Increasing Consumer Awareness

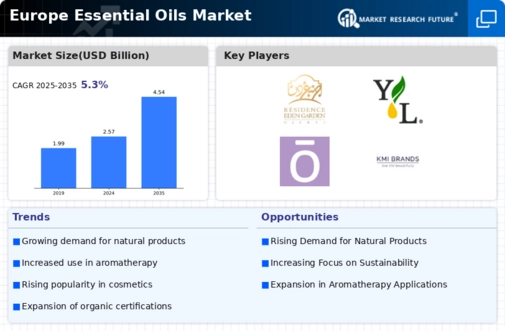

The essential oils market in Europe is experiencing a notable surge in consumer awareness regarding the benefits of natural products. This heightened awareness is largely driven by a growing inclination towards holistic health and wellness. Consumers are increasingly seeking alternatives to synthetic products, which has led to a rise in demand for essential oils. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years. This trend indicates that consumers are not only interested in the therapeutic properties of essential oils but are also becoming more informed about their sourcing and quality. As a result, brands that emphasize transparency and sustainability in their production processes are likely to gain a competitive edge in the essential oils market.

Rising Popularity of Aromatherapy

The essential oils market in Europe is significantly influenced by the rising popularity of aromatherapy practices. As more individuals seek natural remedies for stress relief and emotional well-being, the demand for essential oils has surged. Aromatherapy is increasingly being integrated into wellness centers, spas, and even home environments, contributing to a broader acceptance of essential oils. Market analysis suggests that the aromatherapy segment alone could account for over 30% of the total essential oils market by 2026. This trend indicates a shift in consumer behavior towards holistic health solutions, which is likely to drive further growth in the essential oils market.

Expansion of Distribution Channels

The essential oils market in Europe is witnessing an expansion of distribution channels, which is facilitating greater accessibility for consumers. Traditional retail outlets are increasingly complemented by online platforms, allowing consumers to purchase essential oils with ease. This diversification in distribution is particularly important as it caters to the growing trend of e-commerce, which has seen a significant uptick in recent years. Market data suggests that online sales of essential oils could account for nearly 40% of total sales by 2025. This expansion not only enhances consumer convenience but also provides opportunities for smaller brands to enter the essential oils market, thereby fostering competition and innovation.

Sustainability Trends in Production

Sustainability is becoming a pivotal driver in the essential oils market in Europe. Consumers are increasingly prioritizing eco-friendly products, prompting manufacturers to adopt sustainable practices in sourcing and production. This shift is reflected in the growing demand for organic essential oils, which are perceived as safer and more environmentally friendly. Data indicates that the organic segment of the essential oils market is expected to grow at a CAGR of around 10% over the next few years. Companies that invest in sustainable practices not only enhance their brand image but also align with the values of environmentally conscious consumers, thereby strengthening their position in the essential oils market.

Regulatory Support for Natural Ingredients

The essential oils market in Europe benefits from a regulatory environment that increasingly supports the use of natural ingredients. Various governmental bodies are implementing policies that promote the use of essential oils in cosmetics, food, and therapeutic applications. This regulatory support is crucial as it encourages manufacturers to innovate and expand their product lines. For instance, the European Union has established guidelines that facilitate the safe use of essential oils, thereby enhancing consumer confidence. As a result, the market is expected to witness a steady growth trajectory, with an estimated increase in market value reaching €1.5 billion by 2027. This supportive regulatory framework is likely to foster a more robust essential oils market.