain : Aerospace Sector Expansion and Innovation

Key markets include Madrid and Seville, which are central to the aerospace industry. The competitive landscape features players like Airbus S.A.S. and Indra Sistemas, which have established significant operations in the region. Local dynamics are characterized by a strong emphasis on R&D and collaboration between industry and academia, particularly in sectors like commercial aviation and defense.

Rest of Europe : Varied Growth Across Sub-Regions

Key markets include cities like Amsterdam and Zurich, which are emerging as aerospace hubs. The competitive landscape features a mix of local and international players, including Honeywell and Rockwell Collins. Local market dynamics are influenced by varying levels of investment in R&D and collaboration between industry and government, particularly in sectors like commercial aviation and defense.