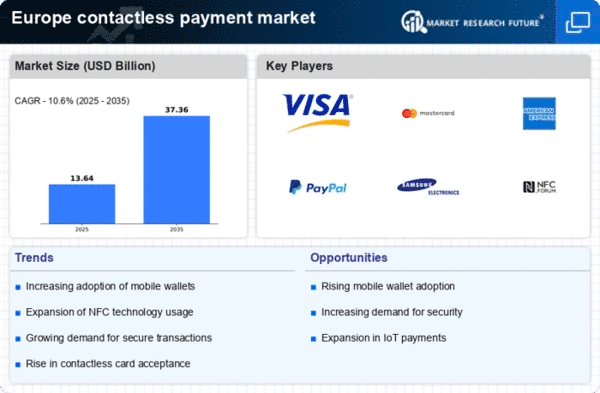

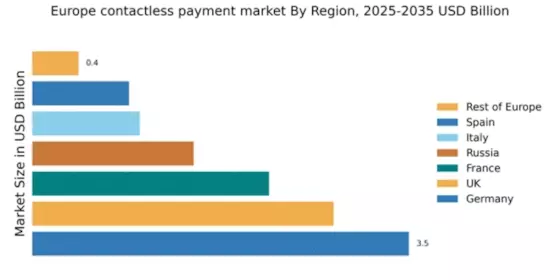

Germany : Strong Infrastructure and Adoption Rates

Germany holds a commanding 3.5% market share in the European contactless payment sector, driven by robust consumer demand and a well-established infrastructure. Key growth drivers include the increasing preference for digital transactions, supported by government initiatives promoting cashless payments. Regulatory policies favoring contactless technology, along with advancements in mobile payment solutions, have further fueled this growth. The industrial landscape is evolving, with significant investments in fintech and payment technologies enhancing accessibility and convenience for consumers.

UK : Innovative Solutions and Consumer Trust

The UK boasts a 2.8% market share in contactless payments, characterized by a high level of consumer trust in digital transactions. Growth is driven by the rapid adoption of mobile wallets and contactless cards, alongside a strong regulatory framework that encourages innovation. The UK government has implemented initiatives to enhance cybersecurity in digital payments, ensuring consumer protection. The competitive landscape is vibrant, with numerous fintech startups and established players like Visa and Mastercard leading the charge.

France : Cultural Shift Towards Digital Payments

France's contactless payment market holds a 2.2% share, reflecting a cultural shift towards digital transactions. Key growth drivers include the increasing use of mobile payment apps and government support for cashless initiatives. The French government has introduced regulations to promote contactless technology, enhancing consumer confidence. Major cities like Paris and Lyon are at the forefront of this trend, with a growing number of merchants accepting contactless payments, supported by key players such as PayPal and Apple.

Russia : Growing Adoption Amid Challenges

Russia's contactless payment market, with a 1.5% share, is on the rise, driven by increasing smartphone penetration and a growing middle class. Government initiatives aimed at modernizing payment systems are pivotal in this growth. However, challenges such as regulatory hurdles and infrastructure gaps remain. Key cities like Moscow and St. Petersburg are leading in adoption, with major players like Mastercard and local fintech companies competing for market share, focusing on sectors like retail and transportation.

Italy : Cultural Acceptance of Contactless Tech

Italy's contactless payment market accounts for 1.0%, showing steady growth as consumers increasingly embrace digital payment methods. Key growth drivers include government initiatives to reduce cash transactions and enhance payment security. The Italian government has implemented policies to support contactless technology, particularly in urban areas. Major cities like Milan and Rome are key markets, with significant presence from players like Visa and Samsung, catering to sectors such as tourism and retail.

Spain : Consumer Adoption and Market Growth

Spain's contactless payment market, with a 0.9% share, is witnessing a rising trend as consumers shift towards digital transactions. Growth is driven by increasing smartphone usage and government support for cashless initiatives. The Spanish government has introduced regulations to facilitate contactless payments, enhancing consumer trust. Key cities like Madrid and Barcelona are pivotal markets, with major players like Google and Adyen actively participating in the competitive landscape, focusing on retail and hospitality sectors.

Rest of Europe : Varied Adoption Across Regions

The Rest of Europe holds a 0.43% market share in contactless payments, characterized by diverse market conditions and varying adoption rates. Growth drivers include local government initiatives promoting digital payments and increasing consumer awareness. However, challenges such as regulatory differences and infrastructure limitations persist. Key markets include smaller nations with emerging fintech sectors, where players like American Express and local startups are making inroads, particularly in e-commerce and retail.