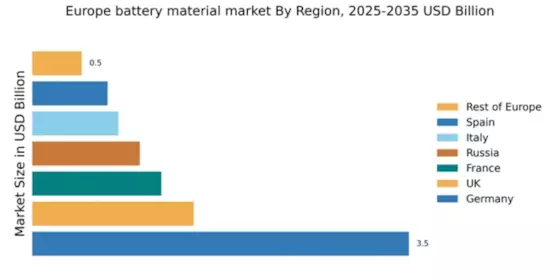

Germany : Strong Infrastructure and Innovation Hub

Germany holds a commanding 3.5% market share in the European battery material sector, driven by robust automotive and renewable energy industries. Key growth drivers include government initiatives promoting electric vehicles (EVs) and stringent emissions regulations. The country is witnessing a surge in demand for lithium-ion batteries, supported by investments in recycling technologies and sustainable sourcing of raw materials. Infrastructure development, particularly in battery production facilities, is also a significant factor in this growth.

UK : Government Support for EV Transition

The UK accounts for 1.5% of the European battery material market, with a growing emphasis on electric vehicle adoption. Key growth drivers include government incentives for EV purchases and investments in charging infrastructure. Demand for battery materials is rising, particularly in urban areas like London and Birmingham, where EV usage is increasing. Regulatory frameworks are evolving to support sustainable practices in battery production and recycling, enhancing market attractiveness.

France : Focus on Sustainability and Innovation

France's market share stands at 1.2%, bolstered by a strong automotive sector and government policies aimed at reducing carbon emissions. The French government has launched initiatives to support battery production, including funding for research and development. Demand for electric vehicles is on the rise, particularly in cities like Paris and Lyon, where local policies favor EV adoption. The competitive landscape features major players like Renault and PSA Group, driving innovation in battery technology.

Russia : Resource-Rich but Underdeveloped Sector

Russia holds a 1.0% share in the battery material market, with significant potential due to its vast natural resources. However, challenges such as geopolitical tensions and underdeveloped infrastructure hinder growth. The government is beginning to recognize the importance of battery materials for the EV market, with initiatives aimed at boosting local production. Demand is primarily driven by the automotive sector, particularly in regions like Tatarstan and Moscow, where industrial development is focused on EVs.

Italy : Focus on Automotive and Renewable Sectors

Italy's market share is at 0.8%, with increasing interest in battery materials driven by the automotive and renewable energy sectors. Government incentives for electric vehicles and solar energy storage are key growth drivers. Demand is particularly strong in regions like Lombardy and Emilia-Romagna, where automotive manufacturing is concentrated. The competitive landscape includes local players and international firms, fostering innovation in battery technology and applications.

Spain : Investment in EV Infrastructure

Spain accounts for 0.7% of the European battery material market, with a focus on expanding electric vehicle infrastructure. Government initiatives to promote EV adoption and renewable energy are driving demand for battery materials. Key markets include Madrid and Barcelona, where urban policies support sustainable transportation. The competitive landscape features both local and international players, with investments in battery production facilities enhancing market dynamics.

Rest of Europe : Regional Variations in Demand

The Rest of Europe holds a 0.46% market share in battery materials, characterized by diverse markets with varying growth rates. Countries like Sweden and Norway are leading in EV adoption, while others lag behind. Government policies across the region are increasingly focusing on sustainability and innovation in battery technologies. The competitive landscape includes a mix of local and international players, with sector-specific applications in automotive and renewable energy driving demand.