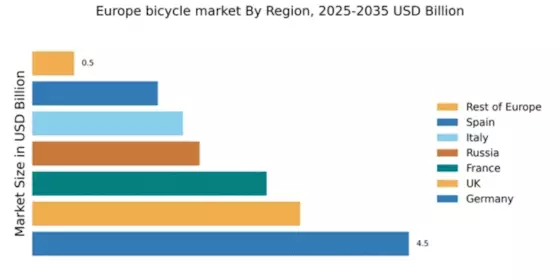

Germany : Strong Demand and Infrastructure Growth

Germany holds a dominant market share of 4.5% in the European bicycle market, valued at approximately €1.5 billion. Key growth drivers include a rising trend towards sustainable transportation, government incentives for cycling infrastructure, and increasing health consciousness among consumers. Regulatory policies promoting eco-friendly transport and investments in cycling paths have further fueled demand. The industrial development in cities like Berlin and Munich supports a robust supply chain for bicycle manufacturing and sales.

UK : Urban Mobility and Health Trends

The UK bicycle market accounts for 3.2% of the European share, valued at around €1 billion. The growth is driven by urbanization, increased cycling participation, and government initiatives like the Cycling and Walking Investment Strategy. Demand trends show a shift towards electric bicycles, especially in urban areas. Local councils are investing in cycling infrastructure, enhancing safety and accessibility for cyclists, which is crucial for market expansion.

France : Tourism and Urban Cycling Boost

France captures 2.8% of the European bicycle market, valued at approximately €900 million. The growth is propelled by cycling tourism, especially in regions like Provence and the Loire Valley, alongside urban cycling initiatives in cities like Paris. Government policies promoting cycling as a sustainable transport mode have led to increased infrastructure investments. The demand for high-end bicycles is rising, driven by a culture of cycling and outdoor activities.

Russia : Potential for Growth and Development

Russia holds a 2.0% share of the European bicycle market, valued at about €700 million. Key growth drivers include a growing interest in outdoor activities and government efforts to promote cycling as a healthy lifestyle. Demand trends indicate a rising popularity of mountain and hybrid bikes, particularly in urban areas. However, infrastructure development remains a challenge, with many cities lacking adequate cycling paths and facilities.

Italy : Cultural Heritage and Innovation

Italy represents 1.8% of the European bicycle market, valued at around €600 million. The market is driven by a strong cycling culture, particularly in regions like Tuscany and Lombardy, where cycling is integral to lifestyle and tourism. Government initiatives to promote cycling as a sustainable transport option are gaining traction. The competitive landscape features local brands like Bianchi and international players, fostering innovation in design and technology.

Spain : Tourism and Urban Initiatives

Spain accounts for 1.5% of the European bicycle market, valued at approximately €500 million. The growth is fueled by cycling tourism, especially in regions like Catalonia and Andalusia, and urban initiatives to enhance cycling infrastructure. Demand for electric bicycles is increasing, driven by urban commuters. The competitive landscape includes both local and international brands, with a focus on quality and performance to meet diverse consumer needs.

Rest of Europe : Varied Demand and Opportunities

The Rest of Europe holds a modest 0.5% share of the bicycle market, valued at around €150 million. This sub-region includes various countries with unique cycling cultures and market dynamics. Growth drivers vary widely, from tourism in the Netherlands to urban cycling initiatives in Scandinavian countries. The competitive landscape is fragmented, with local brands often dominating niche markets. Opportunities exist in promoting cycling as a sustainable transport mode across diverse urban settings.