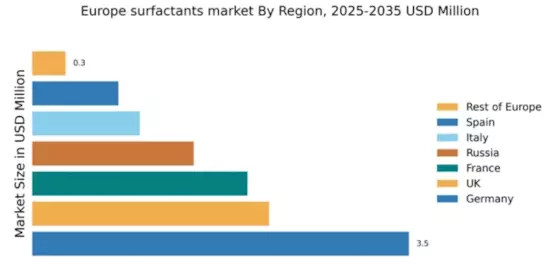

Germany : Strong industrial base drives growth

Germany holds a dominant market share of 3.5% in the European surfactants market, valued at approximately €1.5 billion. Key growth drivers include a robust manufacturing sector, increasing demand for eco-friendly products, and stringent regulatory policies promoting sustainability. The government has initiated various programs to support green chemistry, enhancing the infrastructure for surfactant production and distribution. Industrial development in regions like North Rhine-Westphalia and Bavaria further fuels consumption patterns, particularly in the automotive and personal care sectors.

UK : Innovation and sustainability lead the way

The UK accounts for a market share of 2.2%, valued at around €900 million. Growth is driven by rising consumer awareness of sustainable products and innovations in formulations. The demand for biodegradable surfactants is increasing, particularly in personal care and household cleaning sectors. Regulatory frameworks, such as the UK REACH, are influencing market dynamics by ensuring safety and environmental compliance, while investments in R&D are enhancing product offerings.

France : Diverse applications drive demand

France holds a market share of 2.0%, valued at approximately €850 million. The growth is supported by diverse applications across personal care, agriculture, and industrial cleaning. Increasing consumer preference for natural ingredients is driving demand for bio-based surfactants. Regulatory policies, including the French Environmental Code, promote sustainable practices, while the government supports innovation through funding initiatives. The market is characterized by a strong presence of local manufacturers and multinational companies.

Russia : Industrial growth fuels surfactant demand

Russia's surfactants market has a share of 1.5%, valued at around €600 million. Key growth drivers include industrial expansion and increasing consumer demand for personal care products. The government is investing in infrastructure development, particularly in the chemical sector, to enhance production capabilities. Regulatory policies are evolving, focusing on safety and environmental standards, which are crucial for market growth. Major cities like Moscow and St. Petersburg are key consumption hubs.

Italy : Strong presence in personal care

Italy represents a market share of 1.0%, valued at approximately €400 million. The growth is primarily driven by the personal care and cosmetics industries, where Italian brands are renowned for quality. Regulatory frameworks, including the EU Cosmetics Regulation, ensure product safety and efficacy, influencing market dynamics. The demand for natural and organic surfactants is rising, reflecting consumer trends towards sustainability. Key markets include Milan and Rome, where major players are actively competing.

Spain : Sustainability shapes consumer choices

Spain's surfactants market accounts for a share of 0.8%, valued at around €300 million. The growth is driven by increasing consumer demand for eco-friendly and biodegradable products, particularly in household and personal care sectors. Regulatory initiatives, such as the Spanish Waste Law, promote sustainable practices. The competitive landscape features both local and international players, with cities like Barcelona and Madrid being significant markets for surfactants, especially in the cleaning and cosmetics industries.

Rest of Europe : Varied applications across regions

The Rest of Europe holds a market share of 0.31%, valued at approximately €120 million. This sub-region includes diverse markets with varying demand for surfactants across sectors like agriculture, textiles, and personal care. Growth drivers include regional regulations promoting sustainability and innovation in product formulations. The competitive landscape is fragmented, with numerous local players and some international companies. Countries like Belgium and the Netherlands are notable for their advanced chemical industries, influencing market dynamics.