Growth in Automotive Applications

The automotive sector significantly influences the non woven-fabric market in Europe, as manufacturers increasingly utilize these materials for various applications. Non woven fabrics are employed in automotive interiors, sound insulation, and filtration systems, contributing to weight reduction and improved fuel efficiency. The European automotive industry is projected to grow at a rate of 3% annually, which may further bolster the demand for non woven fabrics. Additionally, the shift towards electric vehicles (EVs) is likely to create new opportunities for the non woven-fabric market, as lightweight materials become essential for enhancing vehicle performance. This trend suggests that the non woven-fabric market will continue to evolve, adapting to the changing needs of the automotive sector while maintaining a focus on sustainability and innovation.

Rising Demand for Hygiene Products

The non woven-fabric market in Europe experiences a notable surge in demand for hygiene products, driven by increasing consumer awareness regarding health and cleanliness. This trend is particularly evident in the production of disposable items such as diapers, feminine hygiene products, and medical supplies. The market for hygiene products is projected to grow at a CAGR of approximately 5.5% from 2025 to 2030, indicating a robust expansion in the non woven-fabric market. Manufacturers are adapting to this demand by innovating their product lines, focusing on biodegradable and eco-friendly materials. This shift not only meets consumer expectations but also aligns with regulatory pressures for sustainable practices. As a result, the non woven-fabric market is likely to witness enhanced growth opportunities in the hygiene segment, reflecting a broader trend towards health-conscious consumer behavior.

Regulatory Support for Sustainable Practices

Regulatory frameworks in Europe increasingly support sustainable practices, which significantly impact the non woven-fabric market. Governments are implementing policies aimed at reducing plastic waste and promoting the use of biodegradable materials. This regulatory environment encourages manufacturers in the non woven-fabric market to invest in sustainable production methods and materials. The European Union's Green Deal, for instance, aims to make Europe climate-neutral by 2050, which may lead to a surge in demand for eco-friendly non woven fabrics. As a result, the non woven-fabric market is likely to experience growth driven by compliance with these regulations, as well as consumer preference for sustainable products. This alignment with regulatory initiatives suggests a promising outlook for the non woven-fabric market in the context of sustainability.

Increased Focus on Construction and Geotextiles

The construction industry in Europe is experiencing a renaissance, with a growing emphasis on infrastructure development and sustainability. This trend positively impacts the non woven-fabric market, particularly in the realm of geotextiles, which are used for soil stabilization, erosion control, and drainage applications. The European construction market is expected to expand by approximately 4% annually, driving demand for non woven fabrics that meet stringent environmental standards. As construction projects increasingly incorporate eco-friendly materials, the non woven-fabric market is likely to benefit from this shift. Furthermore, the versatility of non woven fabrics allows for innovative applications in landscaping and civil engineering, suggesting a promising future for the non woven-fabric market in the construction sector.

Technological Innovations in Manufacturing Processes

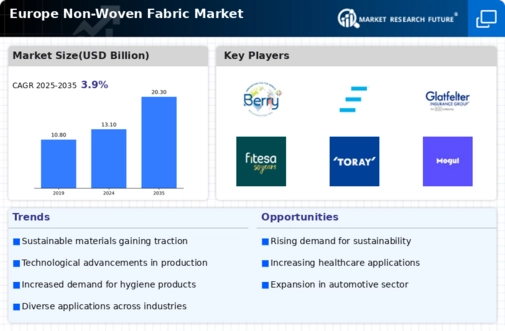

Technological advancements play a crucial role in shaping the non woven-fabric market in Europe. Innovations in manufacturing processes, such as spunbond and meltblown technologies, enhance the efficiency and quality of non woven fabrics. These advancements enable manufacturers to produce fabrics with superior properties, including increased strength, durability, and moisture resistance. The non woven-fabric market is likely to see a growth rate of around 6% over the next five years, driven by these technological improvements. Additionally, automation and digitalization in production processes may lead to cost reductions and increased competitiveness among manufacturers. As a result, the non woven-fabric market is poised for significant transformation, with technology serving as a key driver of growth and innovation.