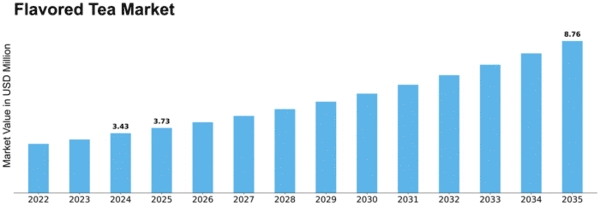

Flavored Tea Size

Flavored Tea Market Growth Projections and Opportunities

The Flavored Tea market experiences the influence of diverse factors that collectively shape its growth and market dynamics. One significant driver is the increasing consumer preference for unique and innovative beverage options. Flavored tea, with its wide array of enticing flavors, appeals to consumers seeking a refreshing and flavorful alternative to traditional teas. The market has witnessed a surge in demand as consumers explore diverse taste profiles, ranging from fruity and floral notes to herbal and exotic blends, contributing to the overall popularity of flavored tea. Economic factors play a pivotal role in shaping the Flavored Tea market. The rising disposable incomes and changing lifestyle patterns of consumers have led to an increased willingness to spend on premium and specialty beverages. Flavored tea, often perceived as a premium and indulgent option, has gained traction among consumers with higher purchasing power. The market responds to economic trends by offering a variety of flavored tea options, including those positioned as luxurious or featuring exotic ingredients. Cultural influences significantly impact the Flavored Tea market, as different regions have unique tea-drinking traditions and preferences. Manufacturers often tailor their flavored tea offerings to align with local tastes and cultural practices, leading to a rich diversity of flavors in the global market. The infusion of local herbs, spices, and traditional flavors in teas helps create products that resonate with the cultural preferences of specific regions. Health and wellness trends are instrumental in shaping the Flavored Tea market. With an increasing focus on well-being, consumers are drawn to teas that offer health benefits beyond traditional black or green teas. Flavored teas often incorporate ingredients known for their antioxidant properties, such as fruits, herbs, and botanicals, appealing to health-conscious consumers seeking both taste and nutritional value in their beverages. Environmental sustainability has become a critical factor in the Flavored Tea market. With growing awareness of environmental issues, consumers are increasingly inclined towards brands that adopt eco-friendly practices. This includes sustainable sourcing of tea leaves, environmentally conscious packaging, and ethical production methods. Manufacturers are responding to this trend by emphasizing their commitment to sustainability, creating a positive brand image that resonates with environmentally conscious consumers. Technological advancements play a role in the Flavored Tea market by contributing to the production processes and packaging innovations. Improved extraction techniques for flavoring ingredients, such as natural essences and extracts, enhance the quality and consistency of flavored teas. Advanced packaging technologies ensure product freshness, convenience, and shelf life, meeting consumer expectations for high-quality beverages. Market factors also include the influence of marketing strategies and branding. Effective promotion through various channels, including social media and experiential marketing, helps build brand awareness and engage consumers. The visual appeal of packaging design, coupled with compelling storytelling and messaging, contributes to the overall perception of flavored tea brands in a competitive market. Distribution channels play a crucial role in the accessibility and availability of flavored tea products. The convenience of purchasing flavored teas from supermarkets, specialty stores, and online platforms contributes to their market reach. Strategic partnerships with distributors and retailers enhance the visibility and availability of flavored teas, ensuring they are accessible to a diverse consumer base.

Leave a Comment