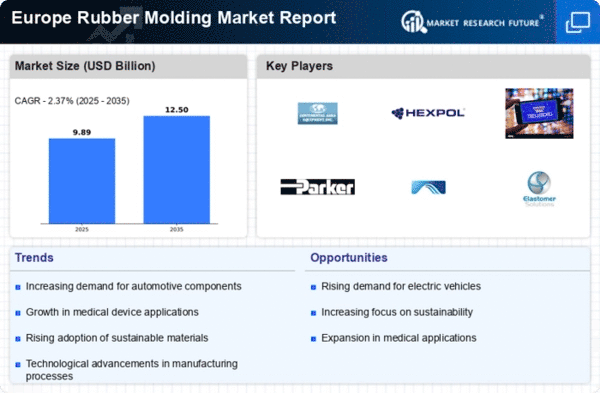

Rising Automotive Production

The automotive sector is a primary driver for the rubber molding market in Europe. With the increasing demand for vehicles, particularly electric vehicles (EVs), manufacturers are seeking high-quality rubber components for various applications. In 2025, the automotive industry in Europe is projected to grow by approximately 4.5%, leading to a heightened need for rubber molded parts. This growth is likely to stimulate investments in rubber molding technologies, enhancing production capabilities. The rubber molding market is expected to benefit from this trend, as automotive manufacturers prioritize durability and performance in their components. Furthermore, the shift towards lightweight materials in vehicle design may further increase the demand for specialized rubber products, thereby propelling the rubber molding market forward.

Expansion of Consumer Goods Sector

The consumer goods sector is experiencing notable growth in Europe, which is positively impacting the rubber molding market. As disposable incomes rise, consumers are increasingly purchasing a variety of products, including household items, personal care products, and electronics. This trend is expected to drive the demand for rubber molded components, which are essential for product functionality and aesthetics. In 2025, the consumer goods market in Europe is anticipated to expand by around 3.2%, creating opportunities for rubber molding manufacturers to innovate and diversify their offerings. The rubber molding market is likely to see increased collaboration with consumer goods companies to develop customized solutions that meet evolving consumer preferences.

Infrastructure Development Initiatives

Infrastructure development initiatives across Europe are significantly influencing the rubber molding market. Governments are investing heavily in infrastructure projects, including transportation, energy, and public facilities. This investment is expected to create a robust demand for rubber molded products used in construction, such as seals, gaskets, and insulation materials. In 2025, the European construction market is projected to grow by approximately 5%, which could lead to increased orders for rubber components. The rubber molding market stands to gain from this trend, as manufacturers align their production capabilities with the needs of infrastructure projects, ensuring that they can provide high-quality, durable products that meet regulatory standards.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent in Europe, impacting the rubber molding market. Manufacturers are required to adhere to various regulations concerning product safety, environmental impact, and material quality. This trend is driving the demand for high-quality rubber molded products that meet these standards. In 2025, it is anticipated that compliance-related investments in the rubber molding sector could rise by approximately 15%, as companies strive to ensure their products are safe and environmentally friendly. This focus on compliance not only enhances consumer trust but also positions manufacturers favorably in a competitive market. Consequently, the rubber molding market is likely to see a shift towards sustainable practices and materials.

Technological Innovations in Manufacturing

Technological innovations are reshaping the rubber molding market in Europe. Advancements in manufacturing processes, such as automation and 3D printing, are enhancing production efficiency and reducing costs. These technologies allow for greater precision in molding, which is crucial for meeting the stringent quality standards of various industries. In 2025, it is estimated that the adoption of advanced manufacturing technologies could increase productivity in the rubber molding sector by up to 20%. This shift not only improves the competitiveness of manufacturers but also enables them to respond more effectively to market demands. As a result, the rubber molding market is likely to witness a surge in new product development and customization options.