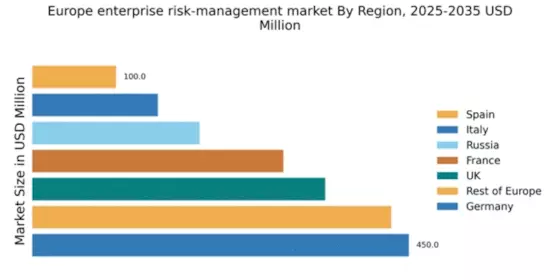

Germany : Strong Growth and Innovation Hub

Germany holds a dominant position in the European enterprise risk-management market, accounting for 30% of the total market share with a value of $450.0 million. Key growth drivers include a robust industrial base, increasing regulatory compliance requirements, and a heightened focus on cybersecurity. Demand trends indicate a shift towards integrated risk management solutions, supported by government initiatives promoting digital transformation and innovation in risk assessment methodologies. Infrastructure development, particularly in technology and finance sectors, further fuels market expansion.

UK : Innovation Meets Regulatory Compliance

The UK enterprise risk-management market is valued at $350.0 million, representing 25% of the European market. Growth is driven by stringent regulatory frameworks, particularly in the financial services sector, and an increasing emphasis on data protection. Demand for advanced analytics and AI-driven solutions is rising, reflecting a shift towards proactive risk management. Government initiatives, such as the Financial Services Act, are enhancing the regulatory landscape, encouraging businesses to adopt comprehensive risk strategies.

France : Diverse Industries Driving Demand

France's enterprise risk-management market is valued at $300.0 million, capturing 20% of the European market. Key growth drivers include a diverse industrial base, particularly in manufacturing and finance, alongside increasing regulatory pressures. The demand for risk management solutions is rising, particularly in sectors like healthcare and energy, where compliance and safety are paramount. Government initiatives aimed at fostering innovation and digitalization are also contributing to market growth, enhancing the overall business environment.

Russia : Regulatory Changes and Growth Opportunities

Russia's enterprise risk-management market is valued at $200.0 million, accounting for 15% of the European market. Key growth drivers include recent regulatory reforms aimed at improving corporate governance and risk management practices. Demand is increasing for tailored risk solutions, particularly in the energy and natural resources sectors. The government is actively promoting initiatives to enhance transparency and compliance, which are crucial for attracting foreign investment and fostering a stable business environment.

Italy : Focus on Compliance and Innovation

Italy's enterprise risk-management market is valued at $150.0 million, representing 10% of the European market. Growth is driven by increasing regulatory requirements, particularly in the financial and manufacturing sectors. Demand for risk management solutions is on the rise, with a focus on compliance and operational efficiency. Government initiatives aimed at supporting SMEs in adopting risk management practices are also contributing to market growth, enhancing the overall business landscape.

Spain : Focus on Financial Services Sector

Spain's enterprise risk-management market is valued at $100.0 million, capturing 7% of the European market. Key growth drivers include a recovering economy and increasing regulatory scrutiny in the financial services sector. Demand for risk management solutions is growing, particularly in banking and insurance, where compliance and risk assessment are critical. Government initiatives aimed at promoting financial stability and transparency are also enhancing the market environment, encouraging businesses to adopt comprehensive risk strategies.

Rest of Europe : Varied Growth Across Sub-regions

The Rest of Europe market for enterprise risk management is valued at $428.86 million, accounting for 8% of the total European market. Growth drivers vary significantly across countries, influenced by local regulations and economic conditions. Demand trends indicate a rising interest in customized risk solutions tailored to specific industries, such as agriculture and technology. Government initiatives across various nations are focusing on enhancing risk management frameworks, promoting stability and compliance in diverse business environments.

Leave a Comment